Fixed income is once again a viable asset allocation tool for multi-asset investors following the carnage across bond markets in 2022, however, questions around duration and credit risks remain.

Skyrocketing inflation throughout last year and the response from central banks across developed markets created one of the most challenging environments for fixed income since the 1970s.

In particular, long-duration government bonds – which have been a mainstay in investor portfolios over the past three decades – were hammered.

Highlighting this, the SPDR Bloomberg 15+ Year Gilt UCITS ETF (GLTL) was the worst-performing strategy across all fixed income ETFs, falling 46.7% over the past 12 months, while the Lyxor Euro Government Bond 25+Y UCITS ETF (MTH) plummeted 44.8%.

Meanwhile, long-duration US Treasuries and corporate bonds fared little better. The iShares $ Treasury Bond 20+yr UCITS ETF (IDTL) was down 31.3% while the iShares $ Corp Bond UCITS ETF (LQDE) dropped 17.8%.

This sharp spike in yields came when equities were also in the red leaving investors with very few places to hide over the past 12 months.

However, the dramatic reset has created an environment where fixed income is now attractive again. According to JP Morgan Asset Management (JPMAM), the “pain” of 2022 is allowing investors to construct diversified portfolios with fixed income for the first time in over a decade.

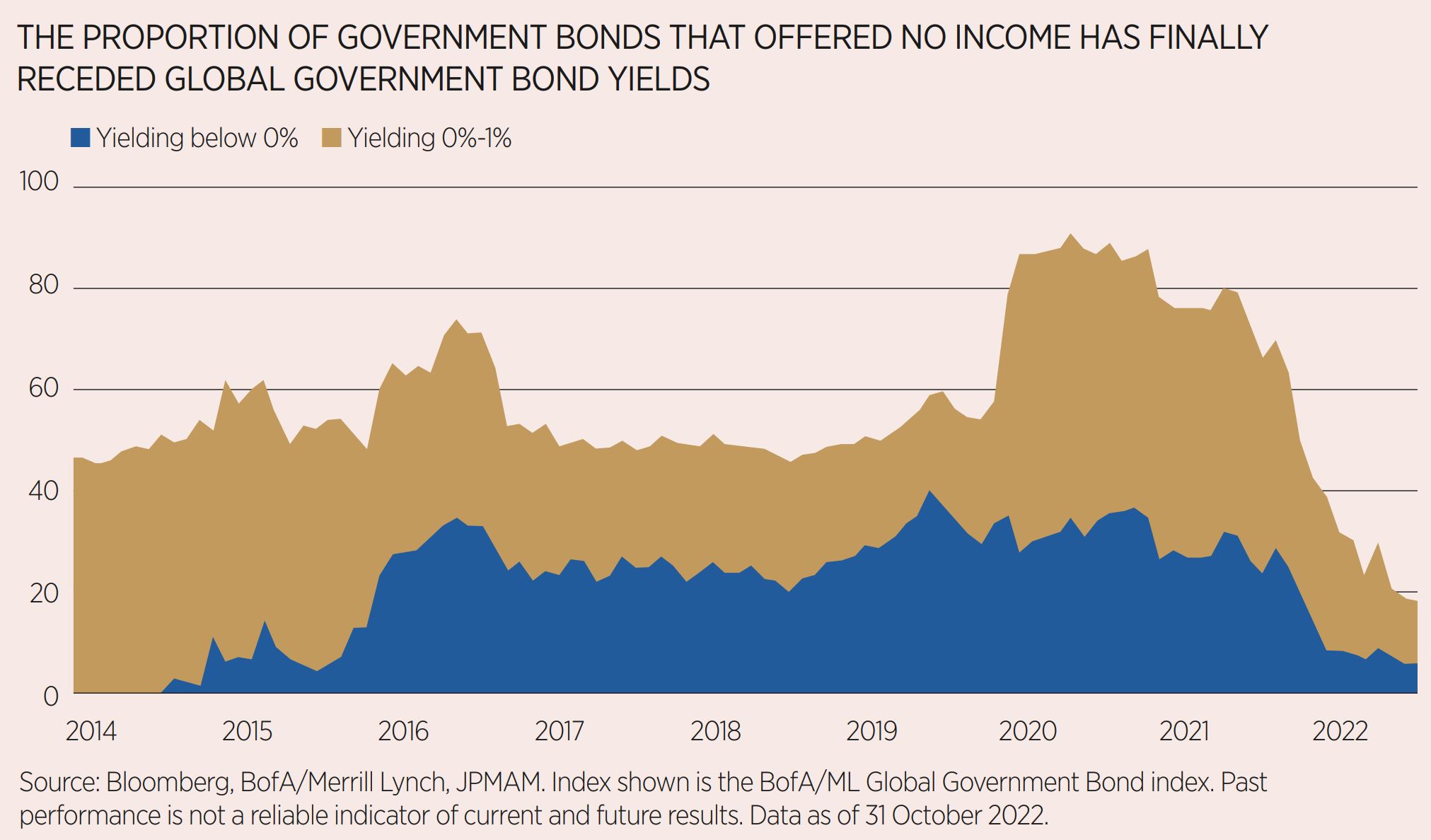

This is primarily due to the multi-decade bull run in fixed income until 2021, exacerbated by central banks’ unlimited quantitative easing measures since the Global Financial Crisis (GFC) which led to 90% of the global government bond universe offering a yield of less than 1%, data from JPMAM showed.

“We are more excited about bonds than we have been in over a decade,” Karen Ward, chief market strategist for EMEA at JPMAM, said. “The potential for bonds to meaningfully support a portfolio in the most extreme negative scenarios – such as a much deeper recession than we envisage, or in the event of geopolitical tensions – is perhaps most important for multi-asset investors.

“Fixed income deserves its place in the multi-asset toolkit once again.”

Recognising this, ETF investors have wasted little time allocating to fixed income this year. According to data from ETFLogic, the iShares Core € Corp Bond UCITS ETF (IEAC) has seen $1.5bn inflows in 2023, the most across all European-listed ETFs, while the PIMCO US Dollar Short Maturity UCITS ETF (MINT) has captured $743m net new assets, as at 20 January.

The improving inflation picture is a key driver of these flows. After inflation spiked to multi-decade highs across Europe and the US in 2022, the central bank response of raising rates has helped drive the Consumer Price Index (CPI) lower.

In the US, for example, the Bureau of Labor Statistics announced on 12 January that inflation had fallen for the sixth month in a row to 6.5% last December, down from 7.1% in November.

Vasiliki Pachatouridi, head of EMEA iShares fixed income strategy at BlackRock, explained to ETF Stream the lower inflation readings has “stimulated” risk sentiment. “Fixed income markets have had a buoyant start to the year with many areas of the credit market showing positive returns,” Pachatouridi added.

Increasing duration was a key trend among ETF investors in 2022. With yields surging, investors poured a combined $7.9bn into the iShares $ Treasury Bond 7-10yr UCITS ETF (IBTM) and the iShares $ Treasury Bond 3-7yr UCITS ETF (CBU7), the most across all European-listed bond ETFs.

The 10-year US Treasury yield, for example, traded above 4% for the first time since 2008 while the 20-year yield surged to over 4.5%. Since late last year, yields have started to fall amid the prospect of a less hawkish Federal Reserve.

In fact, markets anticipate the US central bank will finish its hiking cycle in March with the funds rate at 5% before cutting rates at the end of the year to support the economy.

However, Zeynep Ozturk-Unlu, CIO for EMEA, at Deutsche Bank, said there is currently no value in increasing duration due to the inverted yield curve. For example, two-year US Treasuries are currently yielding 4.2% versus 3.5% for the 10- year meaning investors do not receive a premium for taking on more duration.

“We do not see the value in increasing duration because of the inverted yield curve,” Ozturk-Unlu continued. “It is a difficult balance to strike but at this moment, staying short duration makes more sense.”

Overall, Deutsche Bank does not agree with the market consensus that the Fed will cut interest rates at the end of the year.

“Based on the way [Fed chair Jerome] Powell has been vocal about the central bank’s fight with inflation, the Fed will want to make sure it does not create a second round of inflation in the latter part of the year by reacting too soon,” she added.

This is one of the biggest risks facing the outlook for the bond market in 2023 as recently highlighted by famed hedge fund investor Michael Burry who warned a reduction in rates combined with government stimulus towards the end of the year could lead to another inflation spike.

Fed officials have looked to strike a hawkish tone since the end of last year which has largely been ignored by the market. On 18 January, Fed officials James Bullard and Loretta Mester highlighted the need to increase rates beyond 5% to tackle inflation, according to Reuters.

A more hawkish Fed than the market is anticipating would be negative for long-duration bonds as well as risk-on assets such as high yield.

“If rates keep rising, longer duration bonds will suffer greater losses,” Citi Global Wealth explained. “The rate-hiking cycle will be nearing completion. As such, 2023 could bring a major opportunity to add shorter term, less volatile bonds to portfolios to lock in peak interest rates.”

This article first appeared in ETF Insider, ETF Stream's monthly ETF magazine for professional investors in Europe. To access the full issue, click here.

Related articles