Crypto evangelists have had a long-standing infatuation for correlation, or the absence of it. Touted as a safe haven asset, uncorrelated from traditional stocks, bitcoin is supposed to be a hedge against the excesses of Wall Street. Some 13 years later, the market has moved on – bitcoin's rising correlation with traditional finance may be a sign of maturity, not a sellout.

A historical indicator by nature, correlations inform investors about the relationship between financial assets and indices. If the price of two assets rises in lockstep, they are said to be positively correlated, with a correlation of 1 indicating a perfect positive correlation. The inverse, a correlation of -1, would represent a perfect negative relationship.

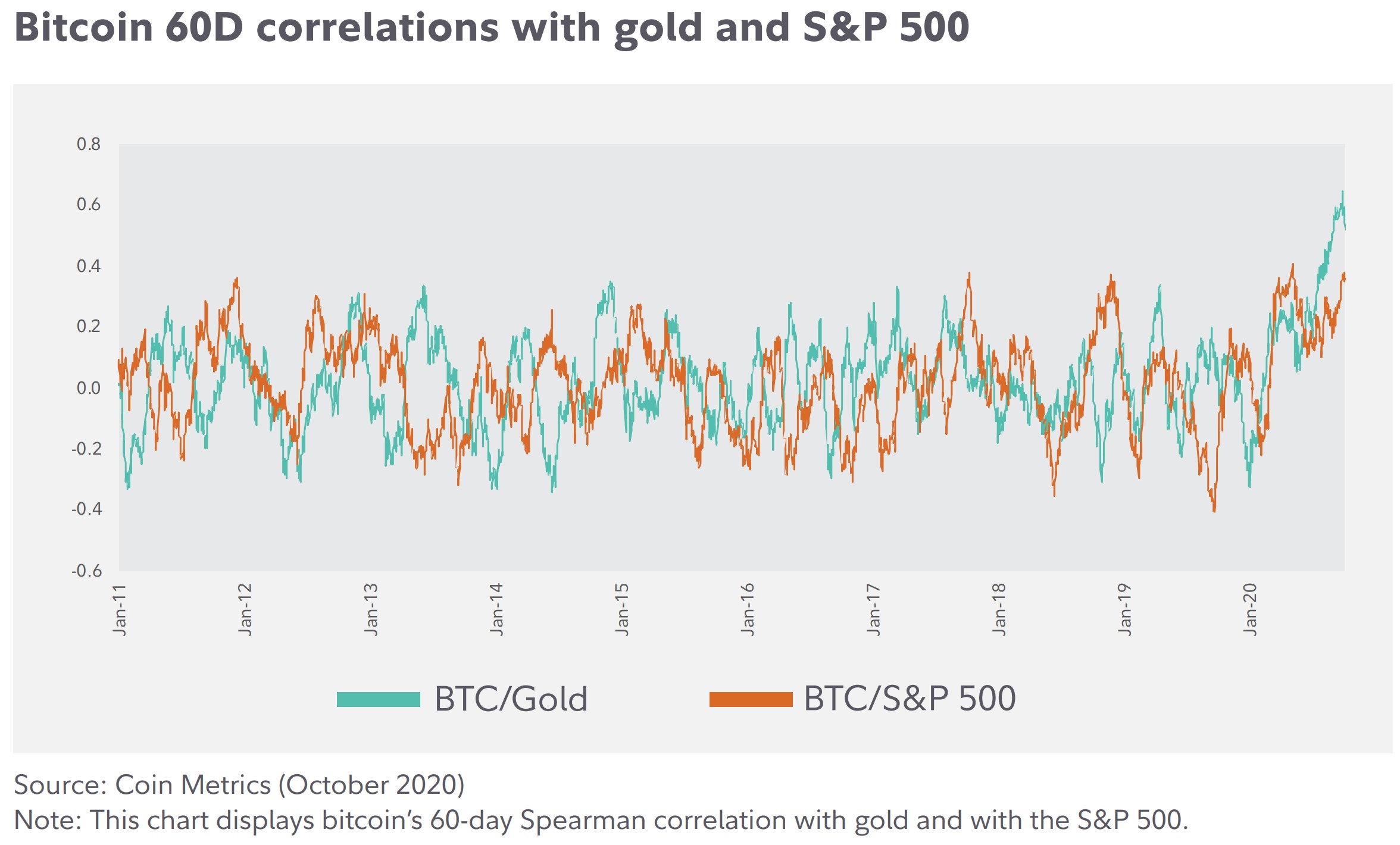

One key argument for including bitcoin in a portfolio is the promise of diversification from traditional stocks. From 2010 to 2020, crypto diehards got their wish. Bitcoin's correlation to the S&P 500 remained at negative or low positive levels, indicating that bitcoin did not sing to the tune of conventional assets – a win for the evangelists.

Chart 1: 60-day bitcoin correlations with gold and the S&P 500

Source: Fidelity

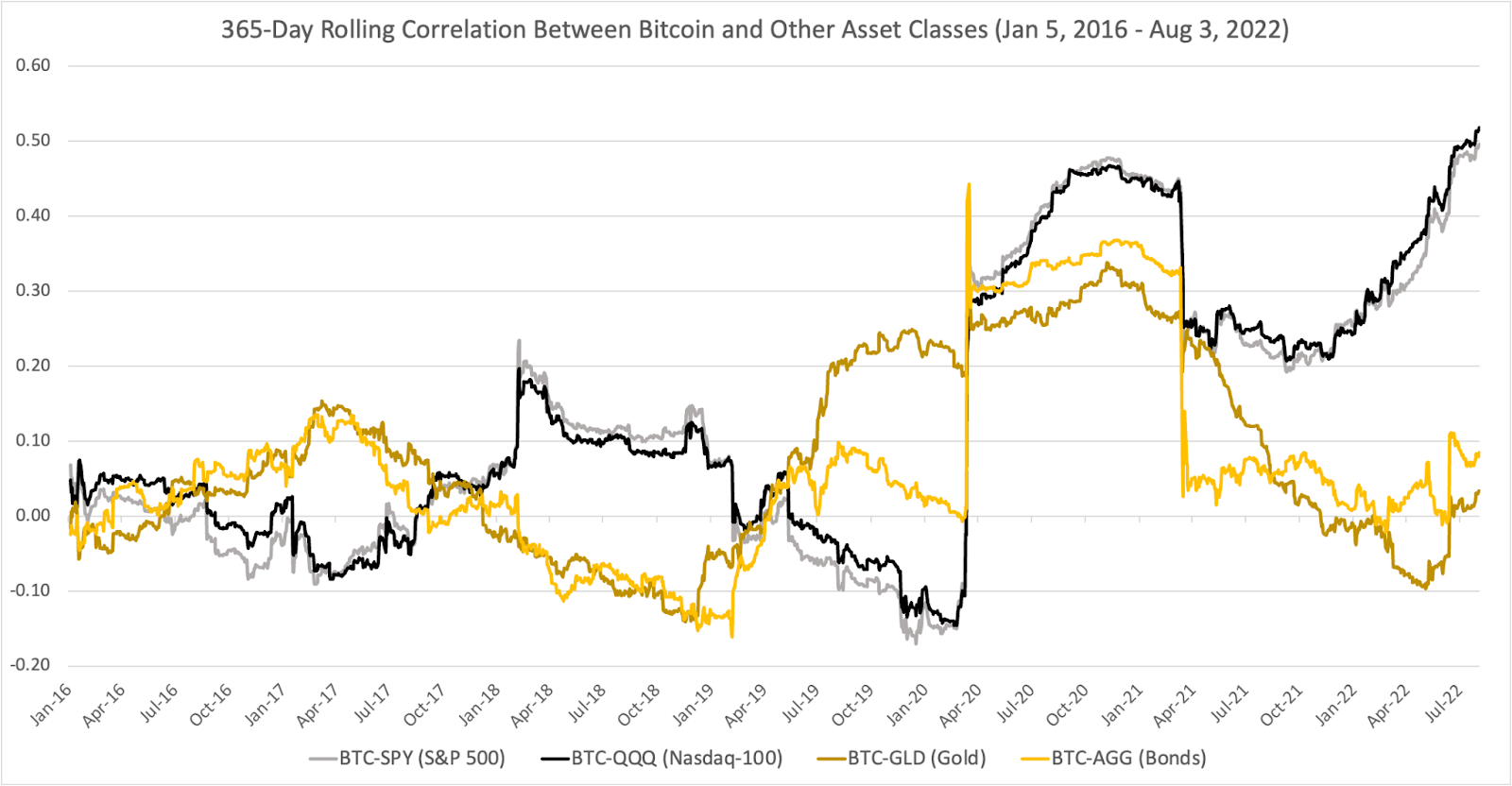

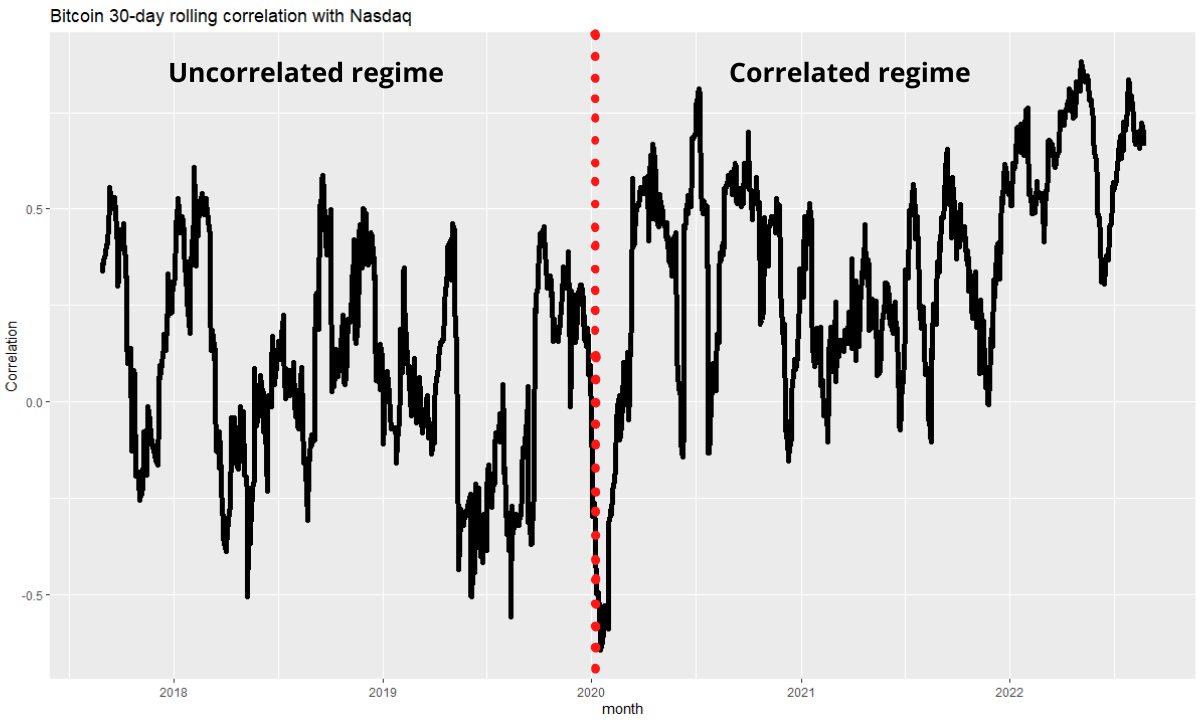

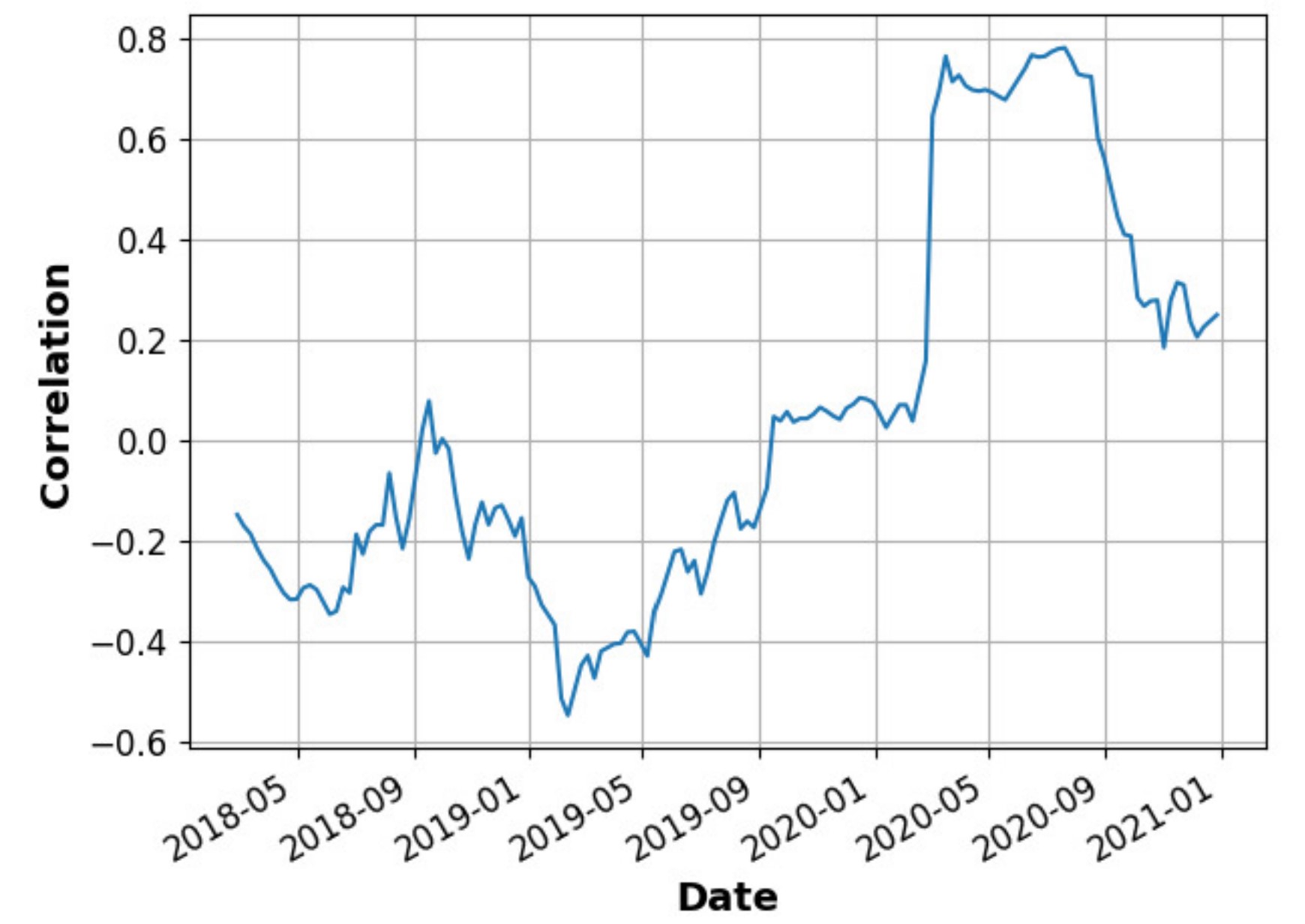

However, much has changed since COVID-19. Data from 21Shares captures a stark regime change, with bitcoin's correlation to the S&P 500 and Nasdaq 100 shooting from a negative correlation of -0.15 to a positive 0.31 between January and April 2020.

As bitcoin's correlation has surpassed a value of 0.5 – a strong positive correlation – and the ‘decoupled-safe haven’ hypothesis remains on hold, what can correlations tell us about crypto investors, the current market regime and the future of the industry.

Chart 2: 365-day rolling correlation between multiple asset classes

Source: 21Shares

A brief history

Today, cryptocurrency exchanges like Crypto.com estimate that more than one billion crypto users will enter the space by 2023, however, this was not always the case.

In the beginning, only the most avant-garde denizens of the internet dabbled in bitcoin. Not until Laszlo Hanyecz purchased two pizzas for 10,000 bitcoins on 10 May 2010 – marking the first purchase of a real-world good with crypto – did internet locker room talk actually walk its walk.

As Paul Vigna and Michael Casey wrote in Crypto Currency: The Future of Money?, during this early period in 2010, bitcoin slowly detached itself from the “geeky fringes of tech society” and fell into the hands of a new breed of investor, the “digital gold digger[s]”.

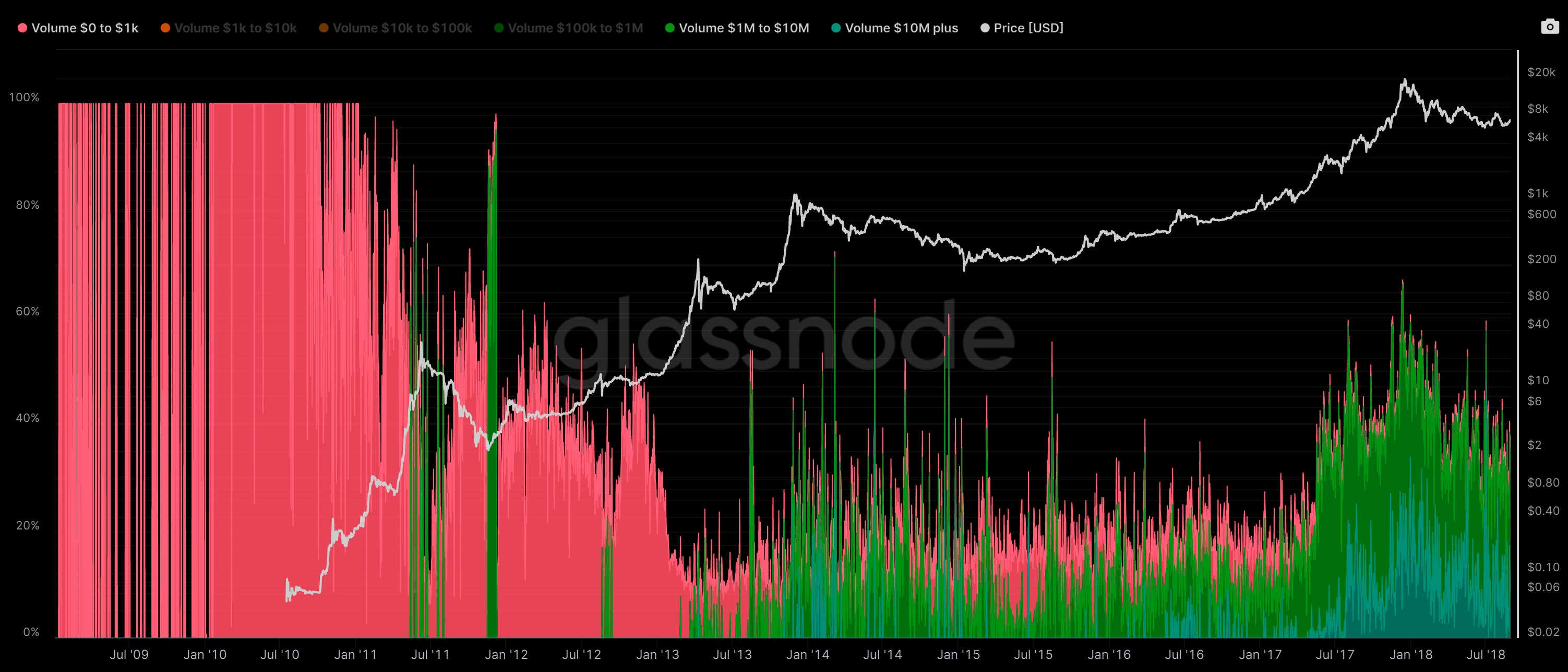

Data from Glassnode indicates that the fledgling bitcoin market was dominated by small, tech-savvy and risk-on merchants, who peddled bitcoin in transactions totalling no more than $1,000.

Between 2010 and 2012, bitcoin's correlation to the S&P 500 averaged -0.25, a moderate negative correlation, according to numbers from TradingView. This lack of association did not go unnoticed and so the institutions joined.

According to Grayscale's first ever Digital Asset Investment Report, institutional investors accounted for 56% of all inflows in 2018. Glassnode captures this growth in institutionalisation, with investments of $1m or more accounting for 28% of the market by more accounting for 28% of the market by 2018.

“Crypto became more institutionalised after the 2017 crash. It made headlines and this was the first time mainstream people really heard of bitcoin,” Clara Medalie, research director at Kaiko, told ETF Stream.

Enthused by the seemingly unrelated nature of bitcoin and its proposition as a diversified asset, a report published by Fidelity Digital in 2020, titled Bitcoin Investment Thesis, claimed: “[Bitcoin] could be a potentially useful and uncorrelated addition to an investor's portfolio.”

The report quoted Chamath Palihapitiya, CEO of Social Capital, who said: “Bitcoin to me is the only thing that I have seen so far that is really fundamentally uncorrelated.”

In line with this thesis, investors began piling assets into bitcoin. MicroStrategy founder Michael Saylor said “bitcoin is digital gold” before purchasing $4bn worth of bitcoin and Elon Musk announced that Tesla would accept bitcoin as payment following a $1.5bn bitcoin binge.

However, bitcoin did not continue to exhibit low levels of correlation. Instead, just as institutional money started to trickle in 2018, bitcoin's correlation to the Nasdaq narrowed to 0.12, a low positive correlation.

Chart 3: Entity transaction volume by dollar amount transacted Jun 2009-August 2018

Source: Glassnode

A ‘new breed’

Locked at home, with too much time on one's hands, a constant stream of government relief money and in shock by the market crashes in March 2019 and June 2020, the COVID-19 pandemic ushered in profound changes to retail and institutional crypto engagement.

Between January 2020 and June 2020, bitcoin's correlation to the Nasdaq rose from -0.1 to 0.801, from a negative to near perfect positive correlation. Today, bitcoin's correlation to the Nasdaq is as high as 0.66.

Sui Chung, CEO of CF Benchmarks, told ETF Stream: "The reason correlations move higher is because the same type of investor begins to invest in two different assets. So, if you take that as market maturation, correlations will start to look very similar.

Chart 4: 30-day rolling correlations between bitcoin and Nasdaq

Source: ETF Stream and CF Benchmarks

For the people, by the people, perhaps the first place to look when trying to understand the correlation regime change is the change in behaviour of retail investors.

Despite Vigna and Casey's cynical remarks about bitcoin's early entourage, their jibe has stood the test of time. Researchers Raphael Auer and David Tercero-Lucas found the post-COVID-19 batch of retail investors are indeed young, tech-savvy and risk-tolerant – not dissimilar to the geeks and digital gold diggers who pioneered the crypto-craze.

However, the authors do believe that a new retail investor has emerged, one who does not believe crypto to be an alternative to fiat but purely a speculative asset. They conclude that this is due to the maturation of the infrastructure surrounding the crypto industry.

“Think about it like Nokia in the 1990s,” Chung continued. “Bad signal, clunky design and most people did not understand it. As the infrastructure around Nokia improved more people had one and it lost its novelty.”

Echoing his thoughts, Luciana Somoza and Antione Didisheim at the Swiss Finance Institute, suggested the more active retail investors trade across the crypto and traditional markets, the stronger correlations become. Interestingly, correlations with tech stocks were the highest.

In particular, they note these new investors treat bitcoin as a speculative tech stock, with the correlation between cross-market trading the highest between crypto and the Nasdaq. They find the inverse to be true. When cross-asset trading is low, correlations remain low or negative. This suggests correlations on the retail side are driven by individuals who see bitcoin as an asset that can be traded like for-like with traditional stocks.

Chart 5: Cross-market trading volume correlation between bitcoin and S&P 500

Source: Luciano Somoza and Atoine Didisheim, Swiss Finance Institute

Testing an ‘old hypothesis’

As infrastructure improvements and mainstream acceptance drives retail engagement, however, the story looks a little different where institutional investors are concerned.

In a working paper for the Bank for International Settlements, Auer, Farag, Lewrick, Orazem and Zoss find that the reason for the uptick in investment is two-fold: institutional investors are searching for yield in a low-return environment and they believe bitcoin could be a hedge against inflation.

Between July and August, BlackRock, Fidelity, Schroders and abrdn have all sought to enter the crypto space. BlackRock, the world's largest asset manager, is a particularly noteworthy development.

Larry Fink, founder and CEO of BlackRock, has been an ardent critic of bitcoin and crypto in general calling bitcoin an “index of money laundering” in 2017. However, on 5 August, BlackRock partnered with crypto exchange Coinbase to allow its clients to access bitcoin via its Aladdin platform.

The reason for this decision, according to BlackRock, was “institutional clients are increasingly interested in the digital asset market”. "It is not BlackRock itself that is interesting, it is what it represents. Nobody offers crypto unless there is an institutional demand. The question is why now? Maybe we are seeing institutional investors test an old hypothesis. Can bitcoin be a hedge against inflation,” Chung suggested.

If bitcoin is seen as a diversified asset and has the potential to be a hedge against inflation, then it is of little surprise that institutional investors are demanding bitcoin exposure from asset managers and banks.

In April, the IMF warned that “unprecedented” levels of government borrowing during the pandemic posed “risks” to economies across the globe. At the time, growth forecasts were slashed from 6.1% in 2021 to 3.6% in 2022. As of July, this has been reduced by 0.4%.

This debt spike has led the UK (10.1%) and the US (9.1%) to experience the highest levels of inflation in 40 years and the eurozone (9.1%), recording its highest levels to date, according to the BIS.

Subsequently, central banks have turned hawkish, ending a decade of record-low interest rates.

“Bitcoin's correlation to equities has spiked as investors seek a safe haven,” Carlos Gonzalez, research analyst at 21Shares, told ETF Stream. “Bitcoin is a nonsovereign form of money that exhibits unique characteristics.”

For institutional investors, the time could be right to give the 'safe haven' idea a shot. Bitcoin is trading 70% below its all-time high and Federal Reserve chairman Jerome Powell said at Jackson Hole that central banks would raise rates “for some time” to curb rampant inflation.

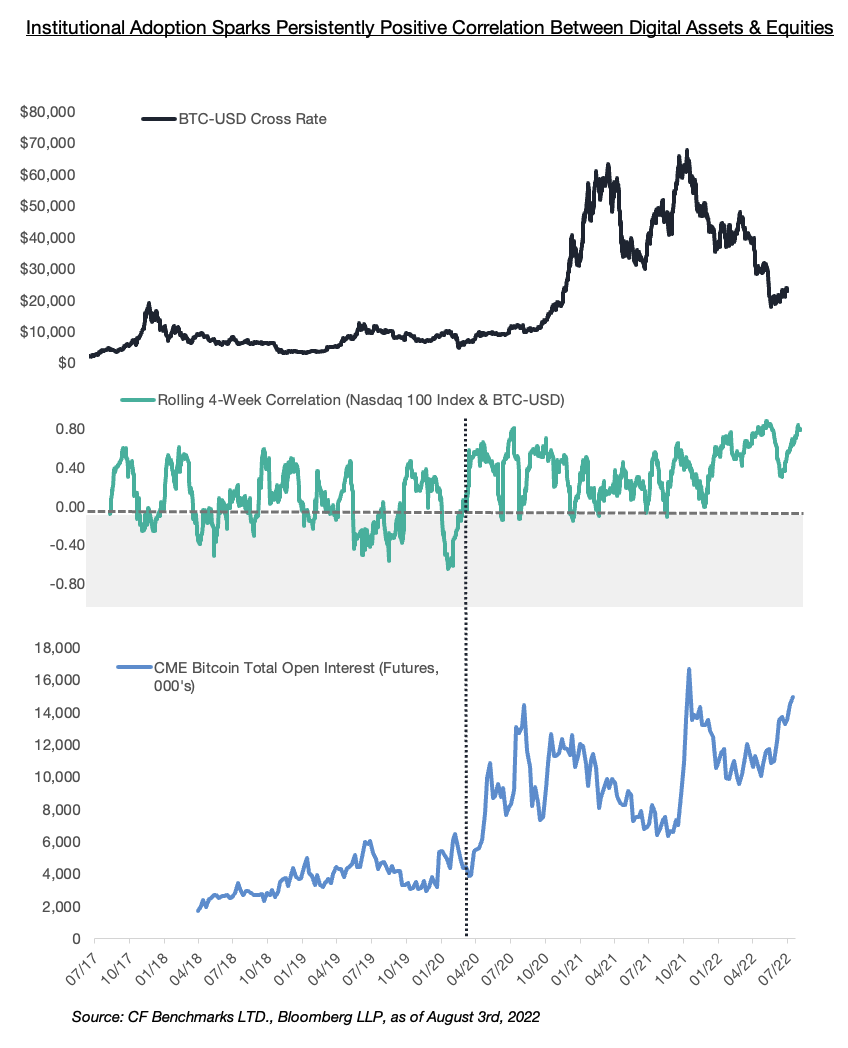

Data from CF Benchmarks captures this institutional 'flight to safety' by detailing the surge in CME bitcoin open interest futures. In March 2020, futures were hovering around $4bn but by August, the number has risen to over $10bn.

This is backed by data from Glassnode which suggests entities engaging in transactions greater than $10m constituted 7% of market volume in March 2020 and a staggering 83.2% of the market, as at August.

Chart 6: Institutional adoption sparks positive correlation

Source: CF Benchmarks

So where do we go from here?

Correlations show the relationship between two different variables and if they move in tandem with one another they are said to be correlated. The fact bitcoin has become widely accepted and accessible means institutional investors are comfortable trading it alongside traditional assets.

Effectively, the more investors in bitcoin, the more it matures and so becomes less speculative, less diversified and more correlated with the other assets.

Lured by the promises of an uncorrelated asset, if bitcoin continues to grow, institutional investors may have to contend with being disappointed despite the maturity the asset class has shown in recent years.

This article first appeared in Crypto Unlocked: In the bleak midwinter, an ETF Stream report. To access the full issue,click here.

Related articles