The idea ESG is a factor that can deliver outperformance much like value or momentum has been shunned in recent research conducted by index provider Scientific Beta.

The white paper, entitled ‘Honey, I Shrunk the ESG Alpha’: Risk-Adjusting ESG Portfolio Returns, argued there is no solid evidence to support claims that ESG can deliver outperformance.

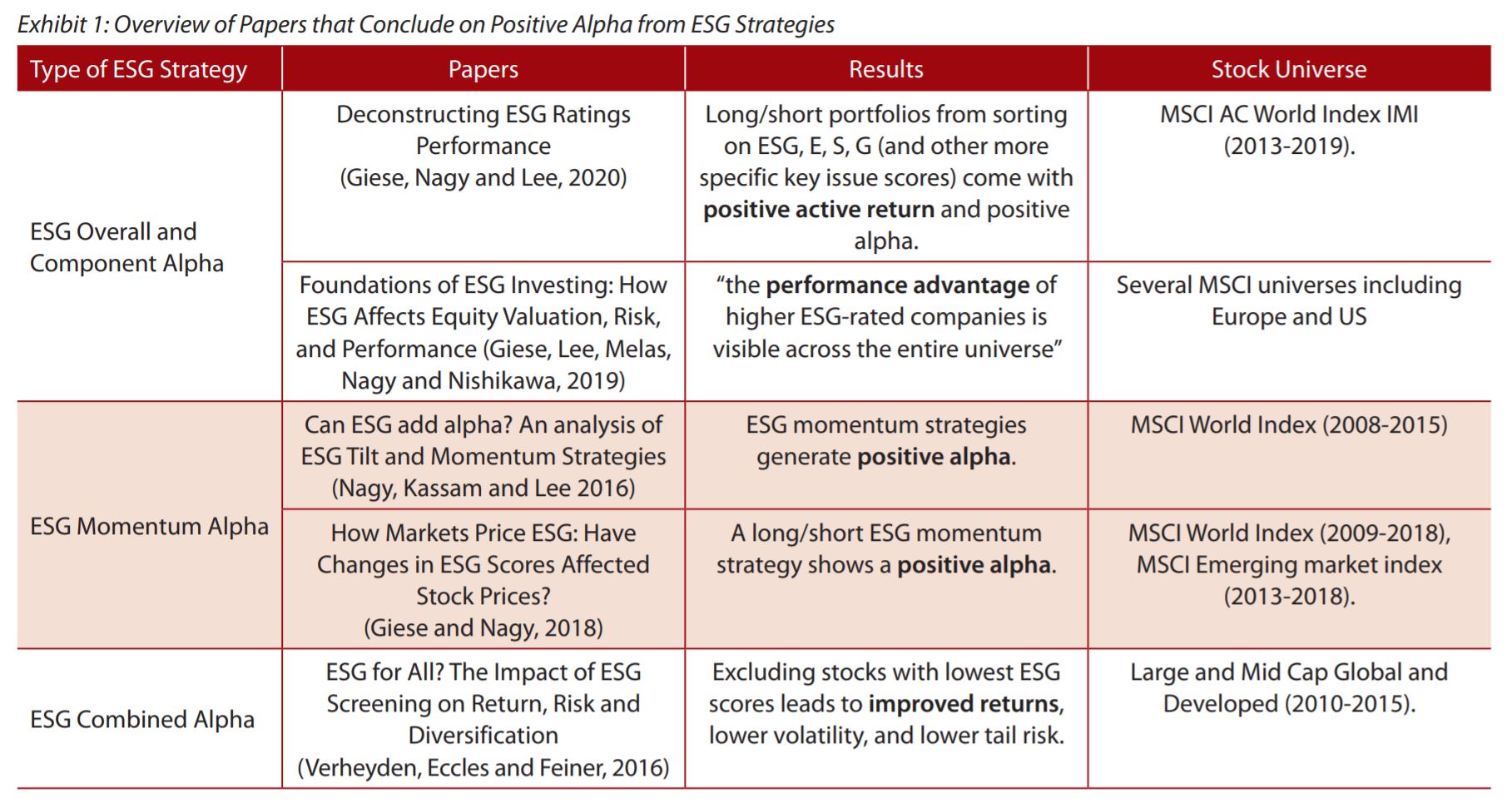

The research is very much against the stance of the asset management industry which has increasingly claimed ESG does deliver outperformance over the long term following the strong returns seen across sustainable strategies since the Global Financial Crisis (GFC).

Source: Scientific Beta

As Dr. Noël Amenc, CEO of Scientific Beta, said: “Claims of positive alpha in popular industry publications are not valid because the analysis underlying these claims is flawed. These results question the way in which ESG providers, and the investment industry more generally, promote ESG.

“By relying on biased research results, which as such have no value, the promoters of alpha in ESG investing are taking the great risk of disappointing investors on this supposed outperformance and diverting them in time from an investment theme that is important for sustainable economic development.”

What makes the report even more compelling is the fact Scientific Beta constructs ESG indices so one may expect them to make claims stating the exact opposite.

In the research, the authors – Scientific Beta’s Giovanni Bruno, Mikheil Esakia and Felix Goltz – studied the performance of 24 ESG strategies between 2008 and 2020 and found the majority did outperform by up to 3% a year.

However, when assessing the drivers of returns, the research found ESG strategies are heavily exposed to companies with high profitability and low investment, i.e. the quality factor.

Highlighting this, one of the US ESG strategies studied saw a 1.7% per year contribution from the quality factor, exceeding its annualised 1.3% returns.

“The results show that the quality factors (high profitability and low investment) make pronounced positive return contributions to most types of ESG strategies,” the report added.

Furthermore, the report said ESG strategies have significant sector biases, especially towards technology stocks that have delivered huge returns since the GFC.

“There is no outperformance of the ESG strategies when applying standard risk adjustments,” the report stressed. “This finding shows that ESG ratings do not add value over information contained in sector classifications and factor attributes.”

Elsewhere, the report added that the increasing interest in ESG has inflated returns since the GFC. Interest in ESG ETFs, for example, has skyrocketed in recent years with the segment collecting more inflows than their non-ESG ETF counterparts in Europe last year.

“Investors can easily overestimate long-term ESG returns when considering short time periods with rising attention to ESG.”

For example, the US ESG strategy delivered 5% performance during periods when ESG received much attention versus 1.3% performance in periods of low attention.

“Our findings contradict common claims in the industry that ESG is a source of outperformance. Investors who look for value-added through outperformance are looking in the wrong place," the authors concluded.

“It might be time to consider ESG strategies for the unique benefits that they can provide, such as hedging climate or litigation risk, aligning investments with norms, and making a positive impact for society.”

Further reading