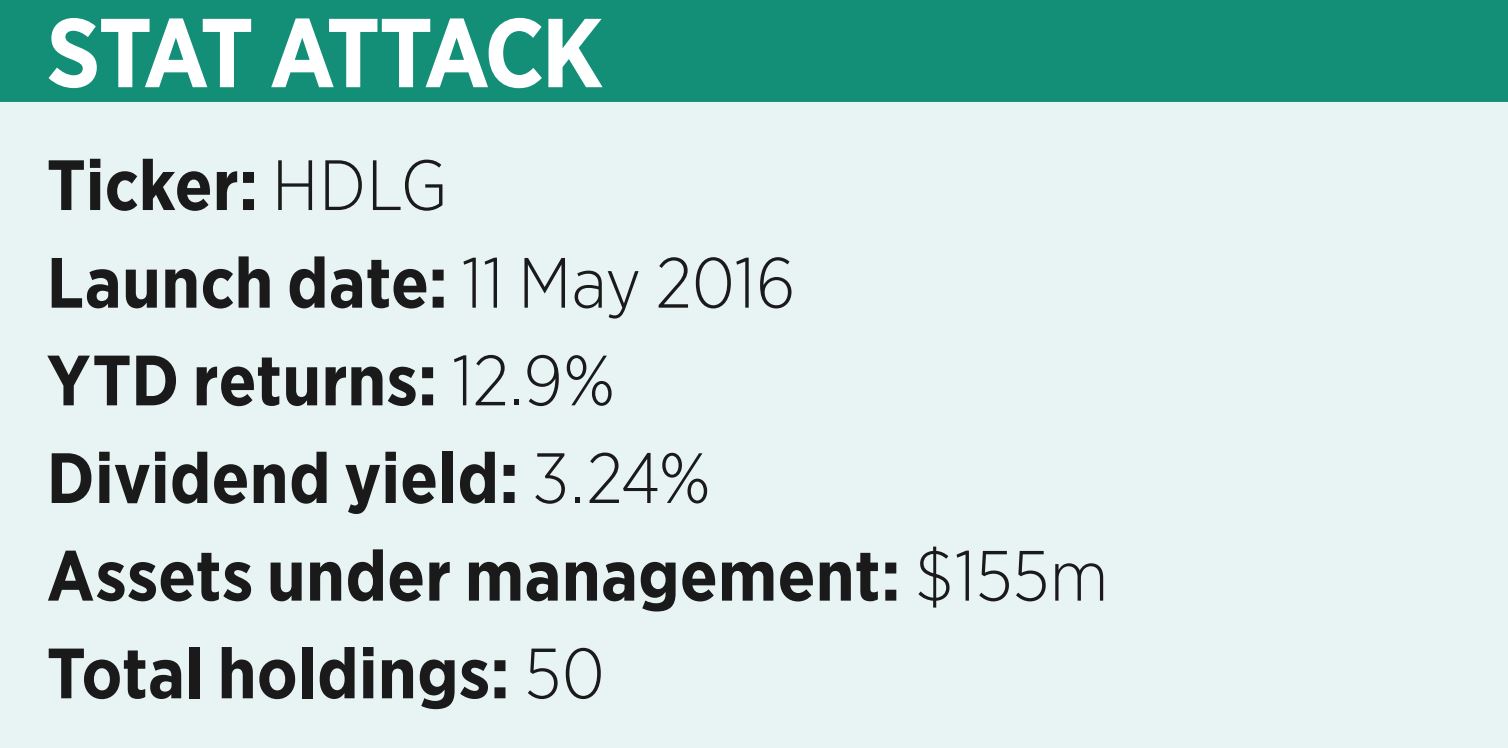

A confluence of investors searching for income and stability to shelter from hawkish monetary policy and a boom in old economy sectors saw the $155m Invesco S&P 500 High Dividend Low Volatility UCITS ETF (HDLG) notch up impressive outperformance so far in 2022.

HDLG has returned 12.9% since the start of the year, as at 19 April, and 8.6% over the past month alone. This is impressive when compared to the largest distributing S&P 500 ETF in Europe, the $32.1bn Vanguard S&P 500 UCITS ETF (VUSA), which has returned -3% and 1.9% over the year-to-date to and month to 19 April.

Aside from far outperforming VUSA, HDLG boasts a distribution yield of 3.24% which not only offers some protection from inflationary erosion but is also more than double the 1.16% dividend yield paid to VUSA investors last year.

While still only a tiny fraction of the size of Vanguard’s behemothic US equity product, HDLG has collected $42.6m inflows in the first three-and-a-half months of 2022, equivalent to a 37.9% jump in assets under management (AUM). VUSA’s AUM climbed by a more modest 1.2% over the same period.

Explaining the rotation into smart beta products such as HDLG, Todd Rosenbluth, head of research at ETF Trends and ETF Database, said: “Investors have favoured defensive stocks, particularly in the utility sector, as well as energy stocks due to rising commodity prices to start 2022.

“These sectors are heavily weighted in the high dividend low volatility product compared to the parent index while the exposure to the technology sector is negligible. While the S&P 500 is broad-based, the smart beta product is more targeted and can and often does perform differently.”

In terms of methodology, HDLG tracks the S&P 500 Low Volatility High Dividend index, which first identifies the top 75 dividend-paying stocks in its parent index and then captures the 50 with the lowest realised volatility over the trailing 12 months. Each security is weighted by dividend yield, with an individual weighting cap of 3% and a cap per GICS sector of 25%.

While VUSA weights 28% to information technology and 3.9%, 2.7% and 2.7% to energy, real estate and utilities, respectively, HDLG flips this on its head with 2.5% to tech, 9.4% to energy, 12.3% to real estate and a considerable 21.4% to utilities.

Such divergences have seemed like a good idea so far in 2022 as investors have sought shelter in ‘real assets’ such as property, infrastructure and commodities as well as companies with more favourable valuation profiles.

Evidencing disparities between sectors, the SPDR S&P US Utilities Select Sector UCITS ETF (SXLU) and SPDR S&P US Energy Select Sector UCITS ETF (SXLE) returned 12.6% and 52% in the year to 19 April while the SPDR S&P US Technology Select Sector UCITS ETF (SXLK) fell 11.2%.

However, investors should tread carefully while attempting to slice and dice market beta. While outperforming VUSA by almost 16% by mid-April in 2022, HDLG boasts annualised returns of 7.3% over the trailing five years – a far cry from VUSA’s annualised returns 15% over the same period.

Furthermore, HDLG’s total expense ratio (TER) of 0.30% is more than four times as much as VUSA’s cut-price fee of just seven basis points. In the long run, investors will have to ponder whether HDLG’s more steady-sailing, income-focused approach offers better prospects than just owning the US large-cap market.

This article first appeared in ETF Insider, ETF Stream's monthly ETF magazine for professional investors in Europe. To access the full issue, click here

Related articles