Vincent Deluard, global macro strategist at StoneX Group, has warned ETFs are not the perfect replica of the market as was originally presumed by the first passive proponents.

In a research note, entitled Passive Attack, Jurassic Park and the Nasdaq Bubble, Deluard (pictured) said the ETF industry was instead “overwhelmingly” allocating capital to giant tech stocks which ran the risk of creating a “self-reinforcing loop of market losses and outflows” if sentiment reversed.

In order to understand the impact of ETFs on stock prices, he constructed a “flow-weighted ETF portfolio” which measures the flows for all US equity ETFs since January 2019.

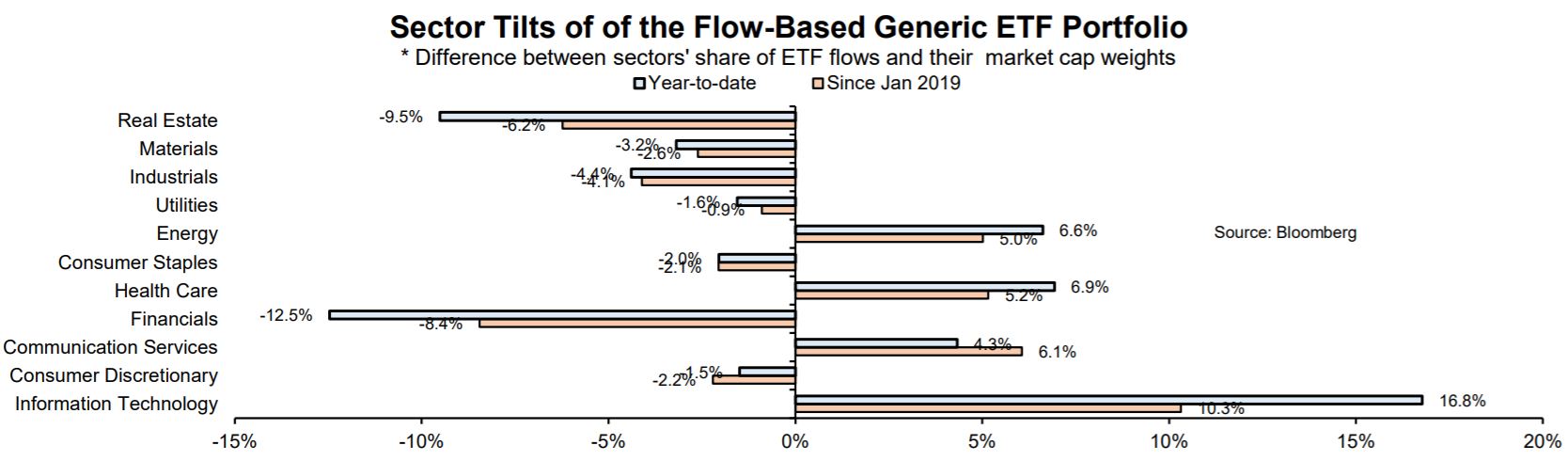

It found technology stocks received 36% of all ETF flows since the start of last year despite accounting for just 26% of the total market capitalisation.

At the other end of the spectrum, financial stocks have seen just 1.8% of ETF flows since 2019 however they account for 10.2% of the total market cap.

“The case for passive investment assumes that index funds simply replicate the market while they subtly but surely transform it,” Deluard said.

“This innocent assumption has led to the catastrophic outcome of five giant tech companies dominating indices and possibly wrecking society in the process.”

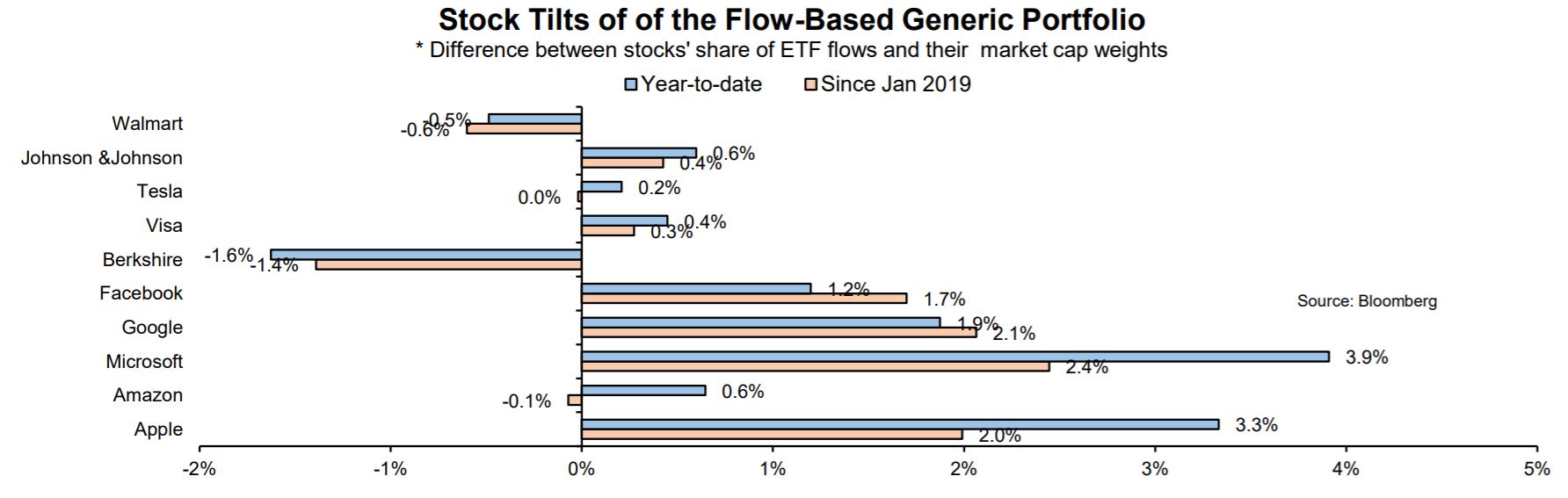

The same effect took place at a single stock level with Microsoft receiving 8.1% of ETF flows this year despite having a 4.2% weighting in the Russell 3000. All the big tech companies have seen a bigger proportion of ETF flows in the past two years than their market cap weights.

According to Deluard, there are three subtle biases at play. The first is on an index construction level where the major indices such as the S&P 500 have a natural bias to certain securities due to their market-cap weighted rules.

Secondly, ETF issuers push products they think will have the biggest chance of success which, at the moment, tend to include quality growth companies over value stocks.

Finally, investors tend to chase “hot” sectors and stocks due to well-established behavioural biases.

The problem for Deluard is ETF flows act as a buyback programme for large tech stocks with Microsoft, for example, receiving $4.7bn just from ETF demand this year.

“This is perhaps the single strongest argument in favour of large tech stocks: as long as the rotation towards passive continues, big tech stocks will benefit from structural, price-insensitive demand,” he added.

ETF Insight: The rise of ETFs has an unintended consequence

Furthermore, he warned the concentration of ETF flows into a handful of stocks with similar characteristics means the sector is very vulnerable if these flows reverse.

“The shift to passive is a structural process which will play out over decades so I am not too worried about the long-term, but I am concerned that the ongoing Nasdaq correction could trigger a self-reinforcing loop of market losses and ETF outflows from the investors who chased the bubble in big tech stocks this year,” Deluard concluded.