Fears of digital warfare becoming an increasing fixture for countries amid Russia’s invasion of Ukraine has shone a light on ETFs in the cybersecurity investment space such as the L&G Cyber Security UCITS ETF (ISPY) and iShares Digital Security UCITS ETF (LOCK).

While LOCK is the creation of BlackRock, an issuer known for its scale, its ETF is smaller and younger than Legal & General Investment Management’s ISPY which launched in September 2015. ISPY is Europe’s largest cybersecurity ETF with $2.8bn assets under management (AUM) while LOCK has gathered $1.4bn AUM since coming to market in September 2015.

Even since LOCK’s arrival, ISPY has remained the more popular of the two products. LOCK has amassed $1.2bn inflows over the past three years while ISPY saw $1.5bn new assets, as at 15 March, according to data from ETFLogic. Over the past year, LOCK has enjoyed $209m of new support versus $469m for ISPY.

Finally, when cybersecurity has been in the public eye this month, BlackRock’s ETF amassed $49m inflows against the $162m inflows enjoyed by ISPY.

These flows are also vindicated by the performance of both ETFs, with ISPY returning 50.9% over the past three years versus 46.2% for LOCK, as at the end of February. Even during a challenging period of relatively hawkish messaging from central banks, ISPY returned -10.3% in the three months to 15 March against -18.1% for LOCK.

Exposure and methodology

ISPY physically replicates the ISE Cyber Security UCITS index of 44 holdings, made up of infrastructure providers developing software and hardware for protecting access to files, websites and networks and service providers offering consulting and cyber-based services.

Companies in the broader investment universe are only eligible if they meet size requirements and have a three-month average daily traded value of at least $1m.

ISPY’s underlying index applies a modified equal weight methodology where company weights are relative to the size of their respective sector and their liquidity versus their peers within each sector. No security can exceed 10% of the underlying index and securities with weights over 5% cannot have an aggregate weight of more than 40%.

Finally, constituents are screened against LGIM’s Future World Protection List (FWPL) which flags companies failing involved in controversial weapons or coal and those that violate the United Nations (UN) Global Compact.

Meanwhile, LOCK physically tracks the STOXX Global Digital Security index of 121 constituents. These are companies that, according to FactSet Revere data, derive at least 50% of their most recent annual revenue from digital security-linked activities including the transmission, safeguarding or handling of sensitive data and control of secure locations such as data centres.

Potential constituents are then screened for size and liquidity, with the remaining universe weighted using an adjusted equal weight methodology. The index also excludes companies that do not comply with the Sustainalytics Global Standards Screening assessment, have involvement in controversial weapons and those displaying a ‘severe’ controversy rating.

Additional screens are applied against companies involved in other controversial sectors including unconventional oil and gas, however, BlackRock noted it may obtain indirect exposure to financial derivative instruments where it does not account for ESG criteria.

As with many thematic ETFs from within a similar theme, there are some notable differences between ISPY and LOCK. For instance, ISPY is heavily tilted to US-listed companies with a 72.7% allocation and 14.1% to Israel versus 63.4% to the US and 12.7% to Japan for LOCK.

Furthermore, ISPY offers a more concentrated exposure, with fewer constituents, a 97.7% allocation to the information technology (IT) sector and single stock weights as high as 4.9%. LOCK, meanwhile, has a top single weighting of 2.2% and allocates 85.9% to IT, 9% to industrials and 4.3% to real estate companies.

Cost breakdown

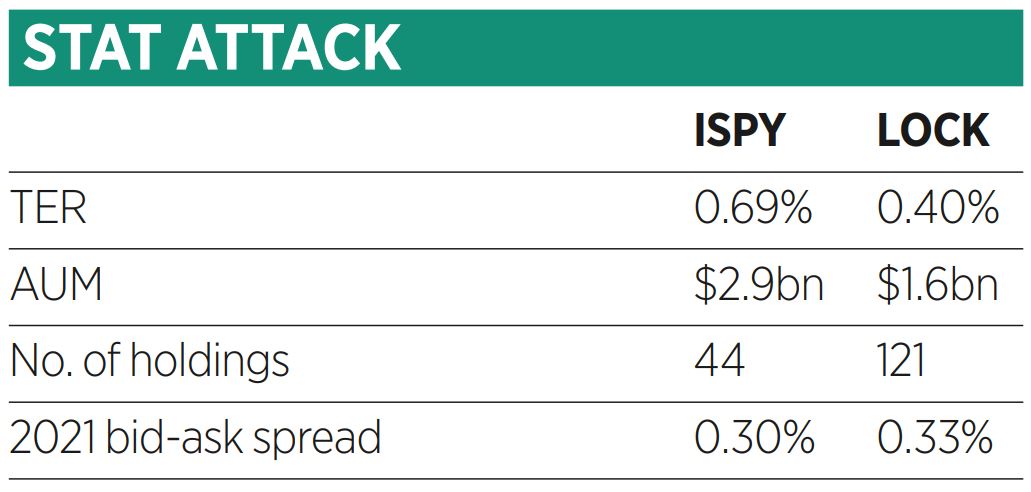

In terms of cost, LOCK is Europe’s cheapest cybersecurity ETF with a total expense (TER) of 0.40% which was offset further by a return of 0.03% from securities lending in 2021. Meanwhile, ISPY carries a TER of 0.69%, the most expensive in Europe.

However, ISPY has one edge on the cost front, with an average spread on its primary listing of 0.30% versus 0.34% for LOCK, according to data from Bloomberg Intelligence. This owes to its greater size and more frequent trading, Athanasios Psarofagis, ETF analyst at Bloomberg Intelligence, told ETF Stream.

Overall, both ETFs have enjoyed significant investor attention in recent years, with the chances of this continuing being high as we position for an increasingly tech-enabled world. ISPY currently leads in terms of assets and performance but ultimately, both ETFs offer slightly different ways of playing the cybersecurity megatrend.

This article first appeared in ETF Insider, ETF Stream's monthly ETF magazine for professional investors in Europe. To access the full issue, click here.

Related articles