If it is not clear by now, the COVID-19 pandemic has been supplanted by inflation as the biggest risk to financial markets. Stocks got off to a rocky start in 2022 as jitters about inflation and the higher interest rates they are fuelling caused a massive sell-off in certain high-growth pockets of the market.

On Monday, the iShares Core S&P 500 UCITS ETF (CSPX) briefly fell nearly 5% off its highs and the Ark Innovation ETF (ARKK), which has been pummelled for much of the past year, was down nearly 50% from its February 2021 top.

Stocks have since bounced back as investors reason – or hope – that inflation may be peaking, moderating the number of times the Federal Reserve will have to hike its benchmark federal funds rate.

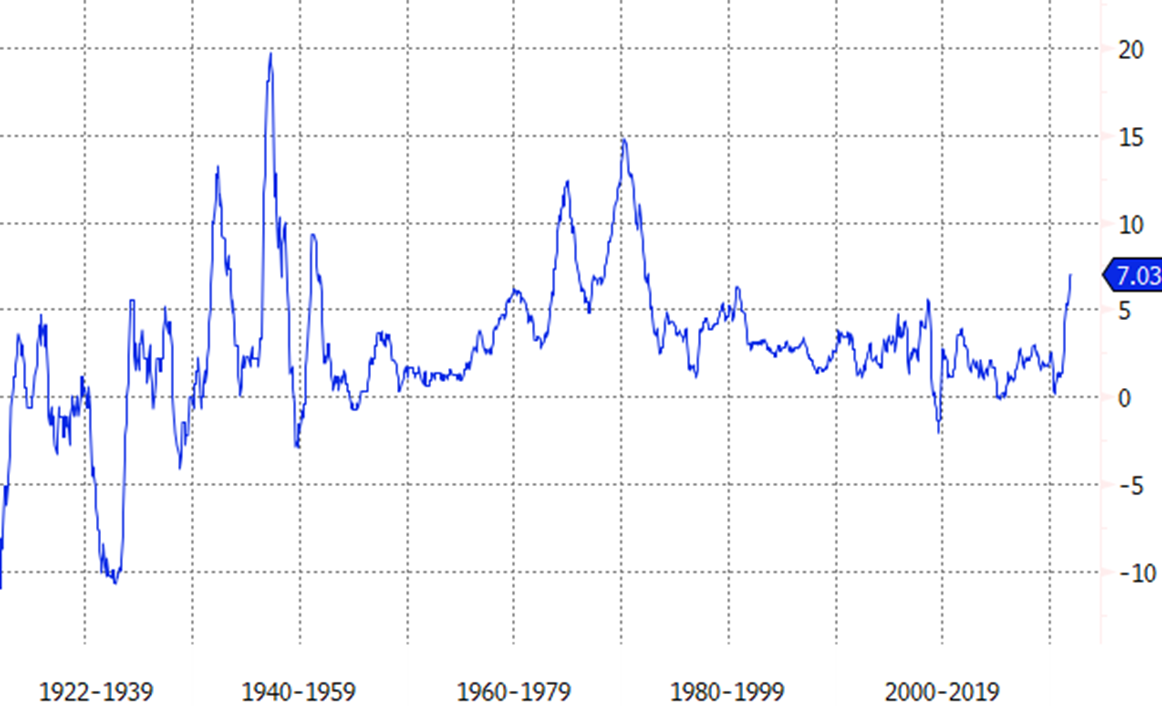

On Wednesday, the Bureau of Labor Statistics reported that the US Consumer Price Index grew 7% year-over-year, a 40-year high, while the core CPI, which strips out food and energy prices, grew by 5.5%, a 31-year high.

CPI growth (YoY)

Fed becomes a headwind

Both the Federal Reserve and most of the investment community believe that inflation will ebb later in the year as supply chain bottlenecks abate. The five-year breakeven rate, a market-derived measure of inflation expectations, currently stands at 2.9%, high by recent standards, but lower than the 3.2% mark reached back in November.

Still, while the consensus expectation is for inflation to cool off, there is a growing sense of unease among investors that something could go wrong.

Once it became clear that inflation was not as transitory as once thought, the US central bank has had to pivot its monetary policy aggressively. The median projection for rate increases this year from Fed officials calls for three hikes, but some investors think the central bank could be forced into four or even five hikes.

Rather than working in support of the market, Fed policy is now a headwind.

Where will inflation settle?

Sure, most investors would agree that inflation staying high is not the base case. Everything from the aforementioned breakeven rates to the nominal 10-year bond yield (currently less than 1.8%) points to a market that is relatively confident that the CPI is not going to be growing anywhere close to 7% in the coming months.

But where will inflation settle? Will it be 2%, or less, as was the case during much of the last bull market? Or will be something higher than that?

Though there are reasons to believe an optimistic scenario is possible or even likely, no one knows definitively how this will all shake out. After all, no one predicted headline growth of 7% in the CPI.

Policy errors

The major stock indices, which have been impressively durable against the threats of inflation, will no doubt be keeping a close eye on inflation readings later this year. This week’s 7% figure, as big as it is, is not the concern. The concern is if inflation will still be holding stubbornly above 3% at the end of the year and into next year.

Under that scenario, price pressures may be much more ingrained in the economy than people think and the Fed is still acting too cautiously. If that’s the case, rates might have to be hiked much more aggressively later on.

There is also the opposite risk as well, that the Fed hikes too much and inflation is predominantly being caused by supply chain issues. Such an overtightening could slow economic growth dramatically, which is obviously bearish for markets. The fact that the 10-year bond yield is under 2% (limiting the number of times the Fed can hike without inverting the yield curve) makes this risk salient.

Again, these are not the base case assumptions, but they are distinct risks to consider. High inflation has not been something investors have had to worry about since the mid-2000s during the last commodities supercycle; that alone makes it unnerving to deal with.

This story was originally published onETF.com

Related articles