The rise of exchange-traded funds over the past two decades has been nothing short of remarkable, however, the proliferation of strategies has led to more niche areas of the market being tracked by huge swathes of assets that are altering the dynamics of those markets in question.

The global ETF market is on course to hit $10trn by the end of the year, with European-listed ETFs currently sitting at almost $1.5trn in assets under management (AUM). This rapid increase in flows comes at a time when issuers are moving away from launching products in the large, liquid, market-cap space and into less liquid strategies tracking small-cap stocks.

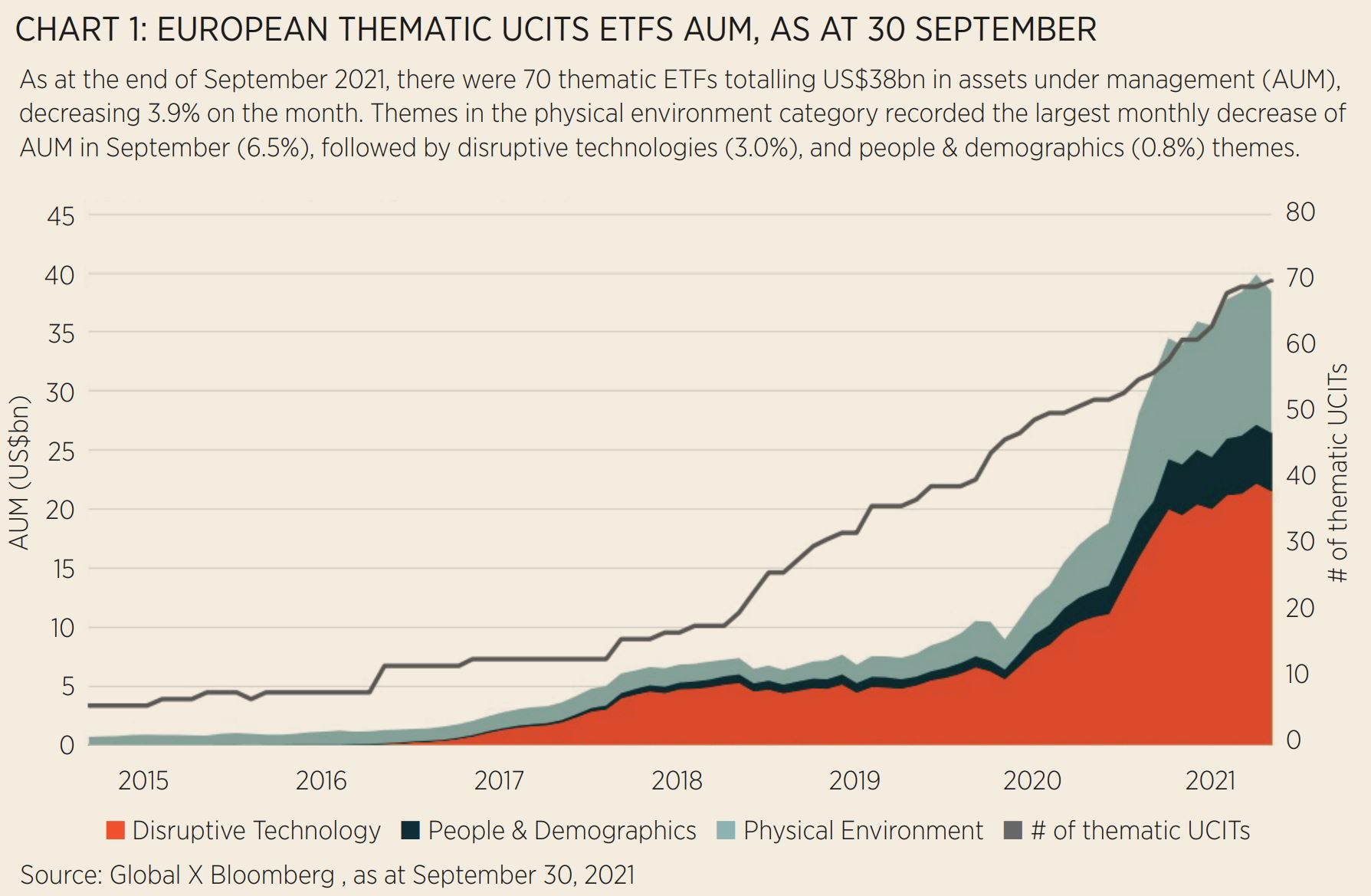

These products have come in the form of so-called thematic ETFs – strategies that track megatrends such as clean energy and cybersecurity. With the lure of huge returns on offer, investors have piled into these ETFs at a rapid rate. Highlighting this, there are currently 69 thematic ETFs in Europe holding $40bn AUM, according to data from Global X, up from under $10bn at the start of 2020.

Furthermore, earlier this year, Bloomberg Intelligence predicted global thematic ETFs could hit $300bn in AUM in less than five years, up from the $170bn the industry currently sits at. This means even more assets will be passively tracking niche areas of markets, a potentially worrying sign for the chief executives of these companies if the megatrend falls out of favour and the flows reverse. The issue has already bubbled to the surface this year.

Questions began to be asked of BlackRock’s two clean energy ETFs following a combined $7.5bn of inflows in 2020. These inflows, combined with US President Joe Biden’s pledge towards climate-related infrastructure projects, sent clean energy stocks soaring, with the iShares Global Clean Energy UCITS ETF (INRG) returning 136% last year, the best performing strategy across all European-listed ETFs.

Artificial price increases

Tracking a basket of 30 or so small-cap pure-play clean energy stocks meant the flows into the two BlackRock ETFs were artificially driving up the price of these strategies. At one point, the two ETFs held more than 8% of the market cap of six companies in January with the teams at BlackRock and S&P Dow Jones Indices (SPDJI), the provider of the underlying index, becoming increasingly worried about the fate of the holdings if flows reversed.

Concerns were so high that SPDJI launched a consultation with the market to restructure the decade-plus-old index which occurred in April. The new-look index now had a new set of rules adding a whole host of stocks to improve the liquidity characteristics, however, SPDJI were not done, and implemented a second set of rule changes in August which introduced emerging market stocks to the index and a fresh set of rules.

The saga highlighted the issues that can arise if flows dramatically increase into an ETF in a short space of time. For BlackRock’s clean energy ETFs, any major impact on the underlying stocks was overall avoided. A run on the strategies could have created a doom loop where redemptions drive further redemptions.

François Millet, head of ETF strategy, ESG and innovation at Lyxor, is acutely aware of the issues facing issuers when designing strategies in these markets.

“This is definitely an issue for thematic and small-cap ETFs more broadly,” Millet explained. “There is a triangular trade-off between the purity of a theme, its diversification and its liquidity. When designing a strategy, we can relax one of the constraints to improve the other two.”

Perfect storm needed

For issues to be created, there needs to be a perfect storm of large index flows and high concentration. As a result, Howie Li, head of ETFs at Legal & General Investment Management, which has one of the most extensive thematic ETF ranges in Europe, said this means actively managing the index design before – and more importantly, after – a strategy goes live.

He stressed that different index designs should be implemented depending on the life cycle of the theme the ETF is offering exposure to. He gave the example of the $1.2bn L&G ROBO Global Robotics and Automation UCITS ETF (ROBO) which saw minimum size caps introduced after flows started to increase. This had the effect of reducing exposure to microcap names that could struggle in an environment where the strategy sees strong inflows or outflows.

Another rule built into the firm’s thematic ETFs is the ability to implement an ad hoc rebalance in between the scheduled rebalances. This, Li said, allows the firm to be flexible if an ETF owns too much of one stock or a stock holds a large weighting in the index.

“When we build indices, there are active decisions involved,” Li stressed. “It is an evolutionary process which is all about managing risks that arise in real-time. There is no right or wrong way of doing this, but we try to avoid off-the-shelf indices.”

However, not all issuers tinker with an index’s rules once an ETF is launched, and some do not have the ability to because they are licensing it from major index providers such as MSCI or SPDJI. Despite this, however, there are a number of metrics investors can monitor to ensure an ETF has not started moving the underlying market.

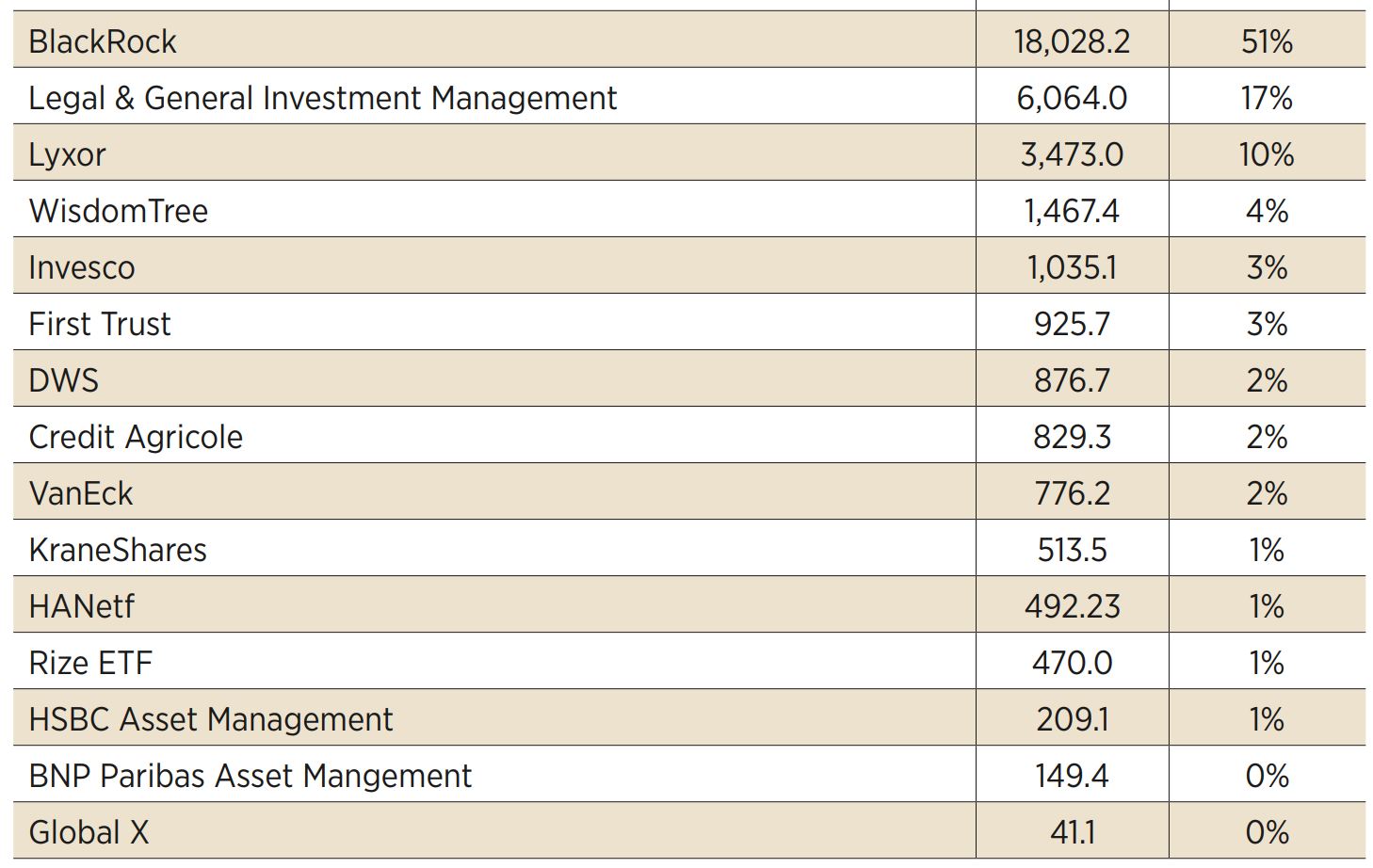

Chart 2: Thematic ETFs: Issuer market share in Europe, as at 30 September

Source: Bloomberg Intelligence

Clues provided

According to James McManus, CIO at Nutmeg, who sold the firm’s exposure to BlackRock’s clean energy ETFs in February, it is crucial to screen the entire investment universe and not just the ETF you are invested in. Understanding the total flows into a certain sector or megatrend can provide clues as to the impact these may have on the ETF.

“This requires you to be creative, and to look cross-market/cross-index to understand the effect of aggregate index flows and the flows of active investors where concentrated too,” McManus said. “It is not a perfect science, but it does give you a perspective of how significant index ownership is to the equity base. It was a clear red flag for us on clean energy.”

Furthermore, the liquidity profile of the underlying securities in the context of index flows should be another area of focus. When modelling the impact of clean energy ETF redemptions on the underlying securities, Nutmeg found a 1% redemption of AUM would exceed 25% of average daily volume (ADV) in 8% of the holdings and above 10% of ADV in a further 18% of the holdings.

“Clearly then, relatively small index flows could have relatively large impacts on volumes in underlying stocks should there need to be primary redemptions,” he added. “This is not something that is particularly common – you need big index flow and high concentration – but definitely something to be aware of particularly in thematic products.”

It is important to note this issue is not only related to ETFs tracking indices as highlighted by the huge inflows into Cathie Wood’s flagship Ark Innovation ETF (ARKK) and its subsequent performance. At the start of 2019, ARK Investment Management had a mere $3bn in AUM but this grew to over $50bn by the start of 2021, with ARKK reaching $25bn following 149% returns in 2020 and huge inflows. Wood was so successful in 2020, it earned her the nickname “money tree” by Korean investors.

However, as with clean energy, the flows began to drive the performance of the underlying stocks, and there became a serious risk these companies would be significantly impacted if investor sentiment reversed. According to data from Morningstar, ARKK owned at least 5% of a company’s shares in more than 33% of its holdings, and at least 10% of the free float in 10 out of 55 companies in the portfolio.

“These risks are present across all funds, in small-caps especially. If there are calls for daily dealing, holding a portfolio of significant size can present challenges when you are trying to sell a stock,” Li said.

This article first appeared in ETF Insider, ETF Stream's new monthly ETF magazine for professional investors in Europe. To access the full issue, click here.