European regulators are shining a spotlight on the murky world of pre-hedging, a contentious process where market makers are “frontrunning” the orders of ETF investors in request-for-quote (RFQ) platforms.

In July, the European Securities and Markets Authority (ESMA) issued a ‘call for evidence’ on the practice of pre-hedging which the regulator defines as liquidity providers “hedging inventory risk in an anticipatory manner in presence of a potential incoming transaction”.

This is particularly relevant to the European ETF market where the majority of trades are executed on RFQ platforms, an unintended consequence of the introduction of MiFID II which attempted to push more flow onto ‘lit’ venues.

On RFQ platforms such as Tradeweb and Bloomberg, investors will request a quote to buy or sell a block of ETF shares from usually a large number of liquidity providers – mainly market makers – all of which are vying to win the trade by showing the best price.

The investor subsequently selects which liquidity provider they want to execute with and the provider is responsible for executing this trade, a relatively straightforward process that fulfils an investor’s best execution requirements.

This simplicity is a key reason why over 80% of European ETF volumes are executed via RFQ platforms versus exchanges or ‘dark pools’, for example.

However, there has been a significant rise in the practice of pre-hedging – when an investor sends an order to multiple liquidity providers and one of those providers pre-hedges the position in preparation of winning the trade.

This evidently has the adverse effect on the price of that specific basket of securities and therefore can leave investors with significant losses after they execute a large trade.

As Jane Street – the world’s largest market maker – said in its response to ESMA’s consultation: “To call this practice ‘pre-hedging’ is a misnomer. By definition, the pre-hedging dealer has not taken on any risk at the point it decides to pre-hedge.

“In the absence of any risk management rationale for pre-hedging, the behaviour can be considered to be a form of market abuse (i.e. frontrunning).”

Echoing Jane Street’s views, the European Fund and Asset Management Association (EFAMA) argued there is “very limited reason” for the practice of pre-hedging to be acceptable without winning the trade.

“We agree with the argument that competitive RFQs can lead to detrimental price impact for clients if multiple RFQ participants pre-hedge without certainty of winning the trade, i.e. for RFQs for an ETF,” the association stressed.

In the US, investors are protected by the Regulation National Market System (Reg NMS), which came into effect in 2005 and requires market makers to provide investors with the best price by sweeping the order book in a bid to find liquidity across all venues, not just the RFQ platform.

In favour of pre-hedging

This is currently not the case in Europe, however, ESMA’s call for evidence has divided opinion across the trading ecosystem.

Many proponents of pre-hedging play down the impact of this practice. For example, the Association for Financial Markets in Europe (AFME), in its response to ESMA, said many RFQs are simply used by investors as a price discovery tool and are “never acted upon”.

If an investor did see the market move significantly after issuing an RFQ then they have the option to not execute the trade. However, if investors have a view on the market, they will look to exit that position as quickly as possible while many use third-party brokers which will always look to execute if given instruction to.

The AFME also warned that if pre-hedging RFQs was routinely considered insider trading, this could have the unintended consequence of driving market makers away from RFQ platforms resulting in liquidity being removed from the market, a “further poor outcome for clients”.

“In the examples of pre-hedging provided by ESMA, not all liquidity sourced by a provider following the provision of a quote will be in response to the original client RFQ,” it continued.

“Certain trades may be normal course market making activity may be in anticipation of other client transactions or may be for other risk management rather than pre-hedging or inventory management which may occur after the provision of a quote.”

Two-sided RFQs

Along with choosing not to execute, one option that was suggested by several industry commentators is sending two-sided RFQs – showing a buy and sell order – which, in theory, means market makers do not know which way an investor is trading.

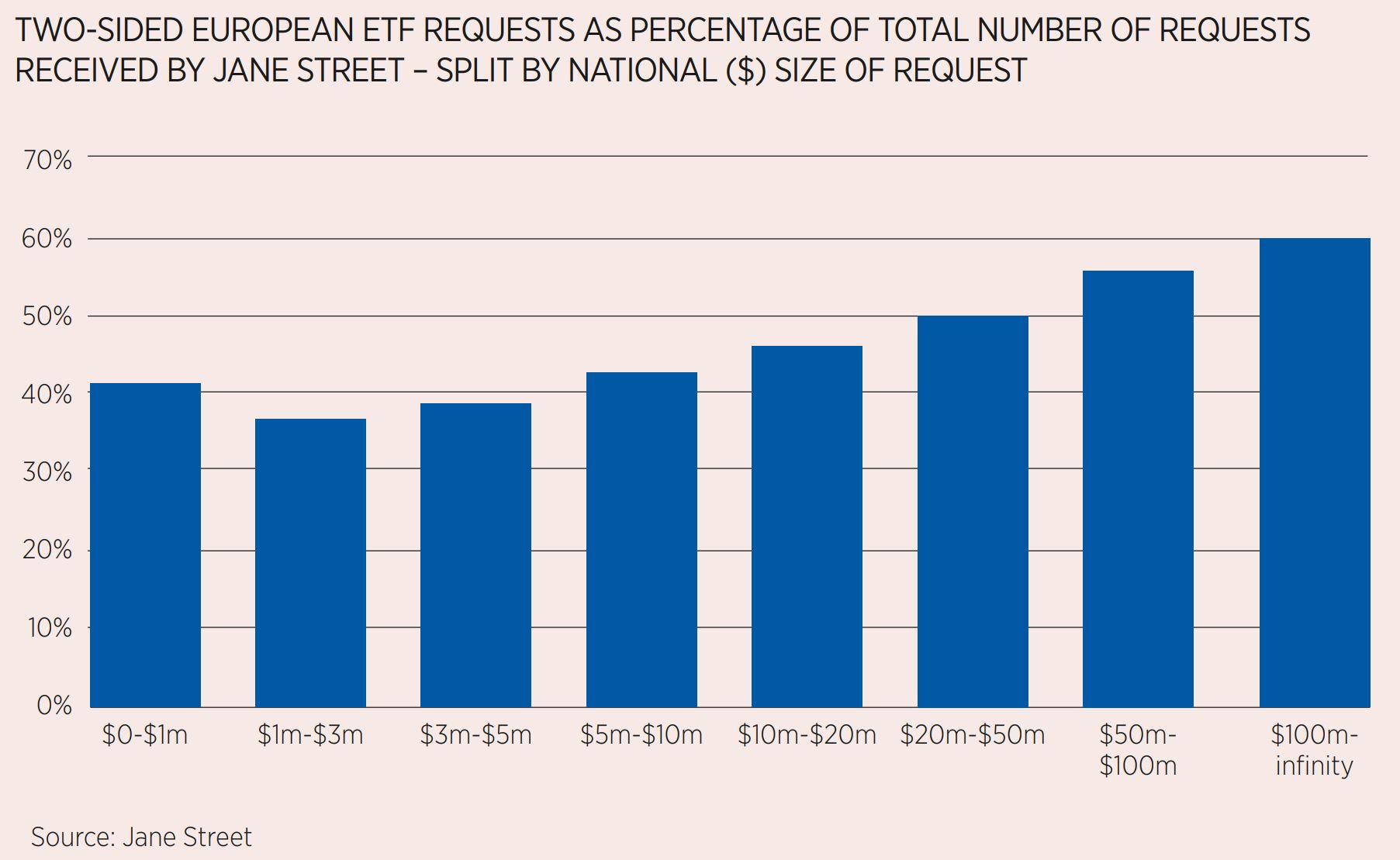

According to data from Jane Street seen by ETF Stream (see Chart 1), approximately 60% of all RFQs the market maker receives for trades over $100m are two-sided while this figure drops to around 40% for all trades under $1m.

One industry source told ETF Stream it is “foolish” if investors show the direction of their trades on RFQ platforms. While this is a good first step, it does not cover investors entirely.

“Pre-hedging is a destructive behaviour. It has a detrimental effect for an investor looking for a price and a positive effect for liquidity providers that choose to pre-hedge,” they continued. “We consistently tell clients to show two-way prices, however, it does not remove the opportunity for pre-hedging to occur because liquidity providers know the type of holdings clients have.”

This is the crucial point around two-sided RFQs. Because dominant liquidity providers have a full view of investors’ portfolios, they are well informed as to whether they are set to buy or sell. Therefore, a two-way quote does little to stop pre-hedging practices.

Investor awareness

Overall, pre-hedging remains a relatively underappreciated practice among ETF investors where the simplicity of RFQ execution is seen as a major advantage. Despite this however, executing on RFQ in a highly fragmented market is an opaque process with the risk of information leakage relatively high.

As a result, Alex Livingstone, head of trading and FX at Titan Asset Management, called for “further investigation and regulation” in the space.

“Pre-hedging in the European ETF market is an issue buyers need to be aware of in their execution process, especially when looking to fill large block orders in the market when disclosing direction,” he warned. “It highlights some of the flaws of the highly fragmented and opaque European market.”

Echoing his thoughts, Frank Mohr, head of ETF sales trading at Société Générale, said pre-hedging is an “obvious” disadvantage of the RFQ functionality and stressed the importance of education in the investor space.

There are a number of actions buyside traders can take to try to limit the risk of pre-hedging. The most obvious is sending the order to fewer liquidity providers when executing on RFQ platforms.

Bloomberg, for example, has a tool on its RFQ platform that allows investors to select certain market makers that have a history in filling orders for specific types of exposure.

This allows investors to avoid showing an order to any liquidity providers that are unlikely to be able to execute the trade.

Furthermore, in a research note seen by ETF Stream, Jane Street told clients to take action by “setting RFQ response times that are consistent with the potential transaction” as well as understanding the trading behaviour and pre-hedging views of liquidity providers.

Going forward, this may determine whether an investor wants to deal with a market maker they know could pre-hedge their position when they execute a large trade via an RFQ platform.

Meanwhile, Europe's largest market maker Flow Traders added it welcomes the European regulator's guidelines on pre-hedging.

“I would prefer a ban on pre-hedging but I do not see how we can stop it,” Mohr continued. “It is up to us to inform and educate investors. You can send an order to 10 market makers via RFQ platforms but is that best execution?”

Uneven playing field

Furthermore, it is not just investors that are being impacted by pre-hedging. Other liquidity providers such as banks that are unable to engage in the practice because of more stringent regulation are also affected.

In particular, pre-hedging is “creating an unlevel playing field”, according to Jane Street, between liquidity providers that do and do not pre-hedge.

There are concerns it could force liquidity providers to widen prices they offer investors on RFQ platforms as rivals can simply pre-hedge the position they see on screen, even if they do not win the trade.

This creates significant business risk for any liquidity provider looking to win ETF trades on RFQ platforms as market prices can be severely impacted. In turn, this could have the unintended consequence of pricing out many players that cannot compete with a handful of market makers and therefore reduce competition.

“Liquidity providers which pre-hedge will impact the market against liquidity providers which do not,” Jane Street added. “This creates an unfair advantage by affecting the prices the latter can offer.”

All eyes will now turn to ESMA to see how they will react to the responses from the market on this issue and whether they will provide guidelines on pre-hedging practices in the scope of the Market Abuse Regulation (MAR) and MiFID.

Tradeweb declined to comment.

This article first appeared in ETF Insider, ETF Stream's monthly ETF magazine for professional investors in Europe. To access the full issue, click here.

Related articles