Demand for thematic ETFs exploded in 2020, however, with the asset class still very much in its infancy, where are the biggest areas of growth going forward?

European-based ETFs attracted a record €9.5bn in inflows during the year, according to data from Morningstar, while assets under management (AUM) nearly trebled from €8.2bn to €22.7bn, helped by strong returns.

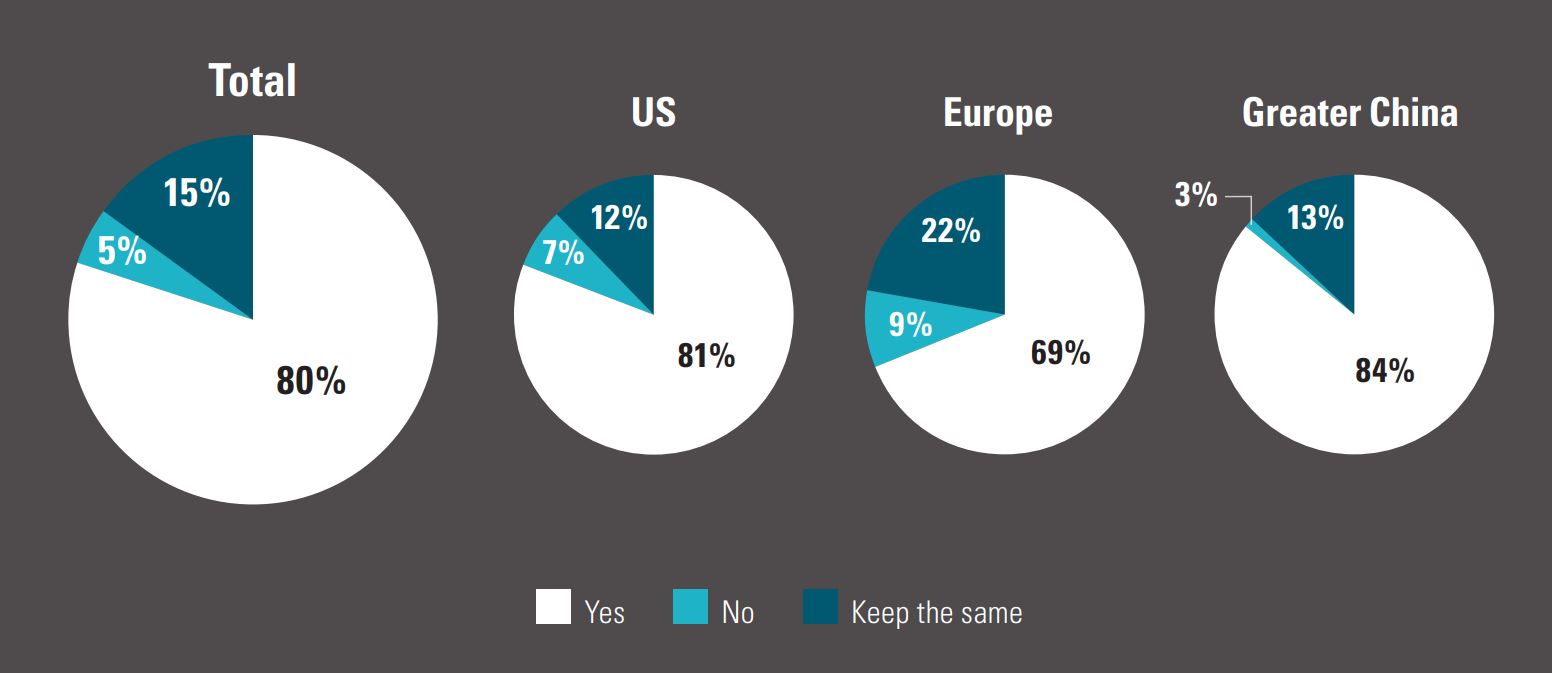

And research suggests this surge in demand is not just a temporary blip. According to Brown Brothers Harriman’s (BBH) 2021 Global ETF Survey, 80% of financial advisers, fund managers and institutional investors globally plan to increase allocations to thematic ETFs.

Chart 1: Do you plan on increasing your exposure to thematic ETFs?

Source: BBH

Antonette Kleiser, senior vice president and product manager for ETFs in Europe and Asia at BBH, said she is witnessing investors “choosing very specific themes, very niche targeted exposures to sub-industries, and using [thematics] as a way to tap into changes in industries”.

A key advantage of thematic ETFs over sector products is that the former are linked to long-term structural themes rather than short-term economic cycles, according to Gregory Berthier, head of product at Lyxor ETF.

In addition, he noted that what makes themes so popular is that they “match the way we think” and can take advantage of the “tectonic shifts” currently happening in the world, which creates unprecedented opportunities for product providers.

Driving forces

Many of the driving forces behind these megatrends of the future have been developing for some time, but the coronavirus pandemic has accelerated some of these and highlighted others that were “not so obvious last year”, Berthier said.

“For example, in disruptive technologies, the themes related to healthcare are key now and people want to invest in them.

“They see that what is happening with the pandemic now may happen again in 10 or 20 years, so we should be able to face this kind of situation by investing in companies that are working in areas such as distance medical consultations.”

Other existing trends, such as technology, have been accelerated by the social distancing measures and the move to working from home, while environmental investing has also gained a boost as we saw the effect of travel restrictions on global carbon emissions.

In fact, sustainability is likely to be one of the most popular areas of thematic ETFs going forward, according to Rahul Bhushan, co-founder of thematic specialist Rize ETF.

“We see a lot of opportunities on the sustainable thematic side at the moment,” he said. This includes areas such as clean water, electric vehicles, food, education and circular economy, and marks a move away from “very tech-oriented US-centric products”.

Rize ETF currently runs four thematic ETFs – Rize Sustainable Future of Food UCITS ETF, Rize Medical Cannabis and Life Sciences UCITS ETF, Rize Education Tech and Digital Learning UCITS ETF and Rize Cybersecurity and Data Privacy UCITS ETF – and plans to continue expanding this range.

Meanwhile, HANetf, Europe’s first white-label platform, has brought products to the market offering exposure to cloud computing, medical cannabis, and more recently a new e-commerce ETF, the Global Online Retail UCITS ETF (IBUY).

According to Hector McNeil, co-CEO of HANetf, the current “red-hot themes” include e-commerce, cloud tech, healthcare innovation, robotics and cyber security. This is reflected in the results of the BBH survey, which found that internet/technology and robotics and AI were the two most popular themes among investors, followed by environment and sustainability-focused thematic ETFs.

Berthier added regulatory changes aimed at curbing carbon emissions across the globe, such as the UK government’s plan to ban new petrol and diesel car sales in 2030, are helping fuel demand for certain themes, such as future mobility: “In 20 years’ time, all vehicles will be electric across the value chain.”

Index construction

But while it may be relatively easy to identify the megatrends that will drive global economies for the coming decades, constructing an index that captures them and performs in line with the theme is a trickier task.

Berthier pointed to the risks of launching products that invest in an extremely narrow theme (such as an airways ETF, for example), since this simply becomes a sub-sector fund, exposed to greater volatility and concentration risk as a result of the small size of the index.

“A theme is a theme when it covers the full value chain of a theme across different sectors,” he said.

“The theme works as long as it reflects what people think. The name should be obvious, the idea behind it should be obvious. It should be clear to understand and should also match what people believe in. If you do not start seeing the evolution of the theme in your daily life, people will not buy it.”

In the short-term, the latter can be a problem even for themes that make sense from a longer-term perspective. For example, Berthier noted the millennials theme was not particularly successful last year as a result of the pandemic.

"We did not really see the theme playing out in the streets, people were not going out to Starbucks and consuming,” he said.

“It is definitely a long-term trend, but it is just not popular right now. When the pandemic is under control and consumption resumes again it will definitely be a very popular theme.”

For Bhushan, a key part of building a successful thematic ETF lies in partnering with sector experts for the specific theme who can share their expertise with the in-house experts at Rize ETF.

“We look for companies that are specialists in each theme and then work with them to create an investing classification,” he explained.

“They are not investors, but they help us achieve what we want to do. We take a theme, break it into sub-themes and map companies into each sub-sectors. The experts know which companies belong to each sub-theme.”

“We do not rely on an index provider that is a team of generalists,” he added. “We do not believe in the idea of jack-of-all-trades, you cannot claim to be an expert in everything.”

Further reading