Israel is at the centre of the global cybersecurity ecosystem. Spurred by record funding in 2021, we view Israeli cybersecurity as well-positioned to be a solution that companies and government agencies around the world turn to for support. A series of high-profile attacks has brought cybersecurity to the forefront of the world’s attention in recent years, and the trend is not expected to abate in 2022.

Globally, three geographical regions stand out as the largest clusters of cybersecurity innovation: the San Francisco Bay Area, Greater Washington DC and Israel. The term cluster refers to a “concentrated density of firms within a geographic region” which typically enjoy the benefits of high concentrations of human capital, shared knowledge, and institutional support.1

Of these clusters, Israel is second in terms of venture capital funding at $4bn and percentage of top 150 innovative cybersecurity firms (as compiled by Cybercrime Magazine) at 32%, which underscores Israel’s reputation as a “start-up” nation.2

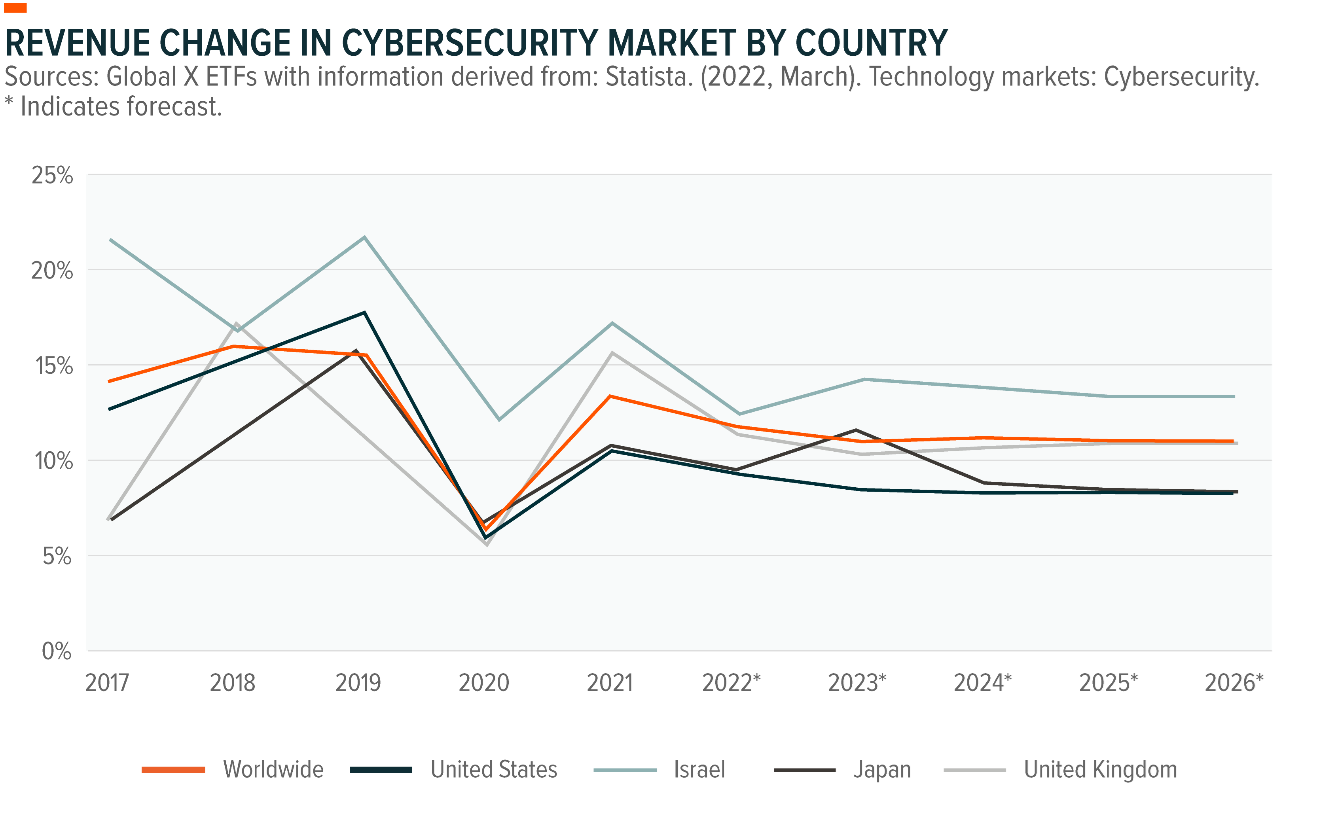

As the chart below indicates, the national commitment to cybersecurity has Israeli cyber firms positioned to maintain a higher level of revenue growth compared to other major countries, such as the US, Japan and the UK.

Notes: Data shown is using current exchange rates as of March 2022. Data shown does not yet reflect market impacts of Russia-Ukraine war, we are currently working on an update.

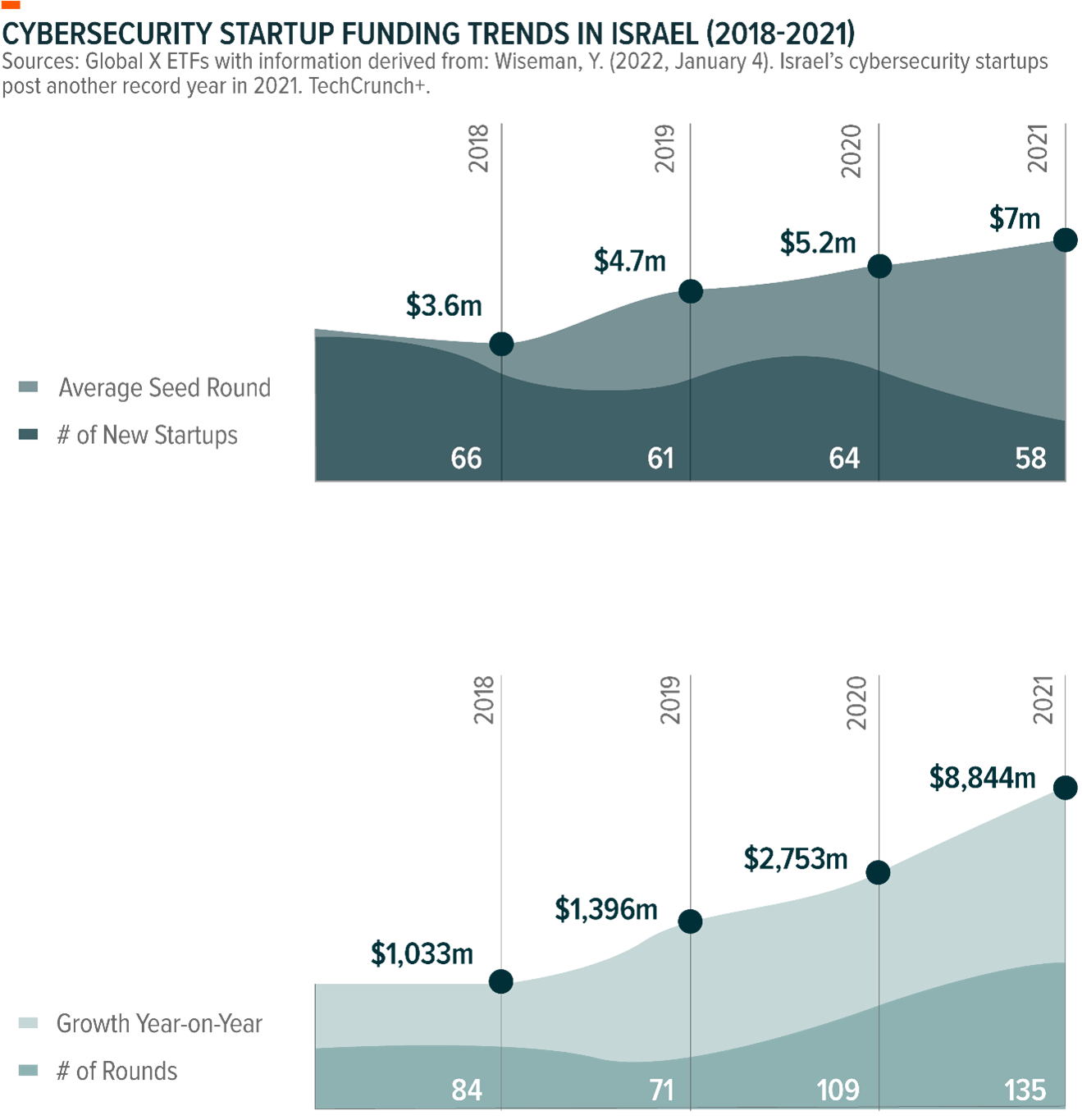

Israel’s cybersecurity sector amassed $8.8bn in funding during 2021, presenting an over three-fold increase in comparison to 2020’s $2.8bn.3 Globally, 40% of private investments in cyber funding rounds went to Israel in 2021, which is remarkable considering the relatively small size of the country.4

The massive inflow of funds into Israeli cybersecurity in 2021 contributed to the emergence of 11 new cyber unicorns, defined as startups with a market value of over $1bn. To put this growth into perspective, as of 2021, 33% of cyber unicorns around the world were in Israel.5

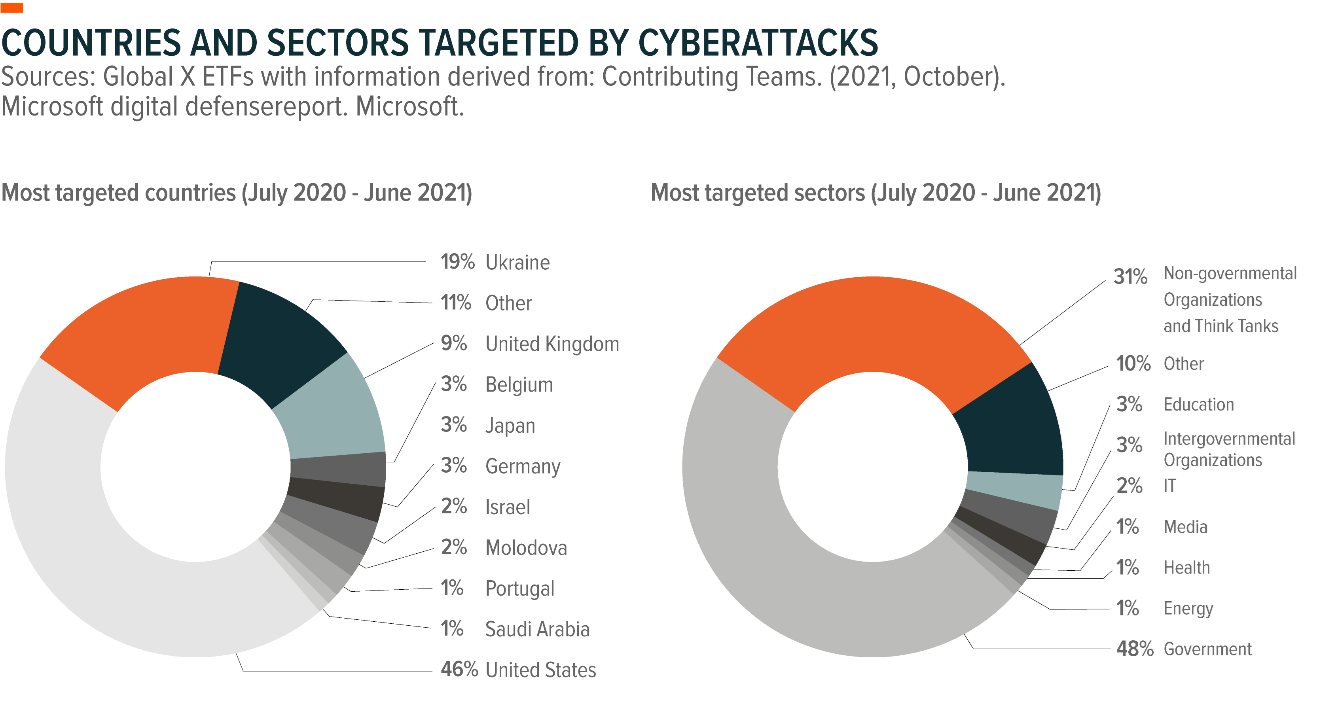

Prior to Russia’s invasion of Ukraine in February, all signs pointed toward more cyber risks in 2022. The invasion set an anxious tone for the year and underscored how geopolitical tensions correlate with rising fear of cyberattacks. Ukraine was the second most targeted country for cyberattacks behind the United States between July 2020 and June 2021, potentially foreshadowing the invasion in 2022.6

With the overwhelming focus of cyberattacks on government institutions, NGOs, and think tanks, governments are upping the ante on cybersecurity spending. In the United States, the Biden administration is proposing $2.5bn for the Cybersecurity and Infrastructure Security Agency (CISA) in 2023, a $500m increase from 2022, and Australia is spending $10bn to double the size of its Australian Signal Directorate.7,8 Meanwhile, France is working to build Campus Cyber, a state-funded cybersecurity innovation centre that is modelled on Israel’s CyberSpark centre.9

Below, we highlight the major initiatives two well-established Israeli firms are taking in 2022.

Check Point: Pivoting to focus on Gen V attacks

Founded in 1993, Check Point is one of the most influential tech companies in Israel. Check Point established itself by becoming a pioneer in firewall technology, controlling a 40% share of the worldwide firewall market by 1996.10 Early this year, Check Point revealed its plans for a shift in strategy in 2022.

The strategy emphasises the rising threats posed by Gen V attacks, which are large-scale multi-vector attacks that can quickly infect a large number of targets across geographical regions.11 Check Point sees AI technology as a crucial tool in countering Gen V attacks and believes its partnership with the chipmaker Nvidia positions it well to use cutting-edge AI technology to thwart these threats.12

CyberArk: Move to subscription-based service nearly complete

CyberArk was founded in 1999 with a solution for the problem of IT administrators having access to all of a network’s data without a robust structure in place to supervise them.13 The privileged access management (PAM) concept was the foundation upon which CyberArk was built, and it remains integral to the company’s operations today. One of CyberArk’s most notable achievements was its 2016 launch of the C3 Alliance, which now has more than 100 members, including Amazon Web Services, McAfee, and Check Point.14 Members of the alliance work together to implement privileged accounts solutions.

In recent years, CyberArk, one of the largest Israeli cybersecurity firms with a market cap of $6.4bn, as of April 2022, has been transitioning its business model away from perpetual software licenses towards subscription-based service.15 The subscription-based service model effectively transfers the burden of convoluted cyber infrastructure from customers to CyberArk, and that could be a much-needed solution as demand for cybersecurity services rises despite a shortage of skilled workers in the field. CyberArk aims to complete its transition to an 85% subscription and bookings mix by Q2 2022.16 As of the end of Q4 2021, its subscription and bookings mix was 71%, compared to 35% in Q4 2020.17

Conclusion

Israel’s cybersecurity industry made significant gains in 2021, adding to its strength. In our view, the industry is well-positioned to solidify and build upon those gains in 2022. While a new cohort of unicorns works with a record amount of funding raised in 2021, well-established Israeli firms are readjusting to the changing landscape in 2022.

We believe investors may find compelling opportunities to capture the growth of a global industry critical to protecting the most important information governments and companies possess. And they may find many such opportunities based in Israel.

Dillon Jaghory is a research analyst at Global X

Footnotes

Hatuka, T., & Carmel, E. (2021, January). The dynamics of the largest cybersecurity industrial clusters: San Francisco Bay Area, Washington, D.C. and Israel. Tel Aviv University. doi:10.13140/RG.2.2.11371.16169

Israel National Cyber Directorate. (2022, January 20). Israeli cyber security industry continued to grow in 2021: Record of $8.8 billion raised. il. https://www.gov.il/en/departments/news/2021cyber_industry

Wiseman, Y. (2022, January 4). Israeal’s cybersecurity startups post another record year in 2021. TechCrunch+. https://techcrunch.com/2022/01/04/israels-cybersecurity-startups-post-another-record-year-in-2021/

Contributing Teams. (2021, October). Microsoft digital defense report. Microsoft. https://www.microsoft.com/en-us/security/business/microsoft-digital-defense-report

Baksh, M. (2022, March 28). The administration expects CISA to grow by just under 300 full-time employees over the next year, for example. https://www.nextgov.com/cybersecurity/2022/03/6-takeaways-cybersecurity-policy-presidents-fy-2023-budget/363713/

Hurst, D. (2022, March 29). Redspice: Budget ushers in Australia’s ‘biggest ever’ cybersecurity spend. The Guardian. https://www.theguardian.com/australia-news/2022/mar/29/redspice-budget-ushers-in-australias-biggest-ever-cybersecurity-spend

Rosemain, M. (2022, February 15). France opens new business campus to tackle cyberattacks. https://www.reuters.com/world/europe/france-opens-new-business-campus-tackle-cyberattacks-2022-02-15/

com. (2022). Check Point Software Technologies Ltd. history, profile and corporate video. Accessed on May 18, 2022 from https://www.companieshistory.com/check-point-software/

Check Point. (2022). Gen-V cyber security: Strategic insights from past generations of threats. https://www.checkpoint.com/pages/gen-v-cyber-security/#

Check Point. (2022, February 4). Check Point Software introduces new strategic direction at annual CPX 360 event and unveils the world’s fastest firewall [Press release]. https://www.checkpoint.com/press/2022/check-point-software-introduces-new-strategic-direction-at-annual-cpx-360-event-and-unveils-the-worlds-fastest-firewall/

Kroll, S. T. (2019, June 17). CyberArk: 20 years of privileged access security leadership, and counting. Cybercrime Magazine. https://cybersecurityventures.com/cyberark-30-years-of-privileged-access-security-leadership-and-counting/

Cyber-Ark Software Ltd. (2022). CyberArk C3 alliance program overview. https://www.cyberark.com/resources/product-datasheets/cyberark-c3-alliance-overview

Bloomberg, L.P. (n.d.) Security description (DES) of CyberArk [Data set]. Retrieved April 28, 2022 from Global X Bloomberg terminal.

(2022, February). Investor relations presentation. https://s22.q4cdn.com/395203516/files/doc_financials/2021/q4/CYBR-Q4-2021-Earnings-Presentation-vFinal.pdf

This document is not intended to be, or does not constitute, investment research as defined by the Financial Conduct Authority.

The value of an investment in ETFs may go down as well as up and past performance is not a reliable indicator of future performance.

Trading in ETFs may not be suitable for all types of investors as they carry a high degree of risk. You may lose all of your initial investment. Only speculate with money you can afford to lose. Changes in exchange rates may also cause your investment to go up or down in value. Tax treatment depends on the individual circumstances of each client and may be subject to change in the future. Please ensure that you fully understand the risks involved. If in any doubt, please seek independent financial advice. Investors should refer to the section entitled “Risk Factors” in the relevant prospectus for further details of these and other risks associated with an investment in the securities offered by the Issuer.