Axel Lomholt joined Qontigo as chief product officer, indices, in November 2021. Previously, he spent nine years in senior leadership roles at Vanguard Investments. Now he has overall responsibility for the STOXX and DAX index portfolio, which includes highly successful benchmark indices such as the Euro Stoxx 50 and the German DAX. Lomholt has ambitious targets for the firm, particularly in strengthening its position in the ETF space.

Lomholt sees Qontigo clearly benefiting from a current trend: “Over the past couple of years, we have seen a growing demand for customised index solutions, also in the ETF market,” he said. “While STOXX indices have a healthy market share in structured products, some of the themes that are playing out in the ETF market mean that it is the right time for us to focus even more attention on licensing indices to ETF providers. In particular, we see clients coming to us for customised thematic, factor and ESG investment strategies.”

A unique value proposition

Lomholt said Qontigo offers a unique value proposition to the market. The company was formed in 2019 through the combination of STOXX and Axioma, a leading analytics provider. “By bringing together STOXX’ index construction expertise with Axioma’s analytics tools, we are able to create highly targeted index methodologies and provide tailored solutions.”

Qontigo’s approach to working with external data also sets the company apart, according to Lomholt. “We have an open architecture approach, that makes it easy to onboard external data, either from leading data providers or even proprietary client data. We do not tell our clients which data they need to use, instead we work with them to ensure their specific goals are met.”

The use of data is becoming a key factor when it comes to developing sustainable investment strategies. STOXX indices use many types of sustainable datasets, among them ESG data from Sustainalytics and ISS ESG as well as SDG data from SDI AOP, an asset owner-led initiative. “Qontigo’s approach is to find and leverage the most robust data available for each sustainable investing case. No matter what new approach is envisaged, we are not limited to any single provider, but are free to go where the best data is.”

In his first months of getting to know his new home, Lomholt says that one thing set Qontigo apart from other index providers: “There is strong demand from our clients for our research and development expertise. It’s all about customisation. Clients want to spend time with us to solve difficult investment problems,” he said. “That is our secret sauce that we now want to scale up.”

STOXX indices have market lead in EMEA-domiciled thematic ETFs

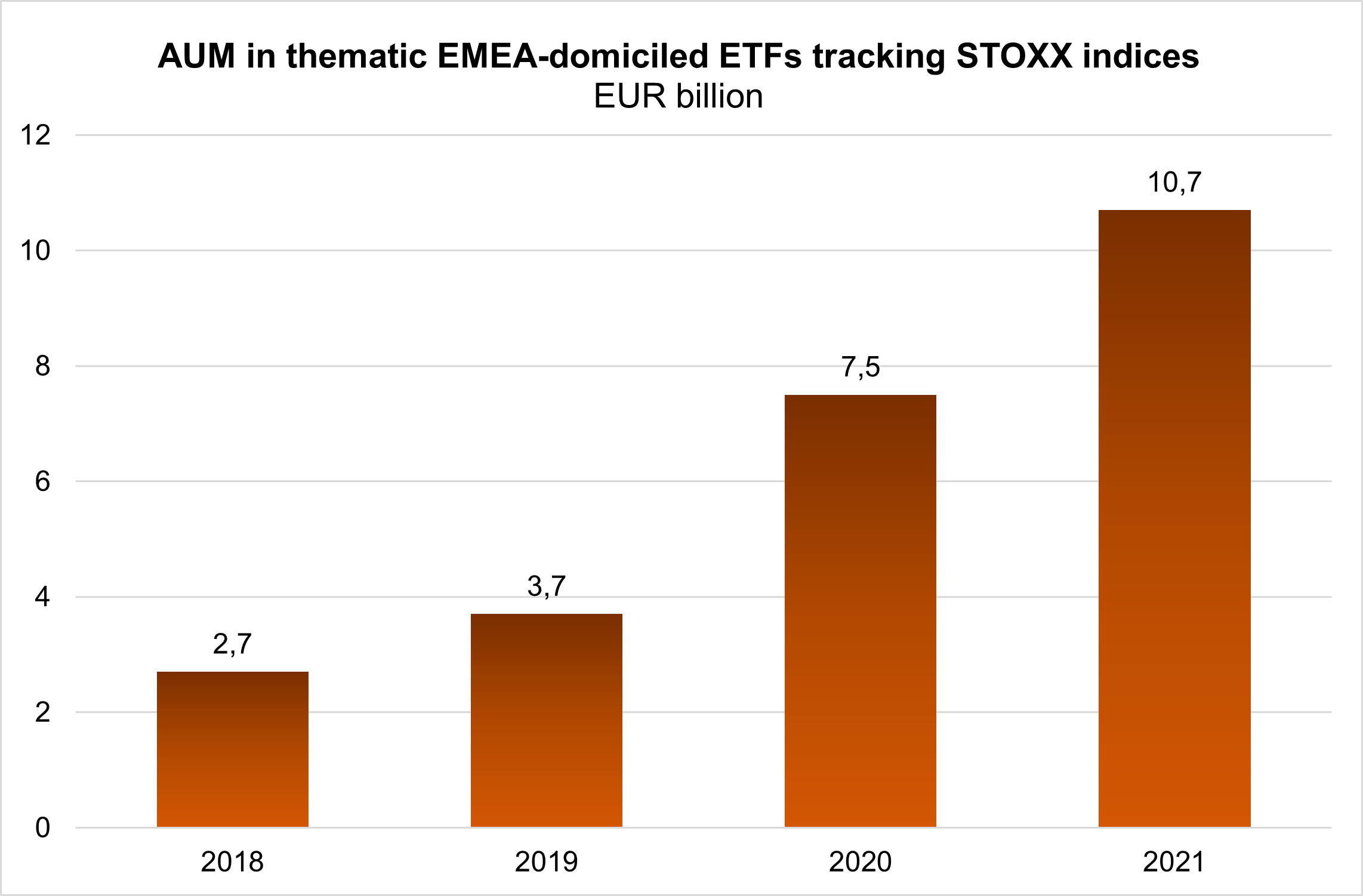

Looking at EMEA-domiciled thematic ETFs, STOXX indices were tracked by €10.7bn of the total €31.3bn AUM at the end of 2021, putting STOXX solidly in the number one position. “That is something we want to build on,” Lomholt emphasises.

AUM growth in thematic EMEA-domiciled ETFs tracking STOXX indices (EUR billion)

Source: Qontigo, as at March 31

Qontigo has a research team that focuses on working with clients and identifying seismic shifts in climate, demographics and technology — known as megatrends. According to Lomholt, when it comes to thematic investing, there is no one-for-all approach. “We employ various methodologies, be they revenue exposure-based, artificial intelligence-based or a combination of various approaches.”

Lomholt is convinced that close collaboration with clients is the key to success. “We have a very productive partnership with BlackRock in the thematic space that started back in 2016. And we continue to see increased demand globally for our thematic expertise. For example, one of our newest thematic indices, the STOXX USA ETF Industry index, was launched for Korean firm Kiwoom. The index tracks 20 US companies that are expected to benefit from the expansion of the ETF market globally, the first index to track this growing segment. We are constantly developing new ideas and there is more to come,” he promised.