By end of 2021, both corporate profits and equity markets had reached record highs. As growth inched higher, so did inflation with the US Consumer Price Index (CPI) reaching a four-decade high in December 2021.

With the COVID-19 fiscal stimulus fading and the Federal Reserve striking a more hawkish tone in an effort to control inflation, we believe attention has moved to tightening market liquidity and resulting volatility. This has been further complicated by the geopolitical crisis indicating, in our opinion, that these dynamics are likely to persist in the medium term. This has led investors to re-evaluate risks and opportunities in their equity portfolios.

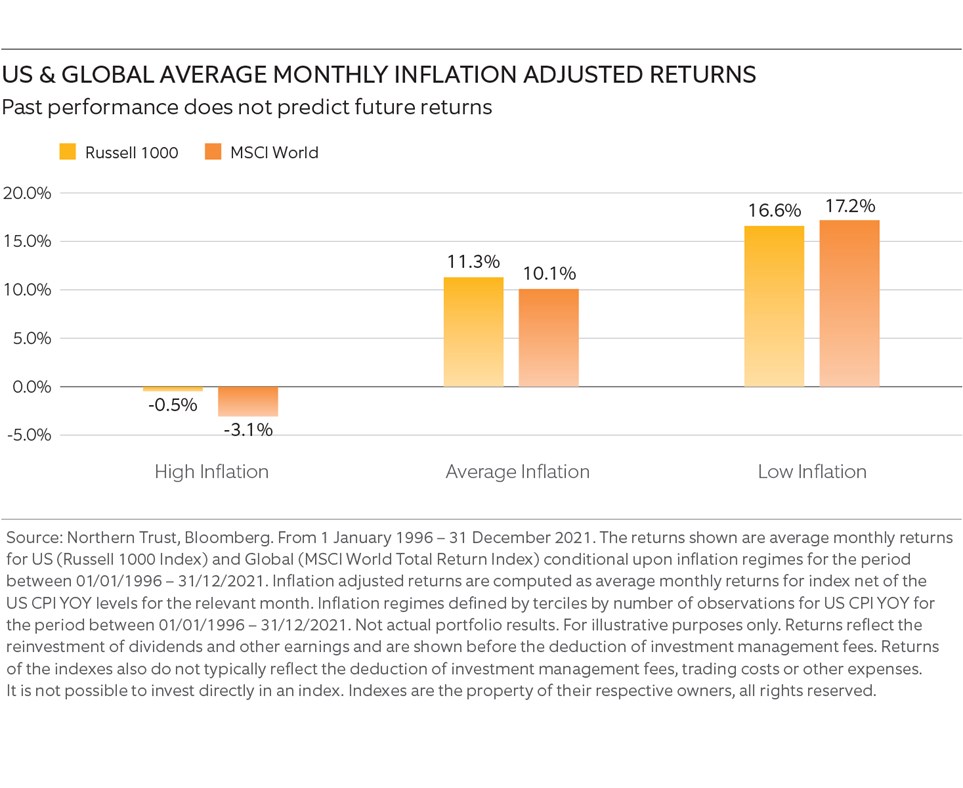

While we do not foresee rampant high inflation in the near future, the key question is how an unexpected change in inflation may impact an investor’s portfolio. Historically, during periods of high inflation, returns from cap-weighted indices fell to keep pace with purchasing power.

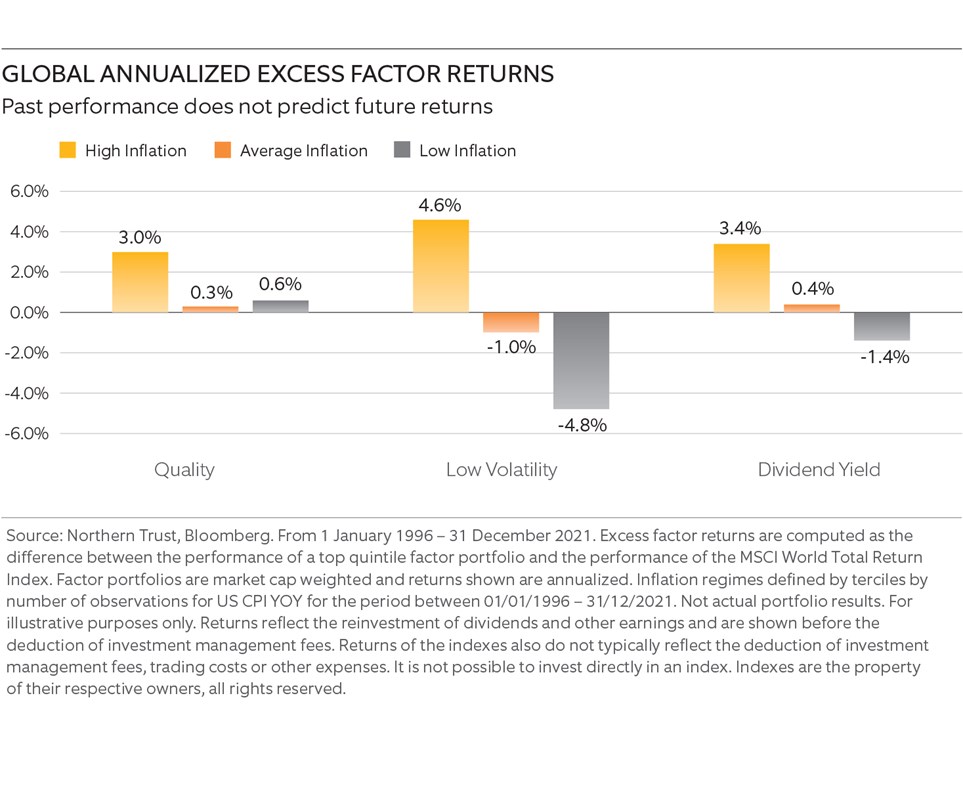

Beyond the cap-weighted indices, there has been considerable academic evidence that style factors such as quality, low volatility and high dividends can be a persistent source of excess returns. Now the question is, can these factors be a source of excess returns during an inflationary environment?

To answer this question, we analysed factor performance across various inflationary regimes within the US and the global developed equity universes.

We observed that during high inflationary regimes, factors have often been a source of excess returns. In particular, the low volatility, quality and dividend yield factors were a source of excess returns for the analysis horizon as seen in the accompanying charts.

Quality performed consistently across various market environments while performing exceptionally well in high inflationary regimes. Low volatility and dividend-yielding stocks had their best performance in higher inflationary regimes while underperforming during periods of low inflation.

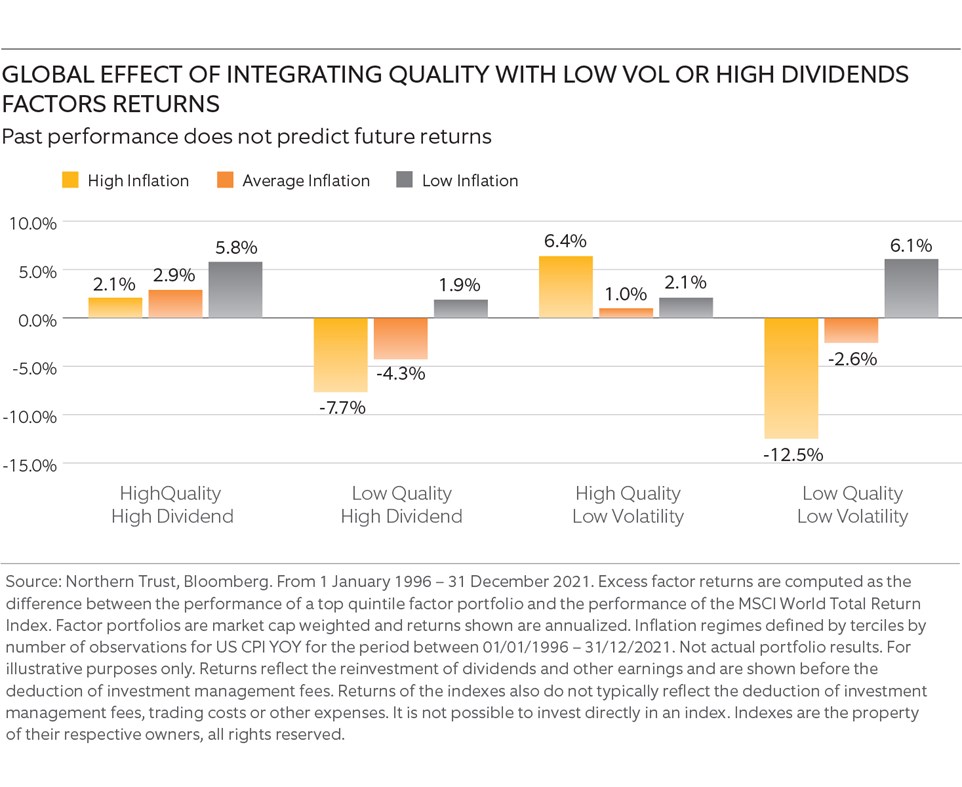

Portfolio design: Combining quality with dividend and low volatility

Low volatility and dividend payers performed well during periods of high inflation while underperforming in periods of lower inflation and/or lower volatility.

While higher inflation regimes brought in genuine risk to an investor’s portfolio, their occurrence and persistence can be hard to predict. From an investment perspective, this means that a dividend and lower volatility strategy ought to be designed in a manner that the impact of this factor’s cyclicity can be mitigated.

Quality stocks have provided consistent performance across both inflationary and volatility regimes. Furthermore, research has shown that higher-quality stocks tended to outperform lower-quality stocks while exhibiting lower risk.

Hence, integrating the quality factor with dividend yield or low volatility factors within a portfolio may help to mitigate the cyclicity of these factors while still allowing to capture the excess returns during periods of high inflation and high volatility.

Integration of quality may also help provide an assessment of the underlying company’s fundamentals. Within a dividend portfolio, it may help identify dividend payers based on their underlying fundamentals that will be able to sustain and grow their dividends. Within a low volatility portfolio, it may help provide a forward-looking view of volatility.

Our research suggests that the advantages of integrating quality are evident. Portfolios formed at the intersection of high quality and low volatility stocks and those formed at the intersection of high quality and high dividend stocks generated positive excess returns across various market environments. On the flip side, however, the factor portfolios formed at the intersection of low quality and high dividend/low volatility underperformed.

Inflation has remained persistent and taking a multi-factor approach through the integration of quality with either the low volatility and dividend factor has historically gone a long way towards meeting desired investment outcomes not only in inflationary regimes but across all the market environments.

Abhishek Gupta is senior quantitative strategist at Northern Trust Asset Management.

FlexShares offers carefully designed, intelligent ETFs, backed by the strength and expertise of Northern Trust Asset Management – part of a 132-year-old global financial services firm with over $1trn total assets under management.*

*31 March 2022. Northern Trust Asset Management.

Learn more about quality, low volatility and high dividend and how they are implemented in the FlexShares suite of ETFs here.

IMPORTANT INFORMATION

This information does not constitute a recommendation for any investment strategy or product described herein. This information is not intended as investment advice and does not take into account an investor’s individual circumstances.

Investing involves risk – no investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment.

Northern Trust Asset Management is composed of Northern Trust Investments, Inc. Northern Trust Global Investments Limited, Northern Trust Fund Managers (Ireland) Limited, Northern Trust Global Investments Japan, K.K, NT Global Advisors, Inc., 50 South Capital Advisors, LLC, Belvedere Advisors LLC and investment personnel of The Northern Trust Company of Hong Kong Limited and The Northern Trust Company. © 2022 Northern Trust Corporation. Head Office: 50 South La Salle Street, Chicago, Illinois 60603 U.S.A.

Issued in the United Kingdom by Northern Trust Global Investments Limited. Issued in the EEA by Northern Trust Fund Managers (Ireland) Limited.