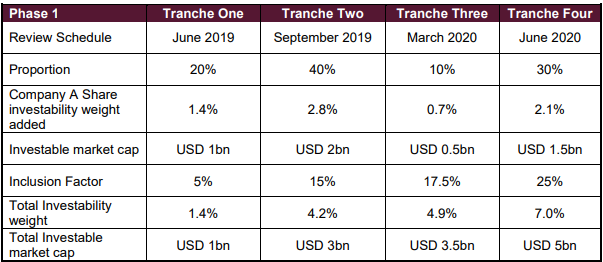

FTSE Russell has split the final steps of the initial phase of including China A-Shares in its global equity benchmarks into two tranches as a result of significant volatility in global equity markets.

The final tranche for the A-Shares inclusion was planned to be completed by 20 March but has been postponed in a bid to reduce the risk to market participants.

As a result, a quarter of the final inclusion tranche will be implemented in March with the remaining three-quarters being implemented in conjunction with the June 2020 index reviews.

ETF discount concerns bubble to the surface

Following client demand, the sizes of the previously announced inclusion tranches have been calibrated against the expected flows into the A-Shares market to avoid adding any unnecessary market disruption.

Source: FTSE Russell

Jessie Pak, managing director, Asia, at FTSE Russell, commented: “After careful consideration based on our own analysis and consultation with a wide range of key stakeholders, market participants and clients, FTSE Russell has allocated the final tranche to March and June to reduce the volume of trading required to calibrate their index portfolios in what remains extremely volatile market conditions.”

S&P Dow Jones Indices has also been impacted by the volatile markets caused by the coronavirus as the firm postponed its quarterly equity indices rebalance earlier this month.