Two of Australia’s most influential fund researchers have said bond ETF discounts are no threat and investors should keep calm and carry on.

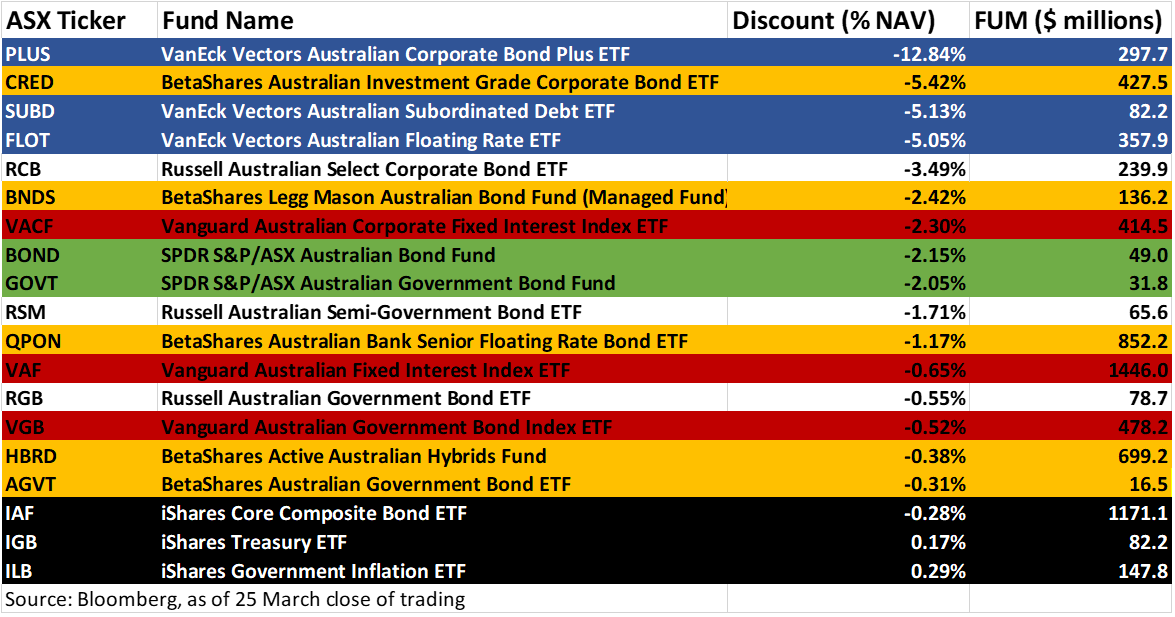

Coronavirus panic has sent global debt markets into freefall, causing many bond ETFs to trade on the ASX at a lower price – called a “discount” – than the funds they are a part of.

The discounts have left many investors confused, as ETFs have been advertised as reliable index following funds. It has also stirred debate among ETF buyers and sellers about how much of a problem discounts are.

According to Dugald Higgins, head of real assets and listed strategies at Zenith, much of the discounts are caused by the fact bond indexes take longer than ETFs to adjust their prices. For this reason, ETF discounts can be a bit of an illusion caused by the indexes being slow to update.

“Once markets go into free fall…the prices at which people trade an ETF can outpace the pricing of the bonds,” he says.

“There is an element of stale pricing in bond indexes due to the way in which the prices are struck in bond markets… bonds they do not trade like shares.

“Rather than trading on central exchanges like shares, they trade [directly between institutions]. That means you will always get a different experience in terms of pricing visibility and the speed at which the price is struck.”

He adds that the same thing can happen to equity ETFs, meaning it is unfair to pick on bonds.

“If you own an ASX 200 ETF and someone like Westpac goes into a trading halt then obviously [Westpac’s shares] will not be trading. But that does not mean that all the ETFs tracking the ASX 200 cannot trade. It means, instead, that market makers take a view on what the ASX 200 is worth and the ETFs then trades there. We saw this happen a lot in turbulent times like the GFC.”

Part of the reason that bond ETFs are trading on discounts is how they are built, Peter Green, head of listed products research at Lonsec, says.

ETFs use one set of companies – called market makers – to trade ETFs. While they use another set of companies – called calculation agents – to decide what the bonds are worth. But only one group – the market makers – actually bears the risk of trading them.

“My gut feel is that the market makers are a bit more trustworthy as they put their balance sheets on the line,” he says.

Like Higgins, he believes that ETF discounts mostly a Müller-Lyer-style illusion. He adds that index companies and market makers have different ways of valuing bonds. Index providers measure from the middle of the market (the “mid point”), while market makers measure from where they sell (“bid point”).

“The gap between the mid-point and bid is quite large. So you get a disconnect between what the iNAV providers are saying and what the market makers are saying. In a way, it is a good lead indicator for what is happening with underlying credit markets.”

ETF discount concerns bubble to the surface

The question many investors ask is how long the bond ETF discounts will last. For both Messrs Higgins and Green discounts will prove short-lived.

“Bond ETFs will bounce back,” Higgins says. “If you are looking at tracking error in six months, I’d imagine there’d be a blip where it goes up. But when you look at other periods of turmoil it flows through quickly. And it only matters if you need to sell.”