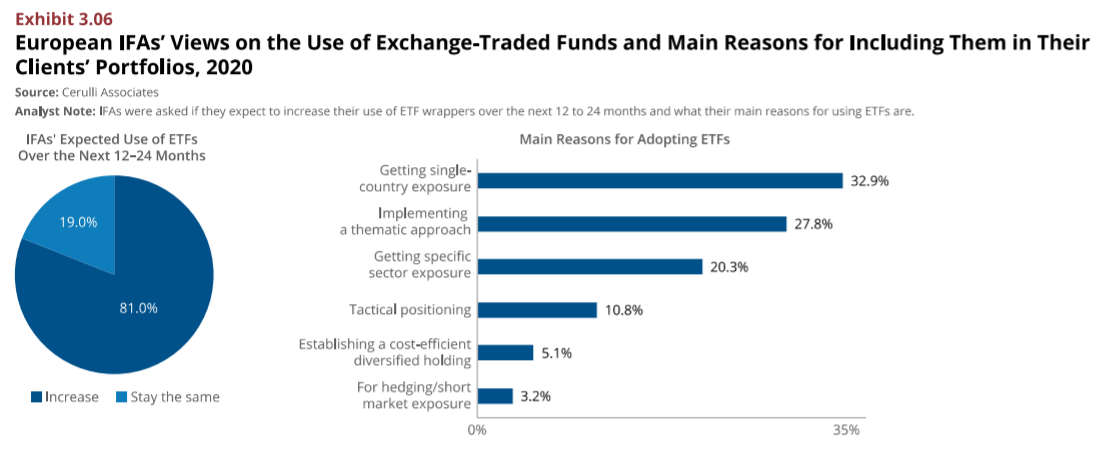

European independent financial advisers (IFAs) are planning to further increase their allocations to ETFs, according to a survey conducted by Cerulli Associates.

The survey, which interviewed 100 IFAs across Europe with €134bn assets under management (AUM), found 81% of respondents expect their ETF adoption to increase over the next two years while 19% said it would stay the same.

The survey, which is part of Cerulli’s European Distribution Dynamics: Cross-Roads and Cross-Borders report, said the increase in allocations to ETFs was being driven by IFAs looking to find new efficiencies in their business models.

Accessing single-country exposures was the main reason for using ETFs with 32.9% of respondents highlighting this factor.

Furthermore, some 27.8% of respondents cited implementing a thematic approach as a key reason while 20.3% said getting sector-specific exposures.

Fabrizio Zumbo, associate director, European asset management research at Cerulli, commented: “European investors now use ETFs as buy-and-hold funds, tactical asset allocation vehicles, and trading instruments and as transparent, lower-cost building blocks for portfolio construction.

“Managers and ETF issuers should consider creating specialised and diversified offerings to differentiate themselves in an increasingly busy market.”

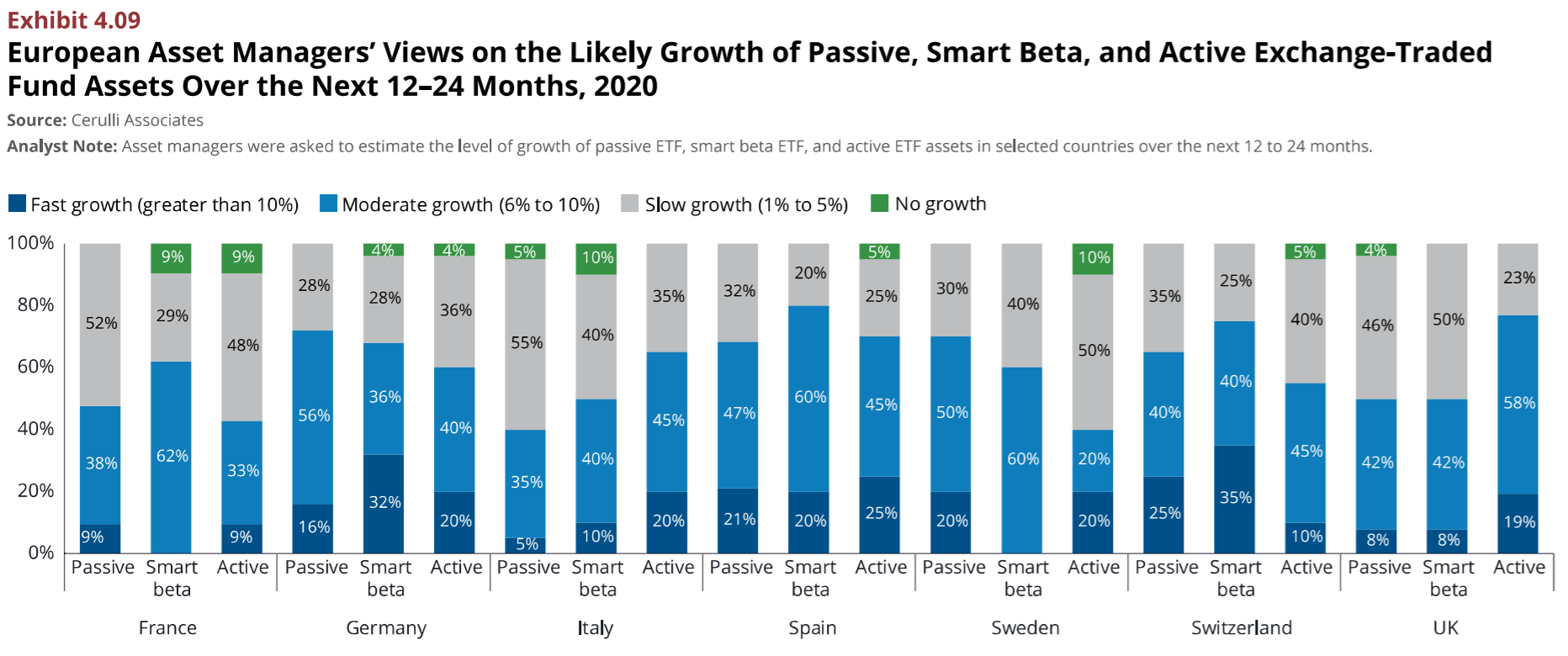

The survey also interviewed 140 European asset managers with over €7trn AUM on the relative growth of passive, smart beta and active ETFs.

It found varying views between countries on the growth of active ETFs. In the UK, some 77% of respondents predicted either fast or moderate growth in active strategies while this number dropped to 42% in France and 59% in Switzerland.

Swiss and German asset managers forecasted fast or moderate growth in smart beta which scored 75% and 68%, respectively.

Zumbo added: “Competition for assets is intensifying in Europe, with new firms entering the market and existing new players boosting their efforts.

“A number of managers at the European level are unveiling new value propositions in the ESG and thematic domains in a bid to enhance the specialisation of their offerings.”

Sign up to ETF Stream’s weekly email here