Australian retail investors are getting their faces ripped off by contracts for difference (CFDs) and companies that peddle them, corporate regulator ASIC has warned.

As the coronavirus has rocked global markets, many retail investors – sometimes called “mum and dad investors” – have decided to use an array of boutique financial instruments to make big bets on market swings. Some have used leveraged ETFs to express their views, but many more have used CFDs, as they provide a wider array of bets and allow investors to make higher stakes gambles.

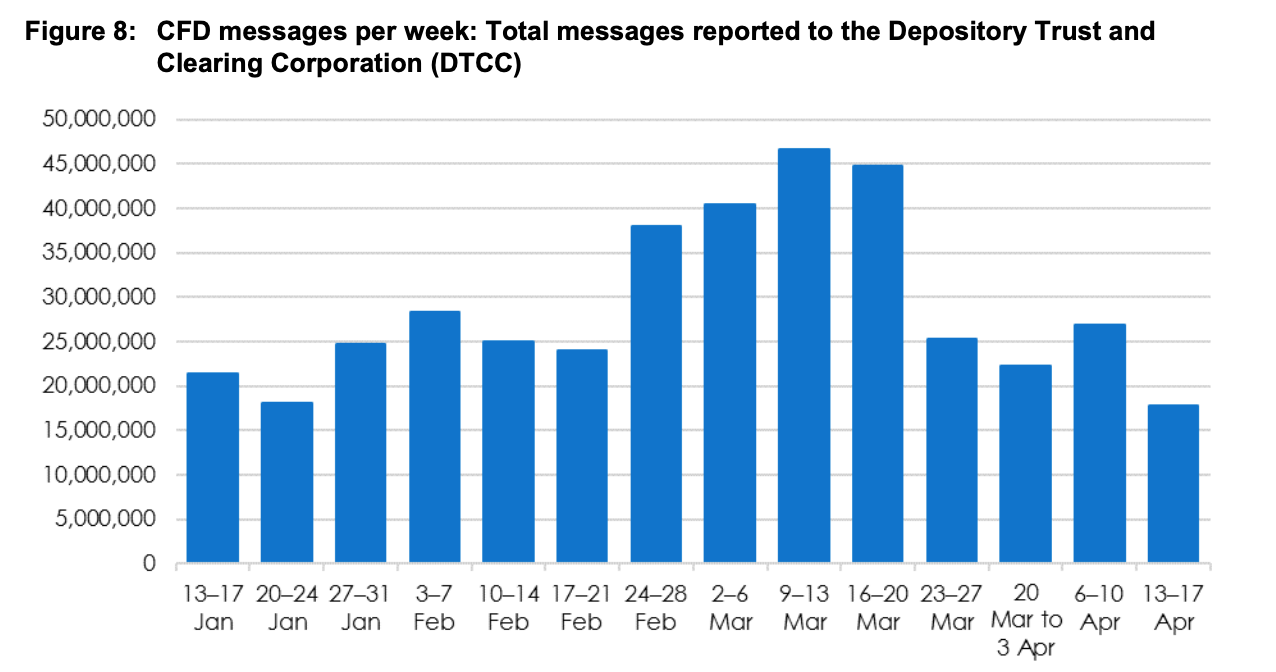

The surge in CFD use has been encouraged by CFD providers, some of which have rolled out new advertising campaigns in attempt to lure punters in.

Source: ASIC

The overwhelming majority of CFD bets have gone badly, with retail punter losses on CFDs hitting $234 million in one week alone.

ASIC explained: “In the week to 22 March, based on a sample of 12 Australian licensed CFD providers, retail client losses were just over $428 million gross (or $234 million net). The 12 providers account for around 84% market share, so the aggregate retail client losses across the industry for this single week may be higher.”

CFDs allow punters to make fruit machine-style gambles on a smorgasbord of price movements, including crude oil, the ASX 200, gold – and many others.

They can be particularly dangerous when they involve limit margins, which allow investors to make bets with money they don’t have. These limit margins can mean that when bets go bad, punters can run up huge debts.

ASIC has filed a law suit to try and ban limit margins on CFDs.

Leveraged ETFs - you can only lose money that you have

Leveraged and inverse ETFs also posed risks for retail investors, ASIC warned. They found that leveraged ETF trading volumes had swelled a massive 16 times over the same period. Almost 75% of leveraged ETF trades had a retail investor on one side, ASIC found.

But ASIC fought shy of applying the cain. Warning only that leveraged ETFs “should not be traded by investors who do not have appetite for this risk or understand the complexity”.

Leveraged and inverse ETFs that give 3x or 4x the daily price movement of an index – which are found in the US and Europe – are banned in Australia.

ASIC took the view that retail investors will not understand the compounding of the daily reset function. Leveraged and inverse ETFs are instead required to operate like actively managed funds.

Sign up to ETF Stream’s weekly email here