BNP Paribas Asset Management has expanded its ETF product range, BNP Paribas Easy, with the launch of a socially responsible credit ETF.

The BNP Paribas Easy € Corp Bond SRI Fossil Free UCITS ETF (ASRI:GR) today launched on Euronext and is set to launch on Xetra on 26 February. ASRI will not be available in the UK.

ASRI replicates the Bloomberg Barclays MSCI Euro Corporate SRI Sustainable Reduced Fossil Fuel Index. The index is comprised of 400 euro-denominated investment grade bonds, enabling investors exposure to Environmental, Social and Governance (ESG) screened products.

The benchmark index includes debt securities from bond issuers with an MSCI ESG rating of BBB or higher. The selection process is an in-house SRI screener which excludes all companies which do not comply with United Nation Global Impact principles as well as companies working within certain sectors. The sectors excluded are alcohol, gambling, pornography, tobacco and weapons to name a few.

The asset manager is aiming to strengthen its index solutions capability within Socially Responsible Investment (SRI) and bond indices for 2019.

Isabelle Bourcier, Global Head of Quantitative & Index at BNP Paribas AM, said in statement: "The launch of BNP Paribas Easy € Corp Bond SRI Fossil Free UCITS ETF is part of a dual approach to develop our low carbon footprint SRI offering and our bond index range. At the end of December 2018, we managed EUR 1.9 billion in ESG index funds."

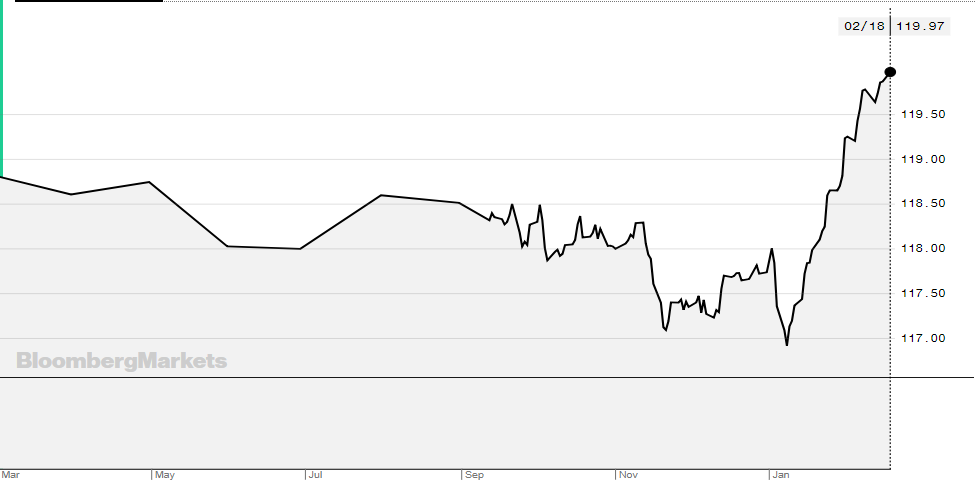

Index Performance

Source: Bloomberg

Short term corporate bonds are known for offering minimal returns due to their low risk. The above graph shows just that with the index producing returns of just under 1% for the last 12 months. Following the effect of the Q4 storm which shocked the equity and fixed income market, the index did recover in the new year, spiking at just over 2.5%.