The majority of actively-managed UK equity funds failed to outperform a comparable benchmark last year, according to S&P Dow Jones Indices’ (SPDJI) bi-annual SPIVA Europe scorecard.

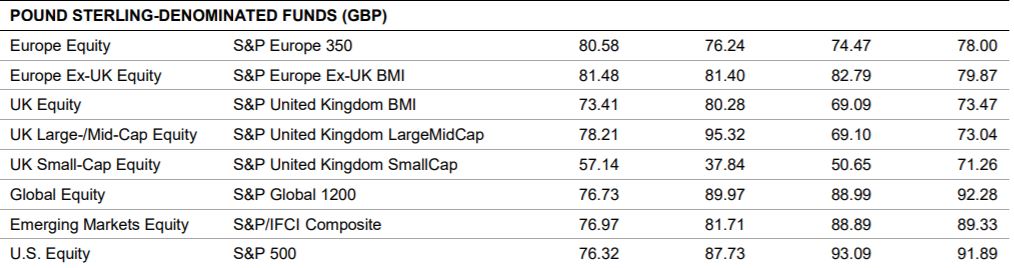

Across GBP-denominated funds, 26.6% of UK equity funds managed to outperform the S&P United Kingdom BMI in 2018, while for UK large/mid-cap funds, just 21.8% beat the S&P UK LargeMidCap index.

There was an improvement in UK small cap funds, typically an area where active managers tend to find success, however, the majority still underperformed with 57.1% lagging behind the S&P UK SmallCap index.

Elsewhere, some 76.3% of US equity funds failed to beat the S&P 500 in 2018. Over a 10-year period, this figure jumps to 91.9%.

For both global equity and emerging markets managers, 23% did not outperform their respective benchmarks, while 18.5% of Europe ex-UK managers lost out to the S&P Europe Ex-UK BMI, the worst sector for active manager outperformance.

Last year marked the return to volatility with two corrections in February and October as investors became increasingly concerned about central bank withdrawal from the markets and ongoing political uncertainties.

In theory, this environment should be a happy hunting ground for active managers, who are able to take advantage of market dislocations and investor overreactions however, the SPIVA Europe highlights the majority have failed to do so.

In the SPIVA US scorecard released in March, US equity managers suffered their fourth worst year on record since 2001 in 2018 with 68.8% lagging behind the S&P Composite 1500.

Source: S&P Dow Jones Indices