Another week goes by where the

has a detrimental impact on a sector’s performance. This time it was oil that suffered significantly by the ongoing arguments between the two countries over fears on

. On Tuesday last week, the price of crude oil fell 8.3% in 48 hours, contributing to its slide since the end of April.

According to data by Ultumus, ETFS WTI Crude Oil ETC (CRUD) was among the worst performing products last week. CRUD saw its Net Asset Value (NAV) fall 6.8% last week. Despite the recent dip, the $600m ETC had inflows of $22.5m as the year-to-date returns remain 23.8%.

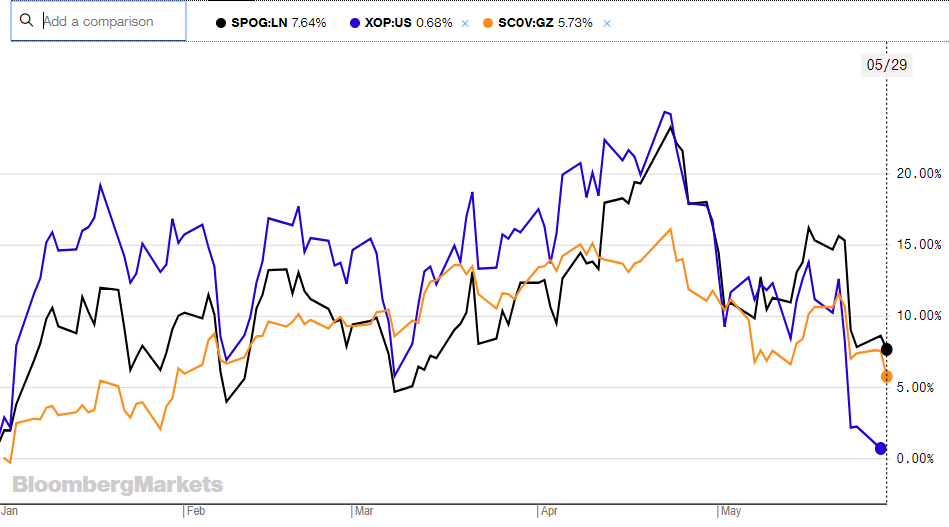

In mid-April, oil and gas ETFs were the best performing, producing double-digit YTD returns. This was a result of the US saying it was ending all exemptions for sanctions against Iran.

The iShares Oil & Gas Exploration & Production UCITS ETF (SPOG) which invests in companies that develop and markets natural gas and crude oil similarly saw its NAV fall 5.5%.

Furthermore, the Invesco STOXX Europe 600 optimised Oil & Gas UCITS ETF (SC0V) and the US-domiciled SPDR S&P Oil & Gas Exploration and Production ETF (XOP) saw their NAVs fall 2.7% and 8.1%, respectively.

SPOG/XOP/SC0V’s YTD Returns – Source: Bloomberg