Net flows for equity ETFs were positive once again for the month of June following significant

. Across the US, Europe and Asia, the asset class pulled in €27bn, according to Amundi’s global net flows report.

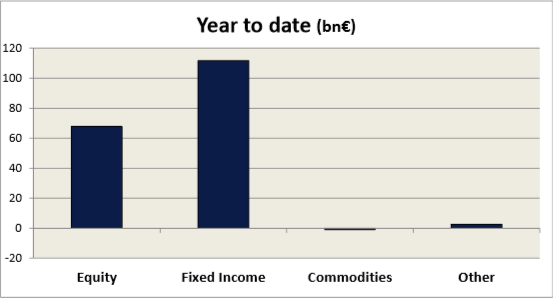

Despite investors’ strategy shift, fixed income ETFs remained favourite, attracting more new cash than its equity counterparts. Fixed income ETF flows were in excess of €36bn last month, bringing the year-to-date net flows to €111.7bn.

In particular, corporate bond ETFs have been the most popular across all regions as European, US and Asian investors have poured in €4.2bn, €9.5bn and €1.6bn, respectively.

The S&P 500 raised 7.2% in June and this performance did not go unnoticed. North American equity ETFs received €39.3bn, €37.9bn of which came from US investors.

The Stoxx Europe 600 also climbed 3.9% over the same period however investors did not react in the same way as they did with US equity. Eurozone domiciled equity ETFs suffered outflows worth €1.4bn, the biggest loss of any region's asset class.

Asset class YTD flows - Source: Amundi

Elsewhere, commodity ETFs’ YTD flows remain negative, even with the asset class pulling in €3.1bn for the month. The significantly large inflow is a result of the rallying gold and oil prices in recent weeks.