Thematic ETFs have seen a surge in performance over the past month in a so-called ‘junk rally’ as investors bet that inflation might have peaked.

Having dominated the worst performing ETFs in the second quarter of the year, thematic strategies have experienced a broad rally over the past month with the top-three performers all tracking digital assets and blockchain equities.

Leading the way, the VanEck Crypto and Blockchain Innovators UCITS ETF (DAGB) returned 65.5% over the past month after plunging 84% since its November 2021 peak, while the Global X Blockchain UCITS ETF (BKCG) has risen 59.5% having slumped 70% from its March high.

Elsewhere, the HANetf Grayscale Future of Finance UCITS ETF (GFOP) has returned 50.5% in the past month after launching at the end of May, while the ETC Group Digital Assets & Blockchain Equity UCITS ETF (KOIP) also fared well, returning 47.1% over the same period.

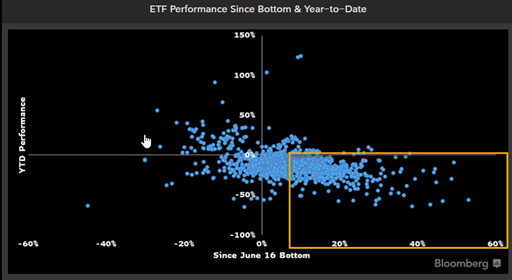

Athanasios Psarofagis, ETF analyst at Bloomberg Intelligence, said the market likely bottomed out in mid-June before lower year-on-year US inflation of 8.5% in July acted as a catalyst for outperformance.

Investors have therefore bet on the Federal Reserve to cool its interest rate hiking cycle by betting on debt-laden growth stocks.

“The past two months have seen what we call a junk rally,” Psarofagis said. “The assets that were hit hardest all year, mainly crypto, were the assets that rallied the most in July.

“It seems like 16 June was the bottom and there is a slight pivot in the market after the July inflation numbers.”

Source: Bloomberg Intelligence

The same sentiment saw an uptick in the S&P 500 over the past two months, up 16.2% since mid-June as inflation showed signs of slowing. Meanwhile, bitcoin has rallied 28.3% to $24,046 over the same period.

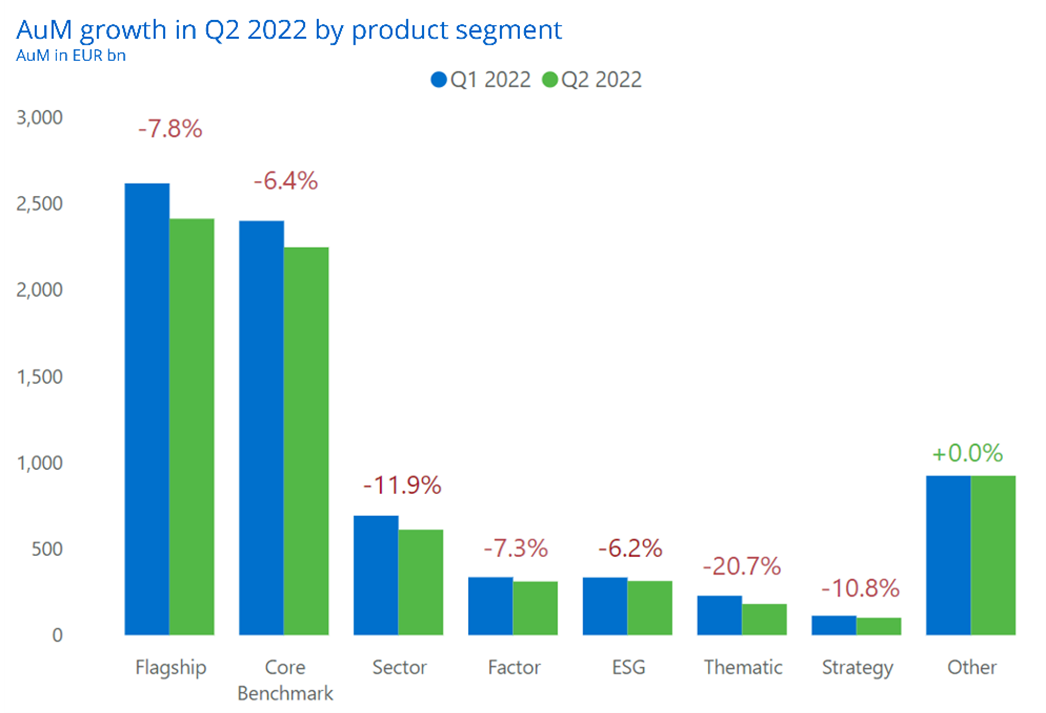

However, it is a change in fortune for thematic ETFs that earlier in the year look as though the shine may have worn off.

Thematics saw the most dramatic assets under management (AUM) decrease of all asset classes over Q2, with crypto equity ETFs leading the way losing 60% of their AUM, according to Qontigo.

Source: Qontigo

Beyond crypto ETFs, clean energy, cloud computing and artificial intelligence strategies have also been top performers over the past month.

Clean energy ETFs surge on Senate Climate Bill approval

The Global X Cloud Computing UCITS ETF (CLO6), the WisdomTree Cloud Computing UCITS ETF (KLWD) and the First Trust Cloud Computing UCITS ETF (FSKY) returned 20.5%, 18.2% and 17.8% in the month to 15 August, respectively.

Meanwhile, the L&G Artificial Intelligence UCITS ETF (AIAG) rose by 18.5%, while the Global X Autonomous & Electric Vehicles UCITS ETF (DRVE) and the Lyxor MSCI Future Mobility ESG Filtered UCITS ETF (ELCR) rose by 18.2% and 18.1%, respectively.

Related articles