Active mutual fund managers must “beware” as investors begin to increase the rate of which they are switching from active to ETFs, according to a survey conducted by TrackInsight.

The survey, which interviewed 373 professional investors across 18 countries, found 57% of respondents are using ETFs to replace active mutual funds, up from 39% in 2020.

“This reality confirms the importance of the long-term shift from active to passive, from high cost to low cost and from low liquidity to high tradability – all fuelled by the convenient access to broad and specific exposures offered by ETFs,” the survey said.

The findings come a week after a Blackwater Search & Advisory survey revealed 82% of 100 mutual fund asset manager respondents are unconcerned about the threat of ETFs to their business.

However, mutual funds have come under increasing pressure in recent years following a series of liquidity issues bubbling to the surface including the gating of former star manager Neil Woodford’s flagship fund and the saga with UK property funds since the Brexit vote in 2016.

The Woodford fallout led former Bank of England governor Mark Carney to stress mutual funds were “built on a lie”.

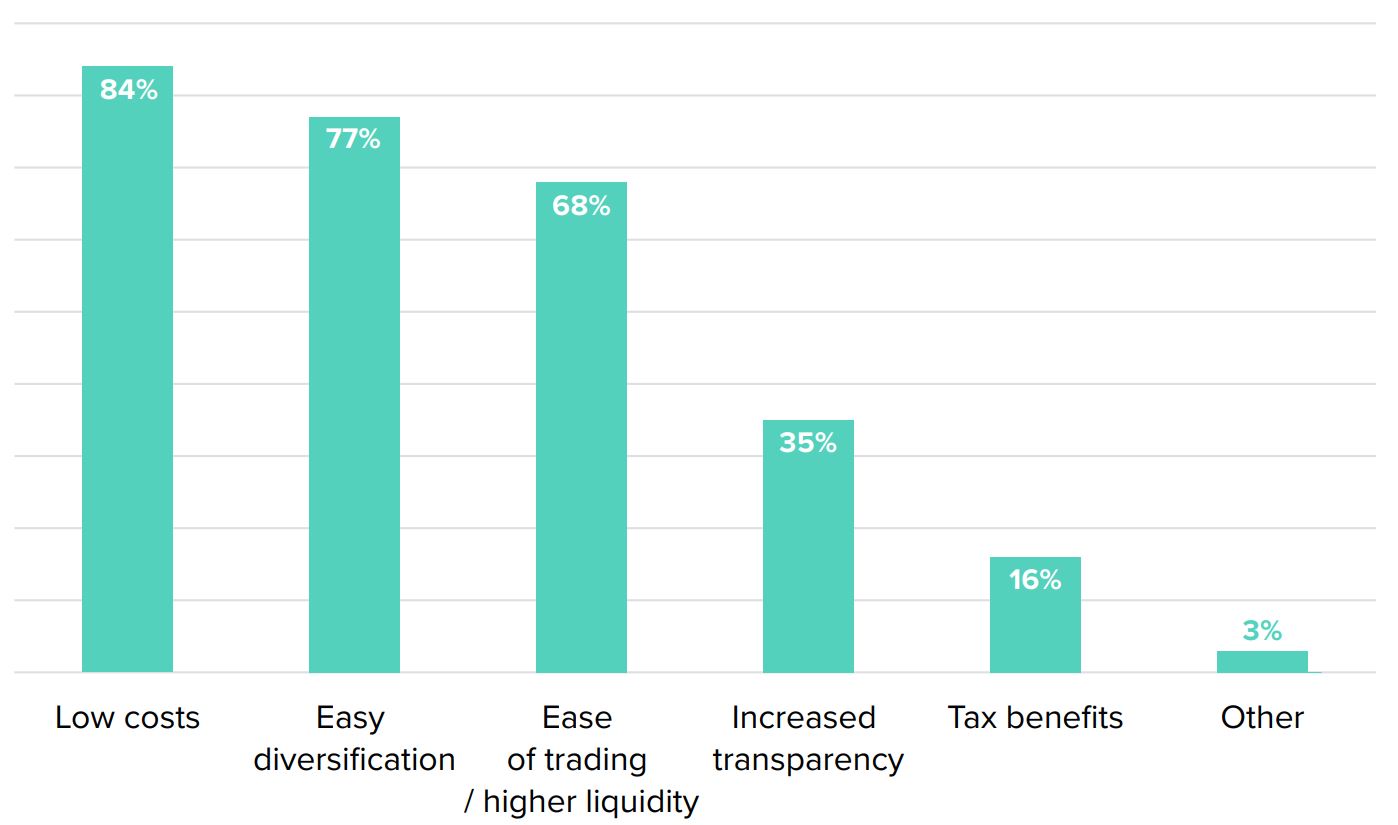

Low cost was highlighted by most respondents (84%) as the main reason for investing in ETFs while 77% cited easy diversification and 68% pointed to ease of trading/higher liquidity.

Chart 1: Main drivers of investing in ETFs in 2021

Source: TrackInsight

“Cost efficiency should rely on the estimation of the ETF’s total cost of ownership, of which the TER is only one component,” the report stressed. “There are several cost layers which are often ignored such as swap fees and stamp duties to name but a few.”

When asked about the metrics investors take into account when selecting ETFs, 70% said ETF liquidity was either “extremely” or “very” important, the highest across all criteria.

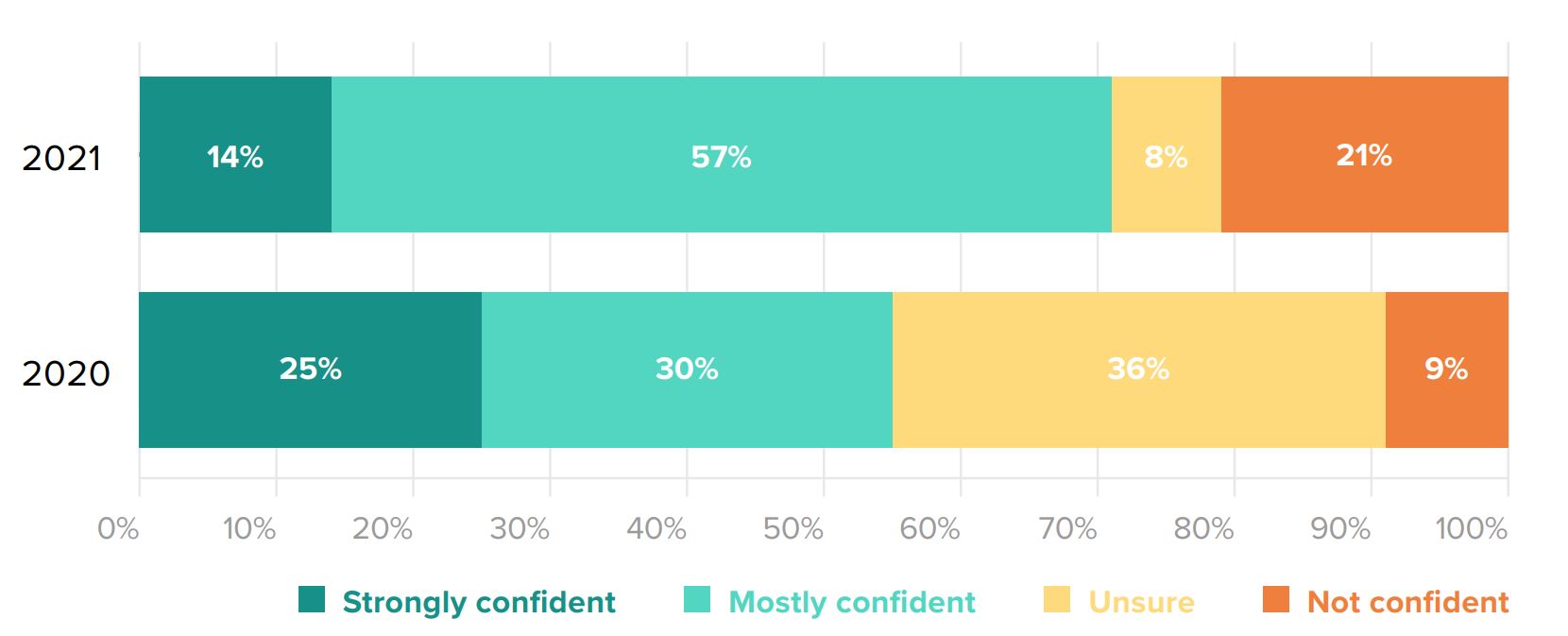

In terms of confidence in the ETF vehicle from a liquidity perspective, 70% are either strongly or mostly confident that ETFs provide additional liquidity during volatile markets, up from 55% in 2020.

Chart 2: How confident are you that ETFs provide additional liquidity during volatile markets?

Source: TrackInsight

“Year after year, liquidity has been cited as the most important criterion by ETF investors,” the report continued. “In 2020, ETFs registered record inflows, flourishing in the face of turbulent and volatile markets as their liquidity and ease of trading confirmed their role as versatile building blocks for institutional portfolios.”