Investors have continued to flee tech ETFs as there appears to be little consensus on how long the rotation away from growth equities will last.

The tech-heavy Nasdaq has been hit hard by the ongoing correction. According to data from Ultumus, the $5.2bn Invesco EQQQ Nasdaq 100 UCITS ETF (EQQQ) saw $318m outflows in the week to 5 March while the $6.4bn iShares Nasdaq 100 UCITS ETF (CNDX) saw $87m outflows.

In terms of tech equity thematics, the $2.1bn iShares S&P 500 Information Technology UCITS ETF (IUIT) saw $53m outflows, while the $970m VanEck Vectors Video Gaming & eSports UCITS ETF (ESPO) dropped by $45m.

These trends follow a year of pandemic trading in which tech stocks were regularly touted as being in bubble territory. Looking for a reason for the bubble to burst, investors were already hyper-sensitive when developments in inflationary concerns, yield curves and interest rates came to the fore.

Speaking on the market’s reaction to these shifts, Alan Miller, founder and CIO at wealth management firm SCM Direct, said prices of growth stocks are significantly affected by changes in long term interest rates.

“A relatively small increase in the discount rate used in any cashflow analysis over an extended period, can have a dramatic impact on valuation,” Miller continued.“The recent growth-value reversal has in part been the result of markets discounting higher inflation and higher interest rates going forward.”

While the causes of the current drawdown are apparent, what is not so clear is how long it will last, or how severe it will get.

Athanasios Psarofagis, ETF analyst at Bloomberg Intelligence, said that while the current rotation to value may be here for some time, the cuts to tech stocks’ oversized gains may offer an attractive entry point.

Indeed, this appears to have been the case this week, with the Nasdaq posting its biggest daily gain in five months, as investors rush in to snatch up 2020-winning equities at cut prices.

“This seems to be part of a bigger rotation and it is growing some legs now. Tech has been the hardest hit over the last three weeks so it is no surprise to see outflows from [EMQQ].

“Thematics like gaming might see some profit [taking] but I do not expect too many significant outflows there as I think these levels attract new buyers,” Psarofagis added.

Offering a different narrative, Peter Garnry, head of equity strategy at Saxo Bank, said that based on historical examples, the company expects the current downturn to last for 121 days – with this prolonged downturn likely to cause further run by growth-focused investors.

Garnry said the Nasdaq’s recovery from last year’s downturn was the fastest in the company’s eighteen-year data sample, and that investors should not expect a similar rate of bounce-back to follow the ongoing correction.

Below are Saxo Bank data on the largest fifteen drawdowns in the Nasdaq since 2003 with the blue line representing the 2020 V-shaped recovery, and the orange line showing the current dip.

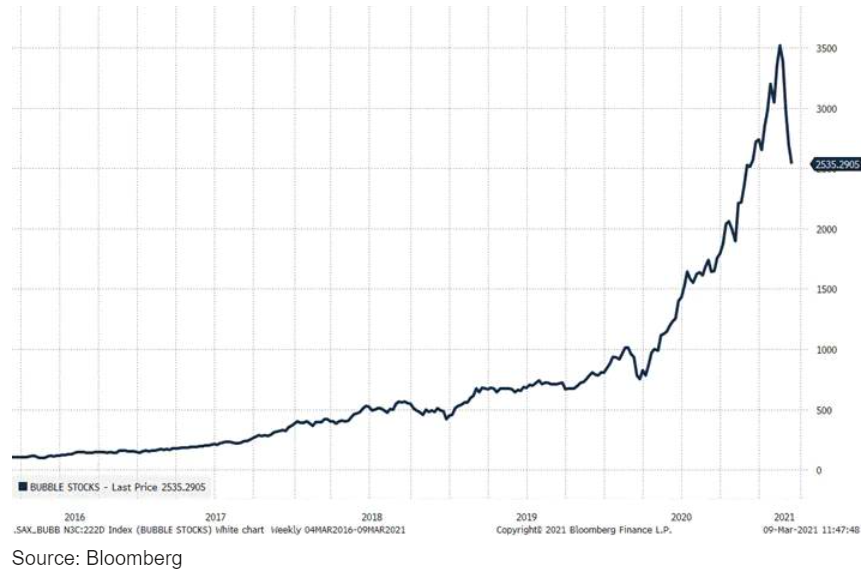

Garnry continued: “The Nasdaq 100 is 15 trading sessions into the current drawdown, down 10.9%, and our bubble stocks basket is down 27.9% since the peak.

“While painful for many investors, we could see our bubble stocks basket experiencing a 50% drawdown taking the basket’s total return index back to levels from September last year – if this happens it would entail a 32% decline in bubble stocks from current levels.

“Outsized gains typically come with subsequent volatility and potentially dramatic drawdowns. That is the lesson of history, and this is no different.”