Thematic ETFs have been dubbed “one of the big winners in 2020” with investors piling record assets into megatrend strategies in a move to capture the “eye-catching returns” on offer.

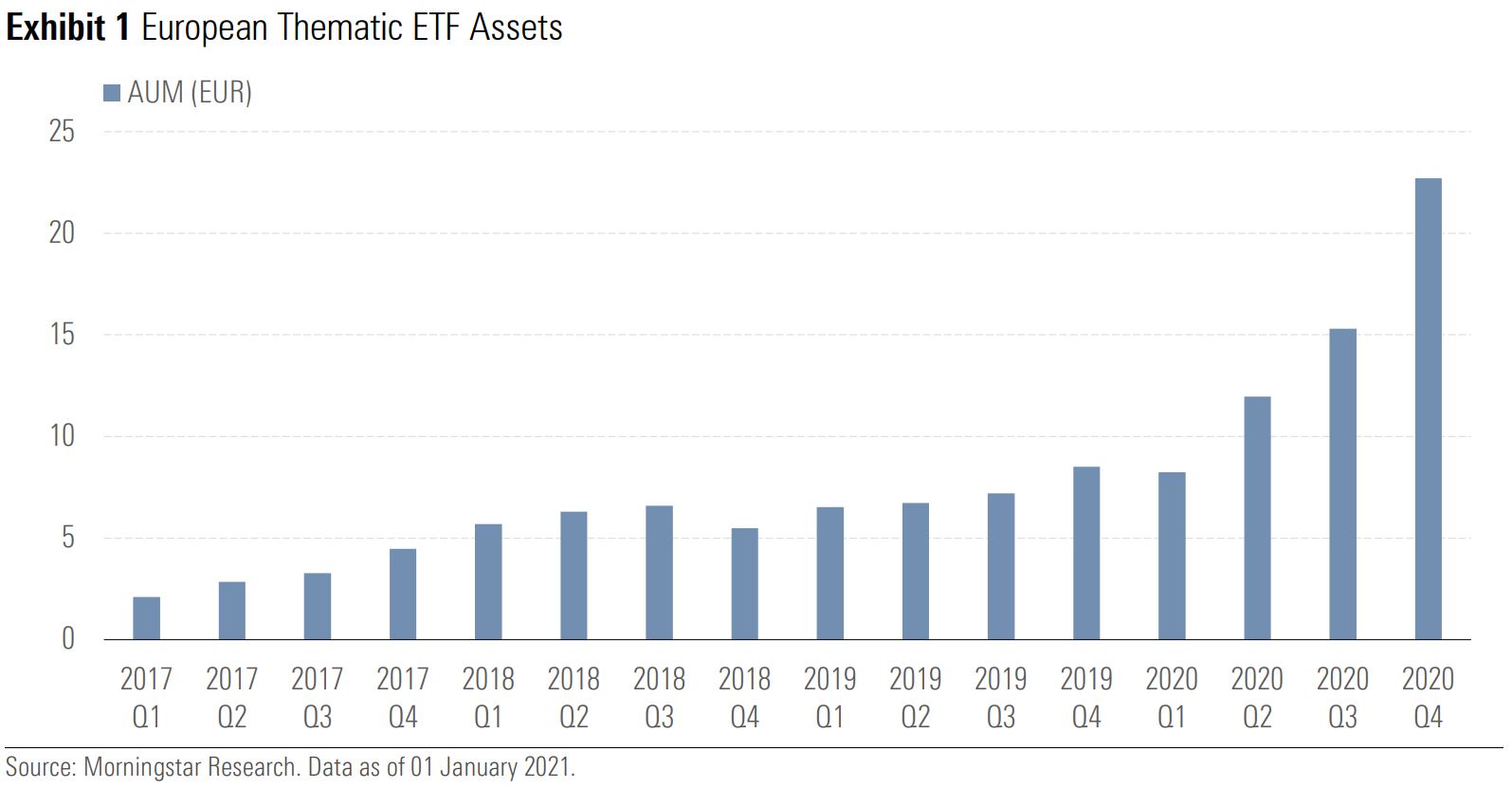

According to data from Morningstar, thematic ETFs, which are the subject of ETF Stream's Big Call event on 31 March, saw a record €9.5bn inflows over the year taking the segment’s assets under management (AUM) to an all-time high of €22.7bn.

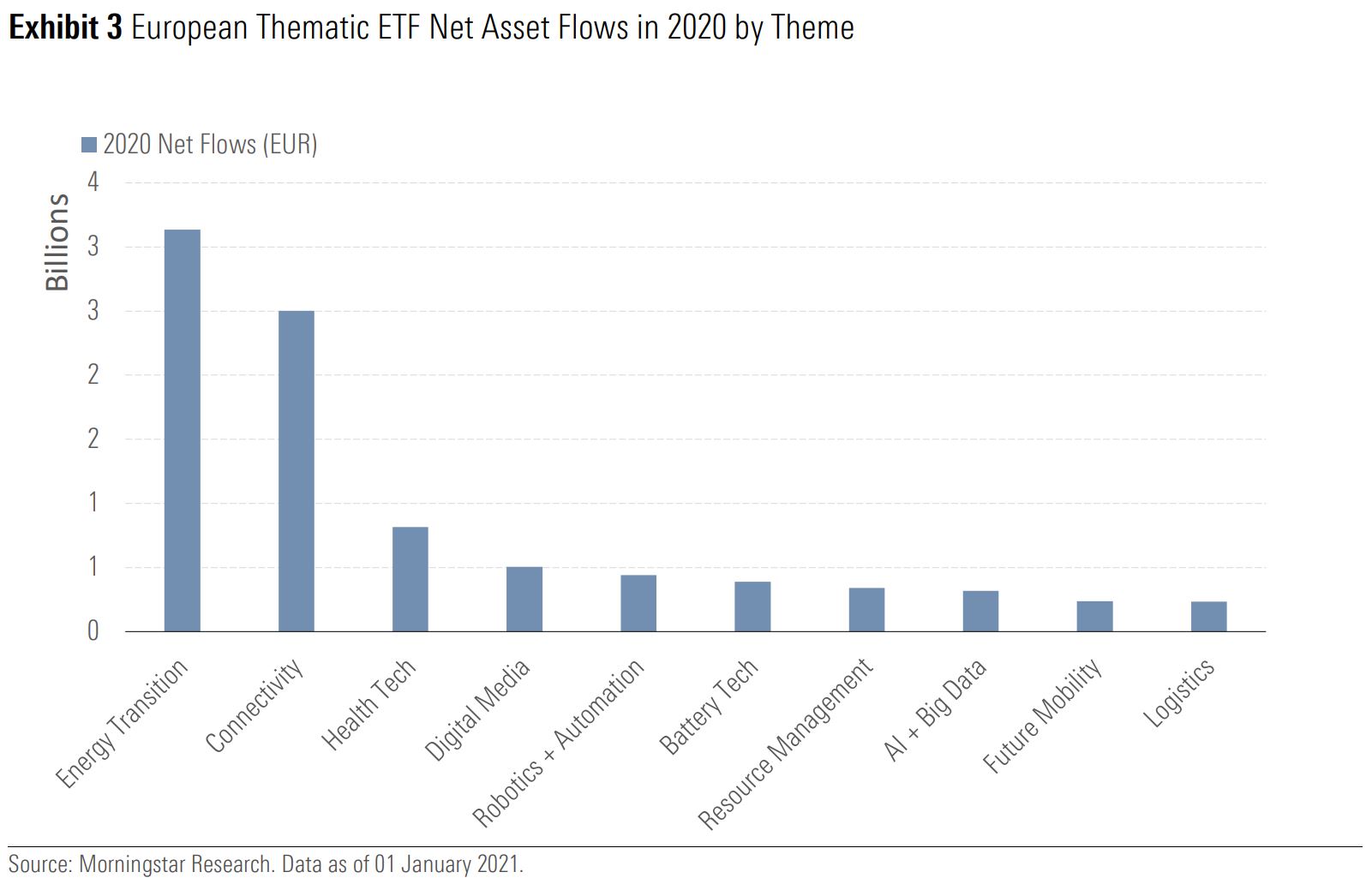

Leading the charge were ETFs focused on the clean energy transition and connectivity which between them claimed more than half of last year’s inflows.

Clean energy-focused ETFs took around a third of total inflows and benefitted from a mixture of favourable political developments and disruption to fossil fuels.

Kenneth Lamont, senior analyst, passive strategies research, Europe, at Morningstar, said: “The disruptive volatility experienced in the oil markets led many to seek alternatives and to re-evaluate the associated risk and return of alternative energy sources.

“The favourable US election result and other pro-environmental political developments globally were also supportive.”

The prime benefactor of these trends was BlackRock’s iShares Global Clean Energy UCITS ETF (INRG), which returned 136% in 2020. Along with boasting the highest returns of any European-listed ETF during 2020, INRG booked $3bn inflows, the third highest in the European market.

Also prospering during 2020 were connectivity focused ETFs, which collected €2.5bn inflows. This came as home working and tech-centric recreation bolstered cyber-security, cloud computing, and videogaming themes.

This, in turn, saw investors chase the gains offered by the likes of the WisdomTree Cloud Computing UCITS ETF (WLCD) and the VanEck Vectors Video Gaming & eSports UCITS ETF (ESPO), which returned 92% and 68% respectively.

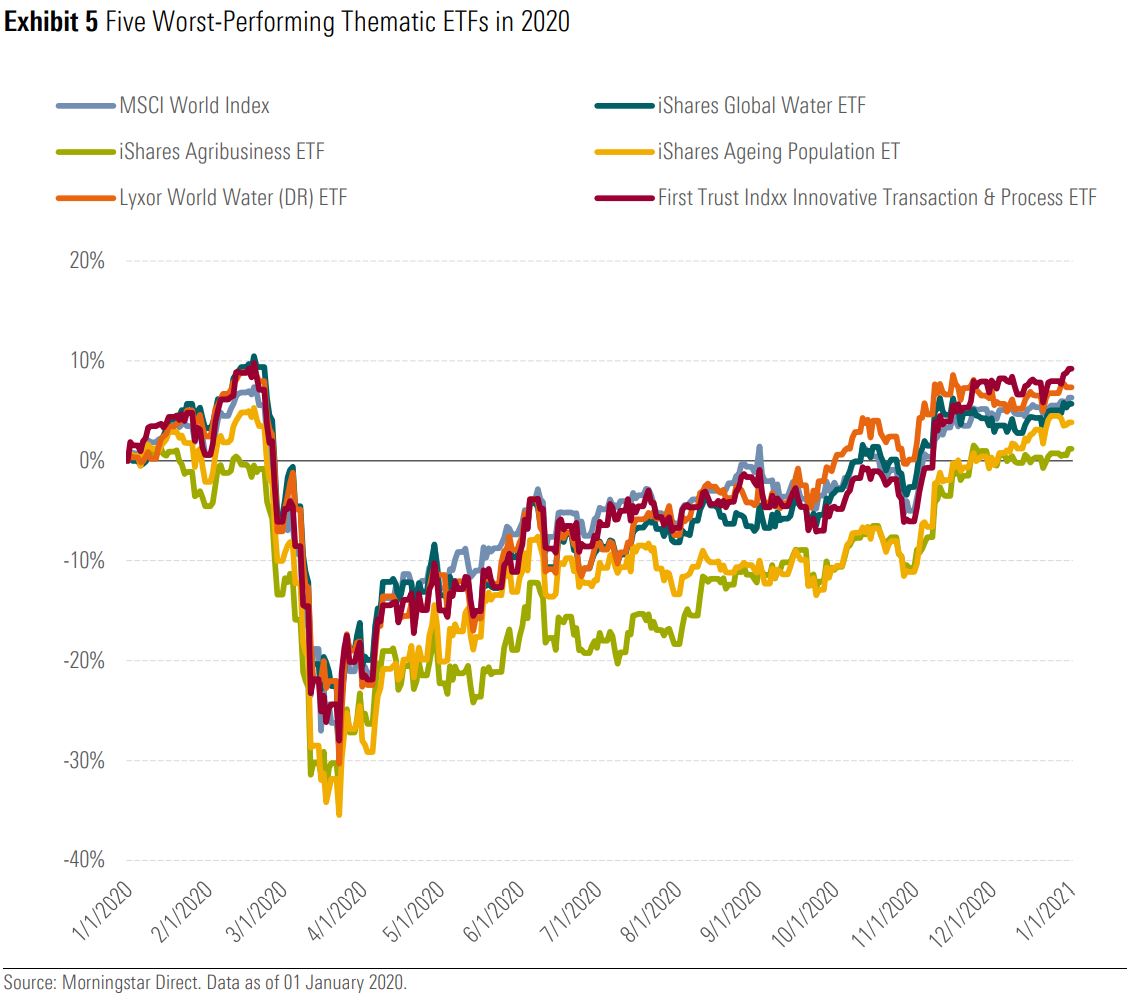

At the other end of the spectrum, two BlackRock ETFs, the $93m iShares Agribusiness UCITS ETF (SPAG) and the $389m iShares Ageing Population UCITS ETF (AGED), only delivered single-digit returns.

“Investors should be wary and look beyond dazzling short-term returns when selecting thematic ETFs,” Lamont cautioned.

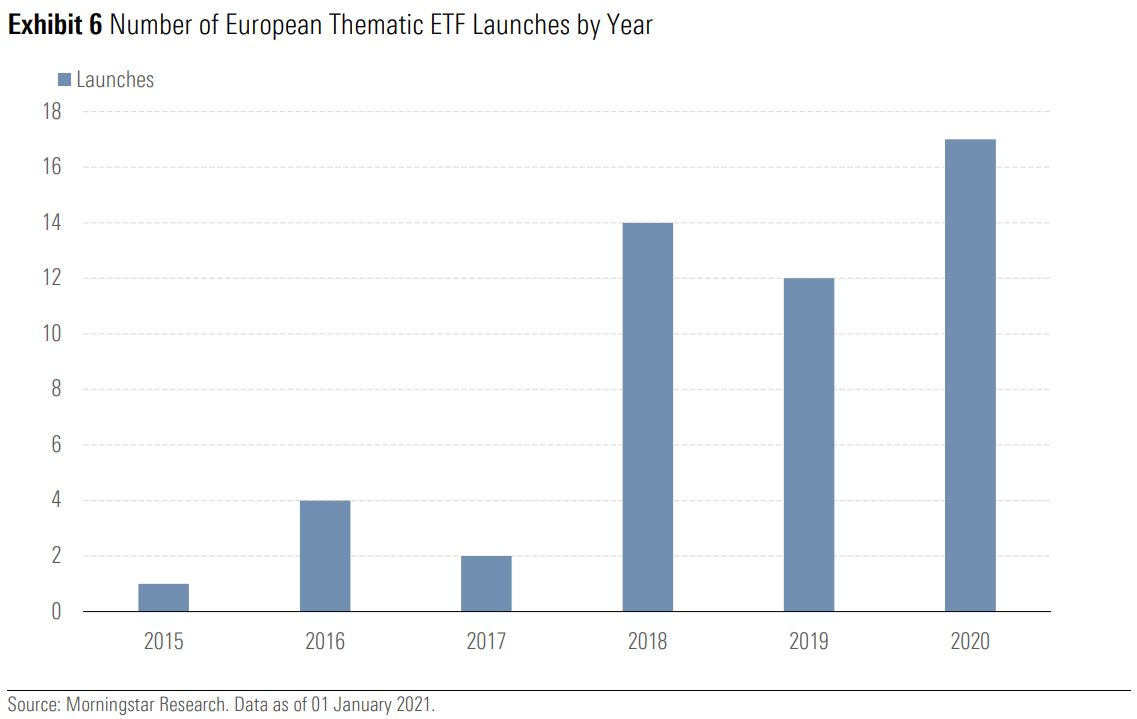

Overall, 2020 saw a record 17 new thematic ETFs come to market, with 33 of the 36 thematic products listed in Europe outperforming the MSCI World index.

Of the new entrants, four ETF launches were made in the connectivity space while clean energy and health segments saw three ETFs debuted apiece.

Meanwhile, the thematic-focused HANetf launched the first medical cannabis ETF, the Medical Cannabis and Wellness UCITS ETF (CBDX) and Global X broke into the European market with the launch of theGlobal X Video Games & Esports UCITS ETF (HERU) and the Global X Telemedicine & Digital Health UCITS ETF (EDOC).