The Bank of Japan (BoJ) may have successfully boosted equity valuations with its $380bn of ETF investments over more than a decade, however, this mass buying is making it cheaper to bet against Japan’s market, according to the Bank for International Settlements (BIS).

The working paper, titled To Lend or Not to Lend: the Bank of Japan’s ETF purchase program and securities lending, warned the policymaker’s groundbreaking ETF-based stimulus is lowering lending fees on Japanese equities, providing better access for short sellers and in turn progressively weakening the impacts of the policy initiative.

By the end of March this year, the BoJ owned 7% of the free float of all Japanese listed companies through ETFs.

The central bank uses physically-backed ETFs and while it holds most of the beneficiary certificates related to these holdings, ETF issuers hold the corresponding underlying stocks to minimise tracking error.

“Under this framework, ETF fund managers have strong incentives to earn lending fees by supplying stocks in ETFs to the stock lending market,” the research said. “It is particularly true for ETFs held by the BoJ, given that the BoJ does not have plans to sell its ETF holdings and is considered a long-term ETF holder.”

The paper found as the policymaker continues to increase its book of ETF investments, the volume of underlying stocks available to borrow has also increased, acting against its goal of stimulating Japanese companies by facilitating lower-cost short activity.

This dynamic was particularly prevalent in stocks with limited availability in lending markets, with the BoJ initially supporting their valuations but also increasing the supply of lendable shares, gradually diminishing the positive effects of the ETF purchase programme over time.

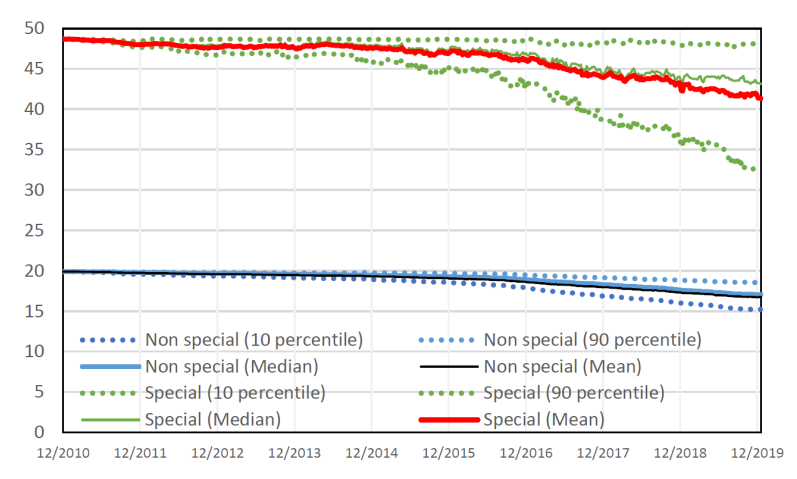

Chart 1: Marginal effect on returns for stocks with limited and plentiful supply for lending

In fact, since the BoJ “substantially increased” its ETF buying in 2015, the positive return impact on these more hard-to-access stocks has been eroded by an average of 15%, with the programme’s positive impact on some stocks diminished by as much as 30%.

The paper concluded that while this dynamic in the lending market is not what the BoJ’s interventionist approach set out to achieve, it does help investors borrow overvalued stocks and sell them in the spot market, helping to correct price distortions.

It warned: “The BoJ should consider the possibility that an exit from their ETF purchase programme may cause a sudden deterioration in the availability of lendable stocks and induce unintended consequences.”

This issue is particularly relevant given Japanese finance minister Shunichi Suzuki’s suggestion in May that the government should buy the BoJ’s ETF holdings at book value as part of plans to distribute wealth to Japan’s younger citizens.