The BetaShares Crude Oil Index ETF (OOO) could face new challenges following its

recent decision to change investment strategy

.

As the coronavirus and Saudi Arabia drove a bulldozer into oil markets last week, BetaShares announced a change of track, moving from OOO’s use of one month futures and using three month futures instead.

The move was designed to protect investors and reduce the risk of the fund going to zero, as some near-term futures contracts had. The index provider, S&P Dow Jones Indices, followed BetaShares this week and ended its use of the June contract.

The new-look strategy has been regarded by many as smart, and likely to successfully protect investors from the risk that OOO goes to zero. If OOO goes to zero, investors will get completely hosed and the fund would need to be removed from the ASX.

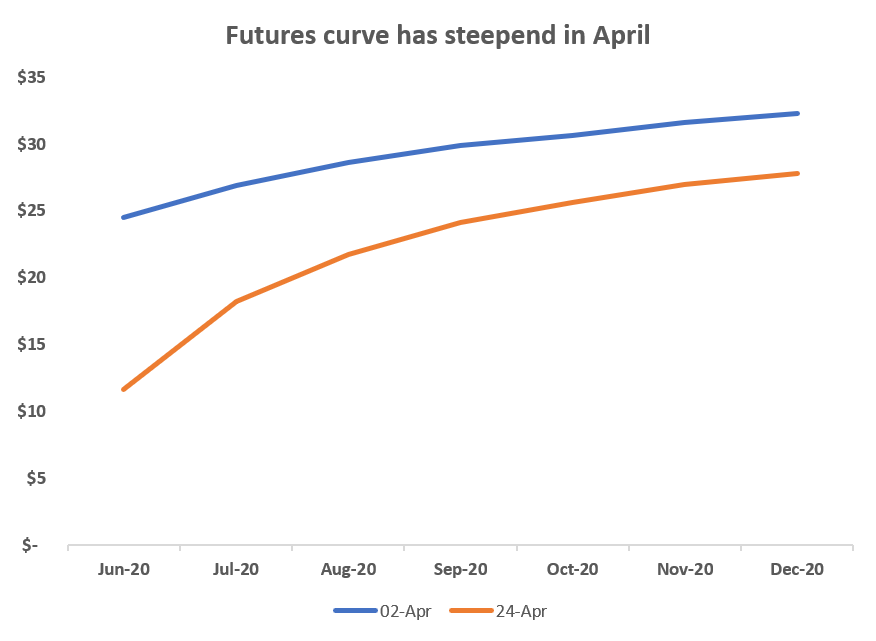

According to BetaShares, swapping to the September contract has mainly been motivated by the desire to mitigate risk and expose investors to less contango. And in those aspects it appears to have succeeded.

However, there are no free lunches. And the new strategy could come with costs of its own– particularly around the potential to miss a sharp rebound in the oil price.

What is contango?

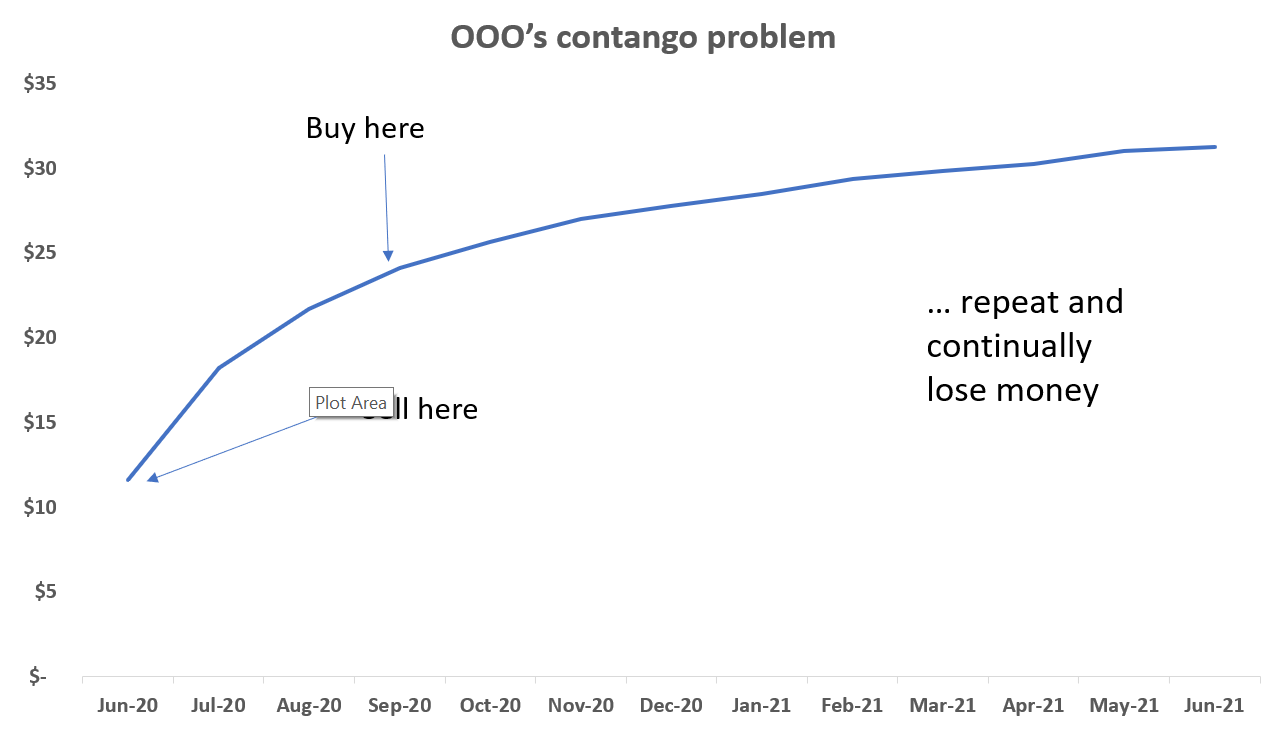

Contango, to simplify, is where futures contracts fall in value as they come closer to their expiry date. When short-lived, contango is not a problem. However, when contango is sustained for long periods of time it locks in a “buy high, sell low – repeat until broke” effect.

Long-term contango can be expensive.

Contango does not show up explicitly as a cost paid by a fund. Rather, it is reflected in a fund’s net asset value, or NAV, which declines while feeling its effects.

BetaShares’ choice: Contango or missed rebounds

Contango is normally the big return-killer for oil ETFs. And contango gives oil ETFs a catch-22 type situation with no good answers.

It means ETF providers have a choice. They can choose to go further out along the futures curve where there is less of it (a good thing) but lower correlation to the spot price of oil (a bad thing). Investors, after all, buy oil ETFs because they want exposure to the oil price.

Or they can go to the near end, where contango is higher (a bad thing) but that also tends to be where you get backwardation, when it occurs (a good thing). It is also more closely correlated to spot (a good thing).

Historic turmoil in oil markets spurs ETF issuers into action

As of last week, BetaShares have gone further out on the curve. This should almost certainly mean there is less contango – even though the curve has steepened right through April. However, there will be less correlation to the spot price of oil. Investors need to understand by investing in OOO they will not be getting the spot price of oil.

The second potential drawback of the new investment strategy is more serious. That is: if there is a sudden sharp rebound in the oil price, OOO will miss out.

If great progress is made on a coronavirus vaccine or antiviral, the oil price could sharply rebound. In this – unlikely – event, OOO will not taste that upside as BetaShares has opted to go further out on the curve which – to repeat – is less correlated with the spot price of oil.

Source: CME, ETF Stream

Was UBS correct all along?

Oil ETFs have always been tricky. And today’s market conditions – which in many respects represent the worst case scenario for oil – offer something of a testing ground for different product structures.

When ETF Securities and US Commodity Funds got the oil ETF trend going in London and New York two decades ago, they thought that the best investment strategy for oil ETFs was to use front month oil futures as they gave investors the closest thing to the spot price.

Futures could then be rolled every month or two, ETFS and USCF thought. Sometimes the market would be in contango, other times it would be in backwardation.

UBS's oil ETF has outperformed. Source: Bloomberg

However, when UBS listed its own products some years later in Europe they took a different view. They thought it was best to diversify and buy futures contracts from every point in the curve and roll futures contracts only every six months.

In light of recent events, and comparing UBS’s fund to its peers in these trying times (including OOO), it appears that there may have been merit to the Swiss bank’s approach.

Repercussions

Oil ETFs around the world are under acute pressure.

In Europe, several leveraged oil ETPs have been closed as they have breached various thresholds in their swap contracts. Meanwhile, in the US, some oil ETPs are facing the threat of lawsuits.

Australia has only one oil ETF: OOO. The fund saw $67 million worth of inflows last week. BetaShares indicated that the inflows were driven by investors looking to go long oil in these trying times – and not by short sellers.

Sign up to ETF Stream’s weekly email here