BlackRock has responded to claims issuers and authorised participants (APs) use the bond ETF creation-redemption process to offload illiquid securities they no longer want to warehouse during periods of market stress.

According to a new BlackRock report, entitled New data behind the bond ETF primary process, the bond ETF custom redemption baskets that are given to APs during periods of market stress, in fact, have very similar risk and liquidity characteristics to the ETFs themselves.

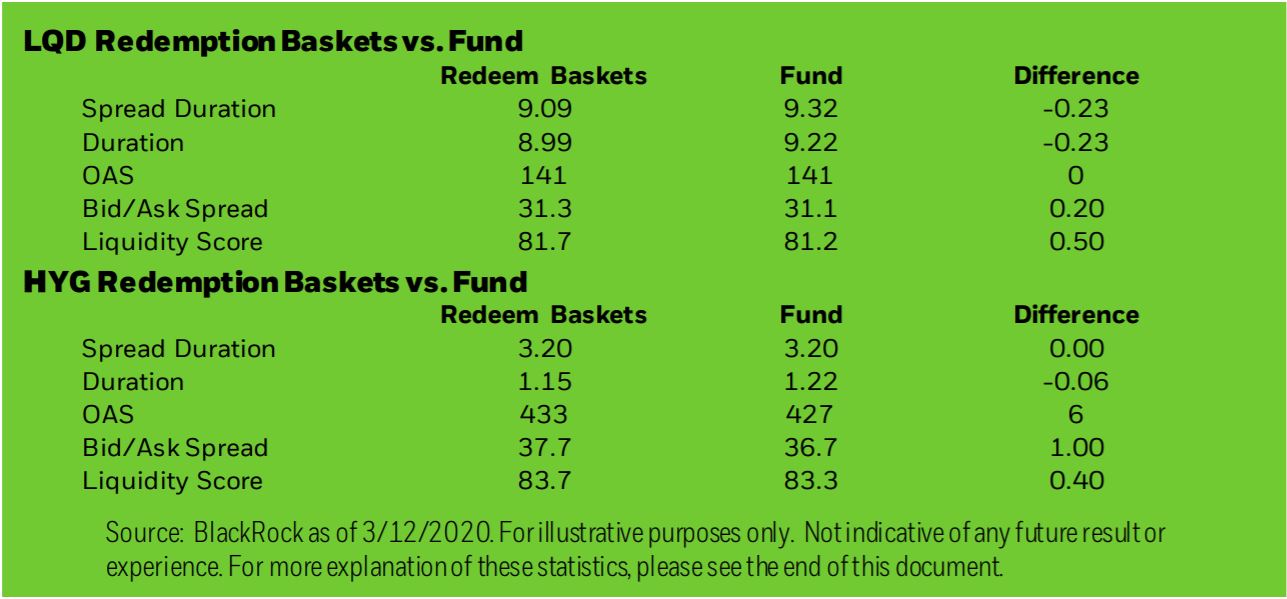

Using data from two of its largest ETFs, the $41.5bn iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD) and the $21.6bn iShares iBoxx $ High Yield Corporate Bond ETF (HYG), the report showed the custom redemption baskets had a similar duration, bid-ask spreads and liquidity score versus the ETFs between 18 February and 12 March 2020.

For LQD, for example, the redemption baskets had a duration of 8.99 years versus 9.22 for the ETF while the liquidity score was 81.7 versus 81.2 for the ETF.

Chart 1: Custom redemption basket composition versus fund comparison for LQD and HYG (2/18/20-3/12/20)

Samara Cohen, co-head of EII markets and investments at BlackRock, and co-author of the report, said: “The custom redemption basket compositions were nearly identical in risk characteristics and liquidity scores irrespective of market conditions, illustrating the nature of the systematic unbiased process.”

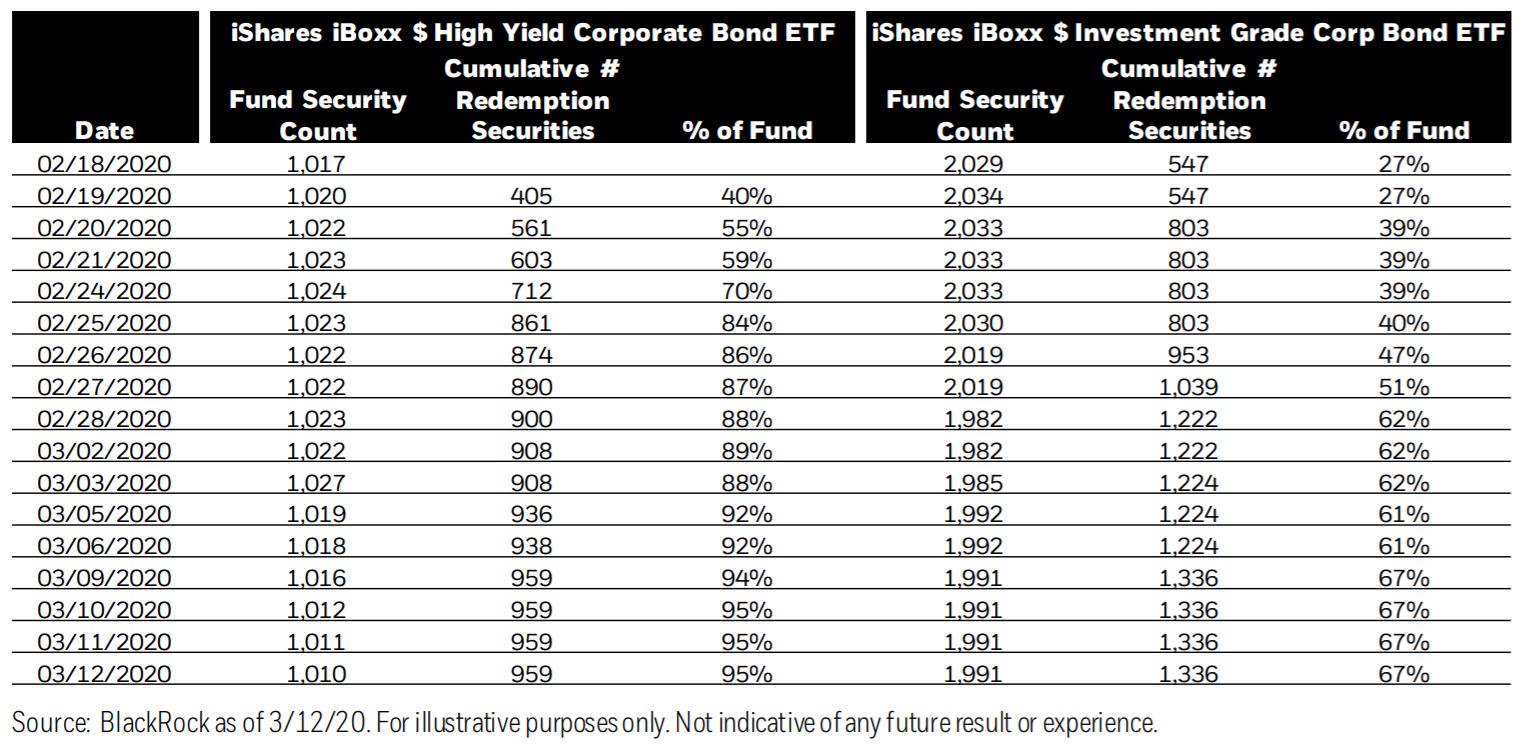

Somewhat interestingly, the report said during periods of large outflows, portfolio managers increased the number of securities in the ETF custom redemption baskets.

The report explained this was done to ensure an ETF’s risk profile remained in line with the underlying index as too many narrow redemption baskets could cause a tracking drift.

For example, between 18 February and 12 March 2020, the number of securities in HYG’s redemption basket increased from 405 securities – 40% of the ETF – to 959 (95%).

Chart 2: Redemption basket security count and replication ratios

“The greater the amount of redemptions, the more necessary it is to broaden the baskets to manage the fund’s risk and tracking profile,” Cohen continued. “If a fund were to incur large redemptions on a narrow basket repeatedly, the remaining holdings would become increasingly skewed relative to its reference index.”

What happens when the lights go out? An analysis of ETFs when liquidity vanishes

The world’s largest asset manager – which controls around 60% of the fixed income ETF market in Europe – was keen to stress the reputational damage that could occur with APs if the custom redemption baskets did not match the overall ETF’s characteristics.

“iShares portfolio managers…have generally aimed to deliver custom in-kind redemption baskets that closely reflect the fund characteristics to help facilitate the fund’s investment objective and minimise the tracking error of the fund.

“Strategically choosing to regularly deliver out a concentrated basket of bonds that does not broadly represent the fund’s characteristics would generally not be in the best interest of the ETF and its shareholders and may lead to elevated tracking error.

“Further, such actions could create reputational risk for and uncertainty around intentions of the fund sponsor within the AP community which could potentially impact the fund’s liquidity.”

BlackRock’s report comes following a Bank for International Settlements (BIS) paper in March which argued ETF issuers “strategically” choose which bonds to include within the basket.

The report claimed this weakened arbitrage forces in the fixed income ETF space as APs were uncertain which basket of bonds they would receive from issuers. As a result, one industry source told ETF Stream they price in the worst basket possible.

Following the BIS report, an article from ETF Stream found ETF issuers and APs were involved in a game of cat and mouse during the creation-redemption process with both parties looking to offload illiquid bonds during periods of market stress.

According to one source, ETF issuers provide APs with a set of guidelines to follow such as sector and country weights and APs look to wrap the worst bonds they have within those guidelines into a creation basket.

However, BlackRock concluded: "The fact that custom baskets are a subset of the fund’s bond holdings is not in and of itself sufficient to prove that the basket is not representative of the fund.

"As discussed, the nature of factor risks in fixed income – those arising from interest rate and credit spread risk – can be adequately reflected utilising fewer securities."