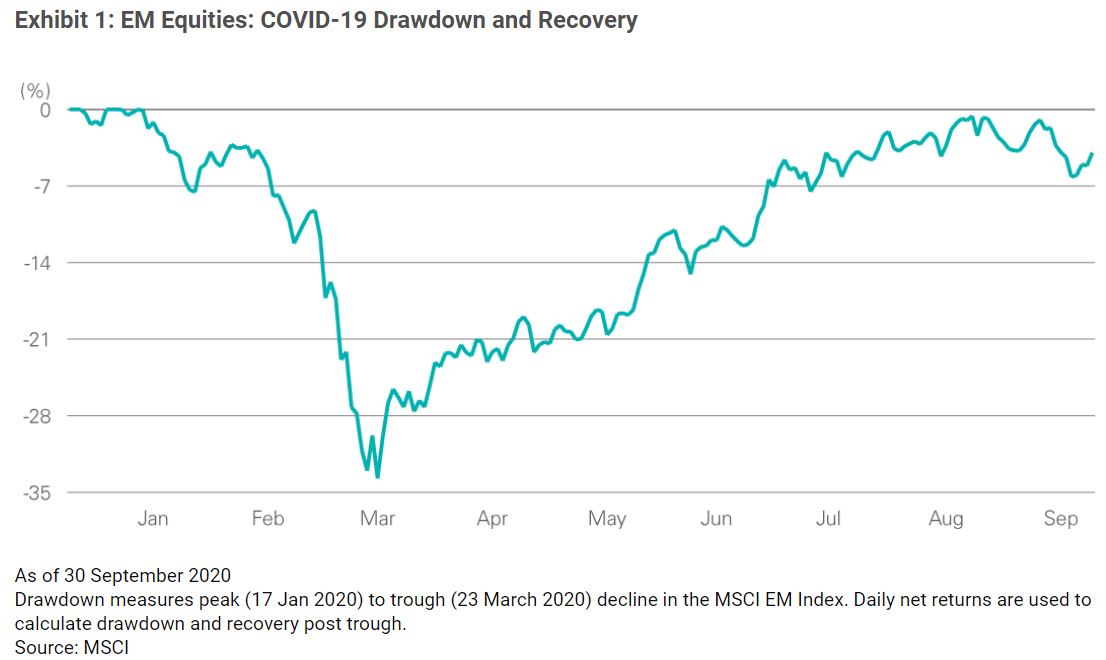

Emerging market stocks climbed back to pre-pandemic levels earlier this week as investors moved risk-on in Q3.

The MSCI Emerging Market index, which tracks the performance of 1,387 companies, rose to levels not seen since the start of the pandemic driven by a strong recovery in China which was the only country to see gains in Q2.

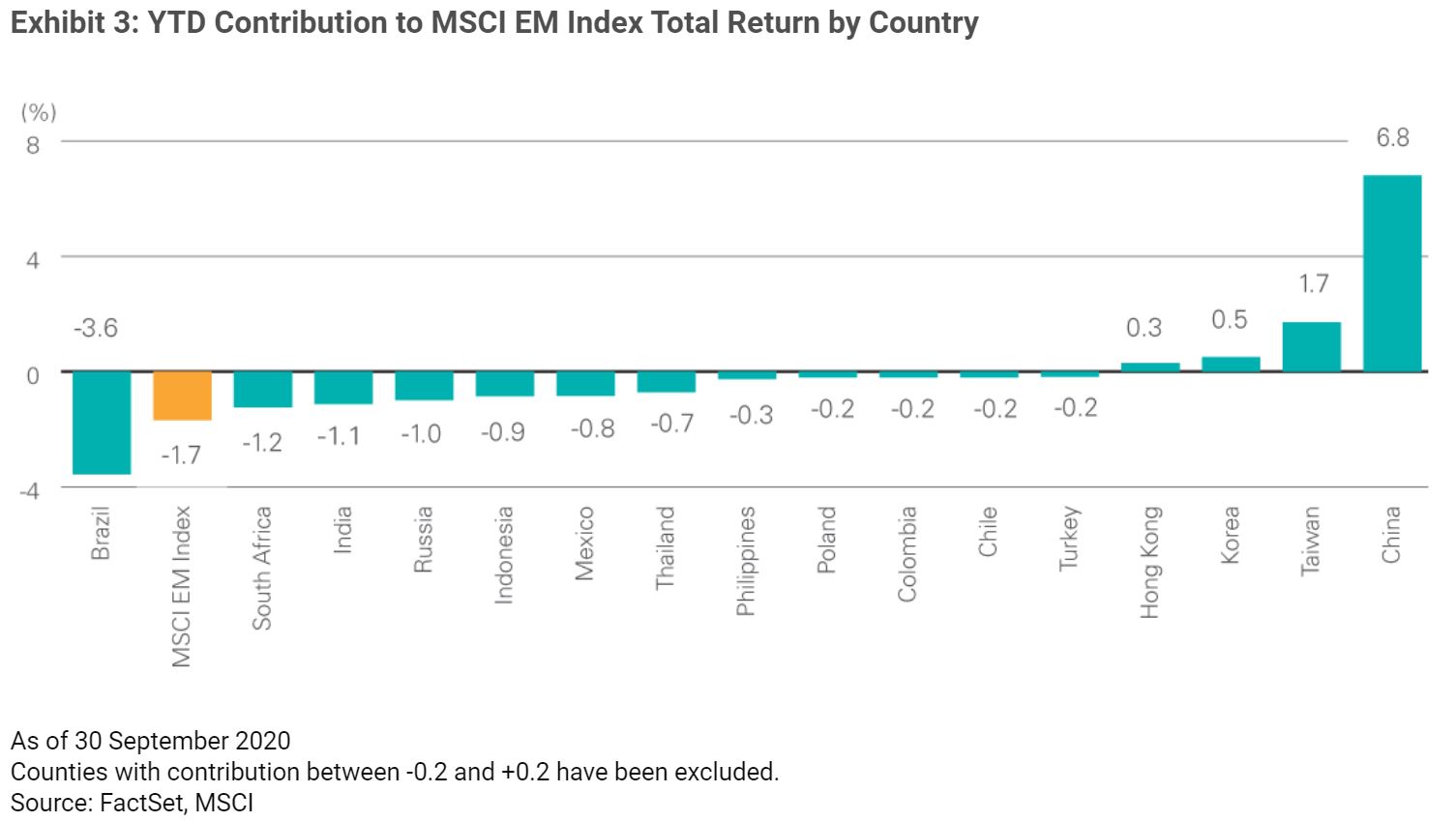

Highlighting this, the MSCI China has returned 16.6% this year versus 10.9% for the MSCI Emerging Markets index and 1.7% for the MSCI World, as at 30 September.

With other emerging market countries only starting to recover from the coronavirus pandemic, China has been the key contributor to the index’s recent performance.

According to data from MSCI, China is responsible for more than 35% of the index’s performance since the 23 March bottom, as at the end of Q3, while Taiwan and South Korea have accounted for another 30%.

As James Solloway, chief market strategist and senior portfolio manager at SEI, said: “The resurgence in COVID-19 infection rates globally has had notable influence on V-shaped recoveries.

“Economies that experienced the most restrictive lockdowns have generally experienced the strongest recoveries with strong examples in Taiwan and China which were the only two countries in the world to post positive year-over-year gains through Q2.”

No longer an ‘optional extra’: What’s in store for China equity ETFs?

China and Taiwan account for a combined 54.6% of the MSCI Emerging Markets index.

In a move to capture the resurgence in emerging markets, investors have piled into ETFs over the past three months.

According to data from ETFLogic, the Amundi Index MSCI Emerging Markets UCITS ETF (AEME), the firm’s physically-replicated version, has seen $754m inflows over this period while investors have piled $286m into the Xtrackers MSCI Emerging Markets UCITS ETF (XMME).

More specifically, China ETFs have also been popular with the iShares MSCI China A UCITS ETF (CNYA) seeing inflows of $293m over the last three months, a significant figure for a relatively under-owned segment of the European ETF market.

In a recent report, Lazard Asset Management warned emerging market returns are being driven by a small number of “richly valued” tech stocks.

Lazard AM highlighted how just two stocks, Alibaba and Taiwan Semiconductor, out of the 1,387 companies in the index accounted for more than 40% over the index’s returns.

“Emerging market stocks are currently on their way back up, but the foundation supporting the rise is very narrow indeed, begging the question of how much further growth it can support.”

Concentration risk in the flagship S&P 500 has been well documented following the dramatic rise of the FAAMG stocks. It is clear investors must also be wary of the same issues when tracking the MSCI Emerging Markets index.