The ease of use, versatility and liquidity of the ETF wrapper has led to its growing adoption within investor portfolios. US-listed ETFs have gathered over $800bn inflows this year, bringing total assets to over $7trn. This trend has been picking up steam over the past few years, with investors showing particular interest in low-cost, passive ETFs.

But there are signs that many of the biggest names in asset management, including top ETF issuers like BlackRock and Vanguard, are betting on an investor that wants a higher degree of control and customization over their portfolios than ETFs can provide. Direct indexing is a term that is gaining traction, as wealth managers compete in a race to snap up direct indexing providers to prepare for continued growth.

Source: Javelin Strategy & Research

In 2020, BlackRock acquired Aperio, a firm that was considered a pioneer in direct indexing. And in 2021, Vanguard announced its first acquisition in the firm’s 46-year history, direct indexing platform Just Invest. With the two largest ETF issuers willing to shell out to acquire this technology, it is no wonder the ETF industry at large is taking notice.

Furthermore, there are few direct indexing technology firms left to buy. Given the high degree of complexity, this technology can take time to build from scratch. Companies that miss out on the ability to acquire a firm with these capabilities already built out risk finding themselves late to the party.

What is direct indexing?

Direct indexing allows investors to directly own all or some of the securities within an index in a way that is customized to fit their individual needs. In other words, it offers access to a specific part of the market in a similar way that an ETF would, except the investor owns the underlying securities instead and can tweak the exposure if desired.

By holding the underlying securities, investors are able to access certain benefits such as reduction of tax liabilities or removing overlapping exposure to large single-stock positions held elsewhere. Customisation can also be used to do things like tilt the portfolio toward specific factors or align the portfolio with the client’s view on ESG issues.

Pros and cons

While direct indexing has often been viewed as an alternative to ETFs, each has its own set of benefits. Investors will need to weigh these pros and cons against their individual needs to determine which one makes sense for their portfolio.

Currently, direct indexing fees are projected to be around 0.15-0.35% annually. This represents a significant premium to many vanilla ETFs that offer cap-weighted exposure to a wide range of asset classes. For now, investors without customisation needs are likely better off sticking with these ETFs.

But smart beta ETFs come with higher fees. For example, the Invesco S&P 500 Low Volatility UCITS ETF (SPLW) has an expense ratio of 0.25%. And ETFs that incorporate ESG screens also have higher fees. The iShares MSCI World ESG Screened UCITS ETF (SAWD) takes a basic approach to ESG screening and rings up at 0.20%.

Investors interested in tailoring their portfolio to their unique ESG views are likely willing to pay just a bit more for the customization and tax harvesting benefits.

Competition or complement?

Direct indexing is often positioned as a direct competitor to ETFs, but they should be viewed as two separate tools in a toolbox, acting in a complementary way to one another within investor portfolios.

Along with client needs, some asset classes may be better suited than others for direct indexing at this time. As an example, since bonds are less volatile and less liquid than equities, this part of a portfolio may be more well-suited for ETFs even if an investor is using direct indexing for all or part of their equity exposure.

In other words, investors should not take an all-or-nothing view, but instead, look to combine these tools in a way that makes the most sense within their portfolio.

Looking ahead

As ETF inflows this year have demonstrated, there are currently few signs that direct indexing is eating into the ETF industry’s growing market share. And though the first US-listed ETF was launched in 1993, ETFs have yet to overtake mutual fund assets.

According to data from Statista, just under $24trn was invested in US-listed mutual funds at the end of 2020, meaning there is still more room for ETF assets to grow, either through investors switching investment vehicles or through further mutual fund-to-ETF conversions.

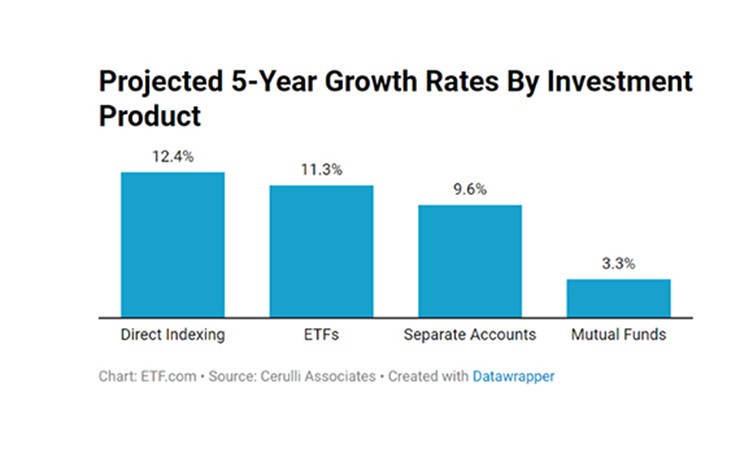

Cerulli Associates, an asset management research firm, has forecasted ETFs will continue to grow at a faster pace than mutual funds over the next several years. But growth rates for direct indexing are projected to be even higher than that of ETFs.

Cerulli’s research projects that direct indexing, a $399bn market at the end of the second quarter of 2021, will grow to over $700bn by 2026.

As direct indexing technology advances and scales, potentially reducing fees over time, this could further shift the dial in direct indexing’s favour for implementation within at least a portion of an investor’s portfolio.

This story was originally published onETF.com

Related articles