DWS has cut the fees on its currency-hedged physical gold ETCs, in a move that makes their strategies the cheapest on the European market.

The Xtrackers IE Physical Gold EUR Hedged ETC Securities (XGDE) is listed on the Deutsche Boerse, while the Xtrackers IE Physical Gold GBP Hedged ETC Securities (XGDG) is listed on the London Stock Exchange.

Both have seen their fees cut from 0.43% to 0.33% apiece, which covers their total expense ratios (TERs) and FX hedge fees.

The fee reductions see the ETCs become the lowest-cost currency-hedged gold ETCs in Europe, undercutting the all-in fees of the Invesco Physical Gold GBP Hedged ETC (SGLS) by one basis point.

While this makes the products attractive in the currency-hedged category, their fees are still ahead of non-hedged products, including the USD-denominated Xtrackers IE Physical Gold ETC Securities (XGDU) which has a TER of 0.25%.

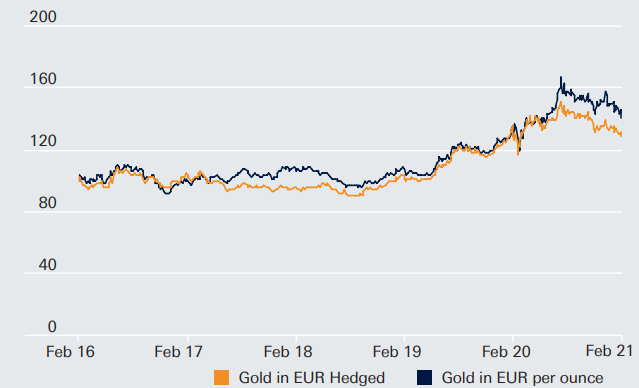

The appeal of XGDE and XGDG rest upon an investor’s desire to hedge against euro-US dollar and sterling-US dollar exchange rates, respectively.

Bloomberg data shows gold in sterling and gold in sterling-hedged products offered similar returns, as at 19 February, while euro-hedged gold outperformed its non-hedged counterpart at the same time point.

Michael Mohr, head of product development at DWS, said: “Our unhedged gold ETC, the Xtrackers IE Physical Gold ETC Securities, is already highly competitively priced at 0.15%, and now we have been able to reduce the fees on our currency-hedged gold products too.”