Europe’s expansive array of leveraged, inverse and leveraged inverse single-stock exchange-traded products (ETPs) would fly off the shelves in other regions, but cultural differences and ease of access prevent them gaining wide appeal.

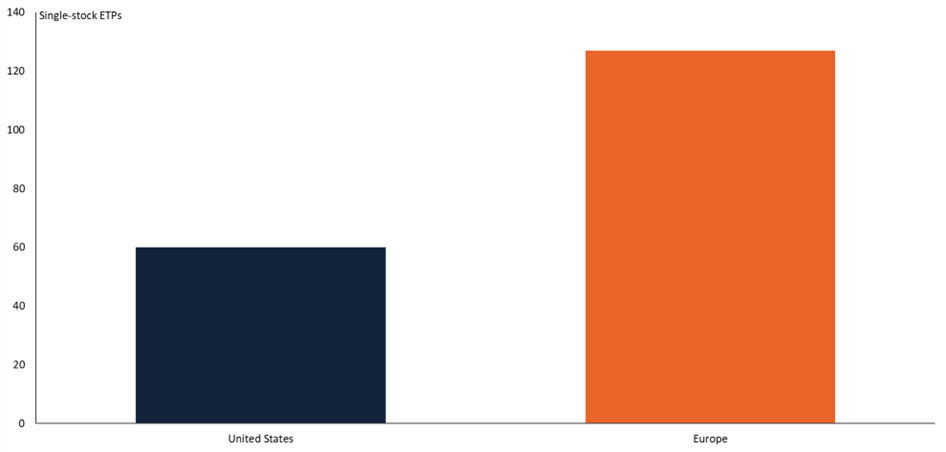

As the below chart illustrates, European investors have access to a much broader range of single-stock ETP offering than their US counterparts, according to figures from Athanasios Psarofagis, ETF analyst at Bloomberg Intelligence.

Chart 1: Number of leveraged and inverse single-stock ETPs, US vs Europe

Source: Bloomberg Intelligence

In total, 47 equities are available to European investors in leveraged, inverse and leveraged inverse form, compared to just 21 in the US.

Moreover, single-stock ETP leverage is capped at two times in the US, whereas stocks in Europe can be levered up by a factor of three.

As such, global investors looking for high octane long or short exposure to a broad selection of individual equities would be licking their lips at the menu in Europe, but these products have struggled to attract widespread demand in the region.

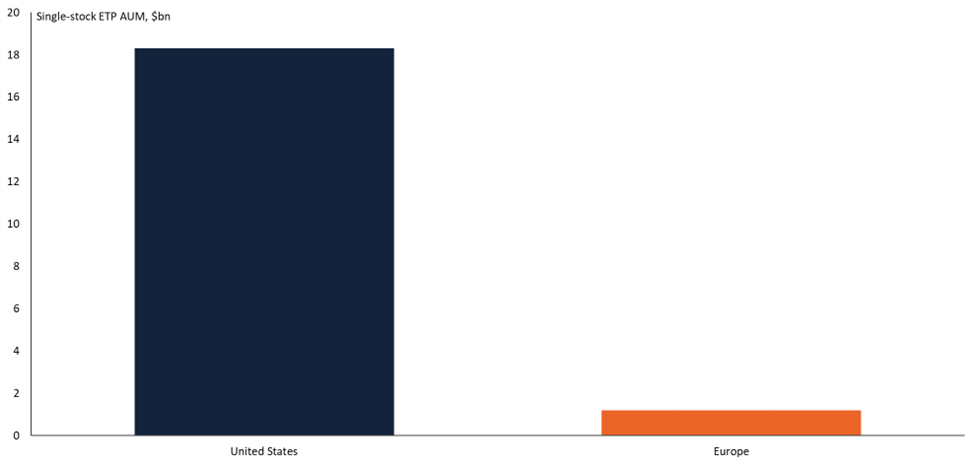

As the below chart shows, single-stock ETP assets under management (AUM) are substantially higher in the US than Europe – this despite a much more limited product range.

Chart 2: Leveraged and inverse single-stock ETP AUM, US vs Europe

Source: Bloomberg Intelligence

The story is similar across leveraged and inverse ETPs more broadly. At 450, no region has a greater number of products than Europe but those products boast just 5.8% of global AUM, according to data consultancy ETFGI.

Why?

Perhaps the main reason for Europe’s feeble adoption is culture.

Oktay Kavrak, communications and strategy director at Leverage Shares, explained that the “US has a more mature market and a deeply ingrained investment culture, which has driven wider adoption of ETPs and ETFs in general.”

Indeed, a study commissioned by BlackRock found that just 12% of European ETF assets were attributable to retail investors at the end of 2023, whereas retail penetration was more than double this level in the US, according to State Street.

For Psarofagis, not only is retail activity higher, but the “gambling mentality” of retail investors is much more pronounced in the US than Europe.

“Could you imagine a 3x Nvidia ETP in the US? People would go mad for it,” he told ETF Stream.

Indeed, the stocks underlying leveraged ETPs in the US exhibit a strong retail flavour.

Nvidia-based products are the most popular in the US market and house $7.6bn in assets, according to data from Bloomberg Intelligence. Other retail favourites like Tesla, Microstrategy and Coinbase feature in the top 5 and very few stocks outside the technology sector have been packaged into single-stock ETFs at all.

In Europe, on the other hand, industrials, banks, mining companies and defence stocks can all be found in leveraged or inverse form.

The problem, however, is that most of them struggle to attract any demand. According to Bloomberg Intelligence figures, of the 127 leveraged or inverse single-stock ETPs in Europe, 112 hold less than $10m in assets.

A further problem is access.

Single-stock ETPs are widely available on US brokerage platforms whereas access is more difficult for European investors.

“Most brokers globally are connected to US exchanges, while access to EU and UK exchanges remain limited,” said Kavrak.

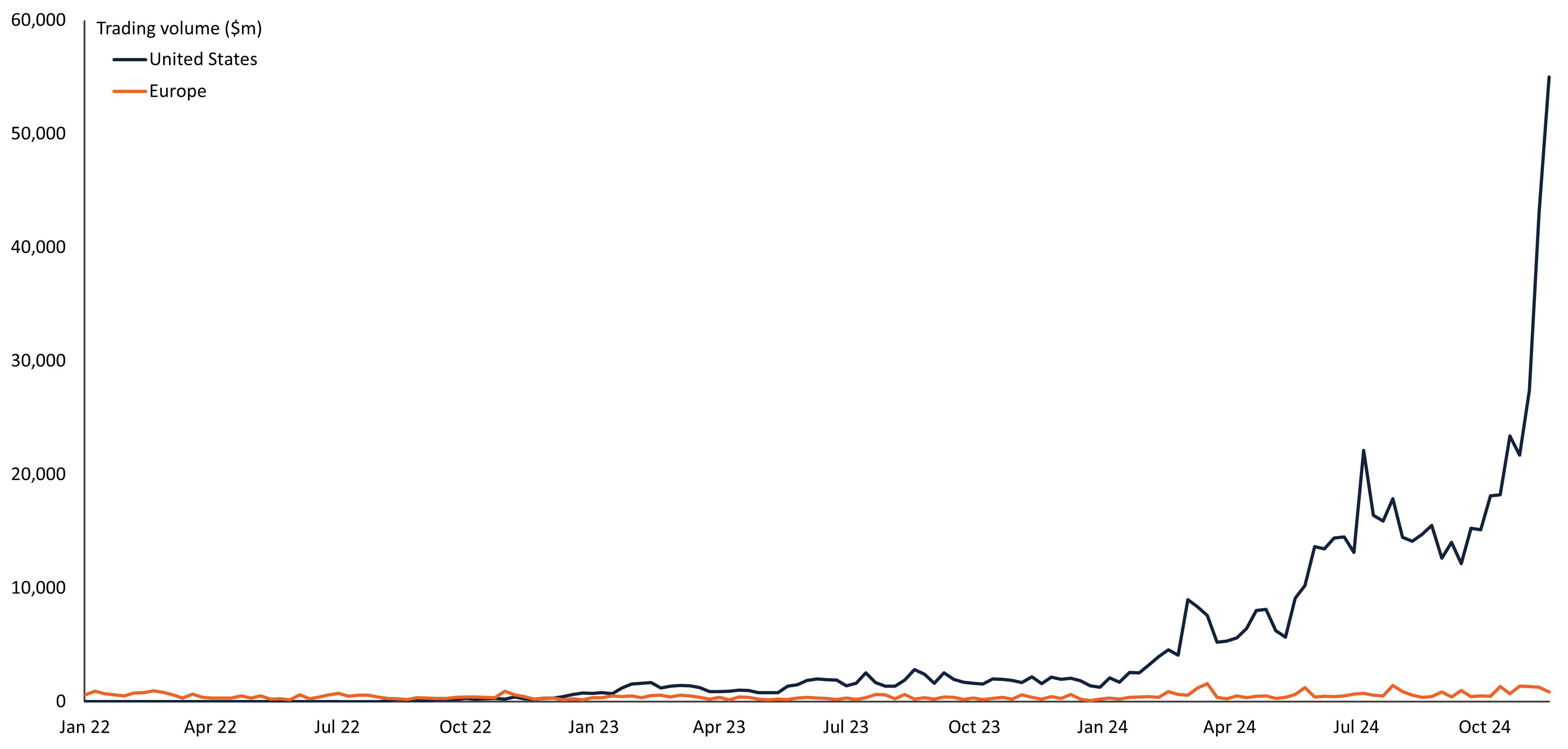

Indeed, as the below chart shows, trading volume of US single-stock ETPs is substantially higher – particularly so after Donald Trump’s victory in the US presidential election sparked a further wave of speculative activity.

Chart 3: Trading volume in single-stock ETPs by region, 2022-present

Source: Bloomberg Intelligence

While adoption in Europe remains a long way behind the US, Kavrak sees the “tide shifting”. In October, the US dollar turnover of Leverage Shares products was up 144% year-on-year, according to figures from the firm.

That said, “progress will remain muted as long as brokers maintain a closed architecture that prioritizes local and US-listed instruments over other global options,” he concluded.