The growth of algorithmic trading in ETFs is helping markets navigate the “fragmented nature” of the European ecosystem, according to BlackRock.

In a recent report, titled The Role of Algorithmic Trading in Optimising ETF Execution Outcomes, the asset management giant said algorithms offer benefits such as alternative market access to current risk or NAV-based trading, liquidity sourcing, execution optimisation and connectivity.

ETFs in Europe predominantly trade using request for quote (RFQ) platforms – also known as risk – however, BlackRock added ETFs could trade more like cash equities using algorithms as the market matures.

The growth of algorithms using a fair value model when trading ETFs is helping when there is less volume across exchanges and expanding investors' toolkits to achieve best execution.

ETF execution is currently dominated by RFQ platforms which accounted for 55% of the market at the end of 2022 versus just 5% for algos, according to Goldman Sachs FICC and Equities.

Conversely, 65% of cash equity trading is done using algorithms while just 10% is done on exchange.

However, over the past couple of years, ETF algorithm trading has been growing and is tipped as a possible driver of more volume on exchange.

Smoothing inventory premium

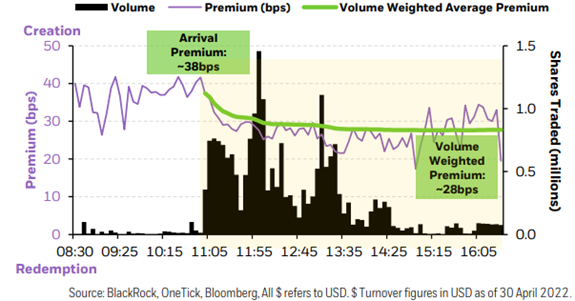

One of the key benefits outlined by BlackRock is ‘smoothing inventory premium’ which can result in substantial savings in trading costs.

It pointed to a £130m sale of the iShares Core FTSE 100 UCITS ETF (ISF) on the London Stock Exchange (LSE) in April 2020 using algorithmic execution, resulting in a 14 basis point (bps) saving in trading costs versus RFQ.

BlackRock said the premium impact of the algorithmic execution was 10bps, calculated by subtracting the volume-weighted premium from the arrival premium, plus a 1bps impact on the underlying.

Meanwhile, the most competitive risk price for the same trade size was 25bps.

“In this example, by executing algorithmically, the client achieved trade anonymity, competitive pricing and reduced investor premium impact over ‘risk’ impact,” BlackRock said.

Hidden liquidity

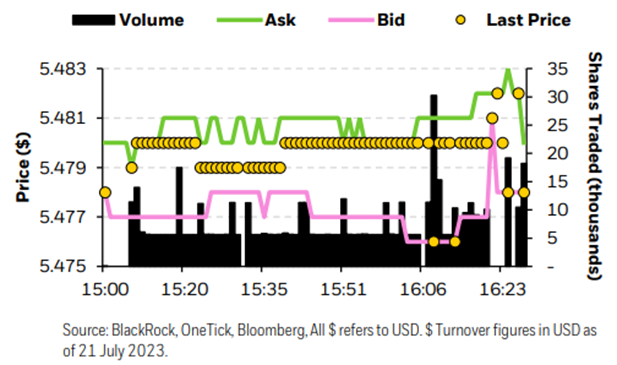

Trading algorithms have also been beneficial in sourcing liquidity, helping to reduce trading costs by seeking the best prices across lit markets, systematic internalisers, ETF primary markets, RFQs and dark pools.

One way this can be achieved is by using hidden orders when executing via algorithms.

On 21 July 2023, BlackRock said its iShares $ Short Duration Corp Bond UCITS ETF (SDIA) traded $21m – well above its $3m average daily volume – 82% of which interacted with hidden liquidity.

It found all buy orders were filled between either at mid or below bid-ask, “illustrating good market quality when executing on exchange”.

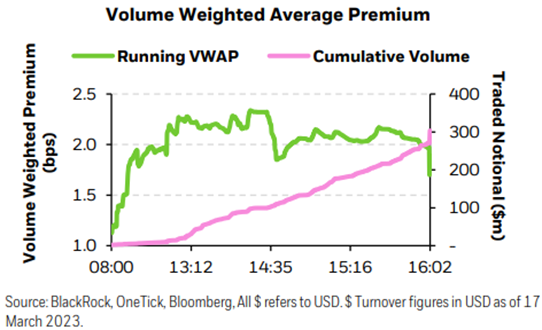

Risk premium impact

BlackRock also noted its ability to minimise the premium impact on large trades which can often risk moving the benchmark if executing via NAV or risk.

The group highlighted a $370m sale of its iShares Physical Gold ETC (IGLN) on 17 March 2023. It said roughly $100m was executed at a 2bps premium while the remaining $270m was executed at “similar or better levels”.

“A large trade size may risk moving the benchmark if executing via NAV or risk. By working the order via algo, the market impact can be minimised, and it is possible to gain exposure throughout the day instead of waiting for London auction time which you get when you trade at NAV,” BlackRock said.

The technology behind algorithms is evolving and brokers are constantly developing their offerings to boost efficiency, according to BlackRock.

This includes integrating RFQ functionality into their algos, automated urgency scaling and access to additional liquidity venues.

“At its core, ETF algorithms are designed to achieve execution outcomes by integrating technology, price feeds, and liquidity pools,” it said. “Clients seeking to execute via ETF algo should consider the range of strategies available.”