Italian fund selectors are increasingly turning to ETFs as a tactical asset allocation tool as well as for their thematic exposure as they look to benefit from the ETF wrapper's ease of trading.

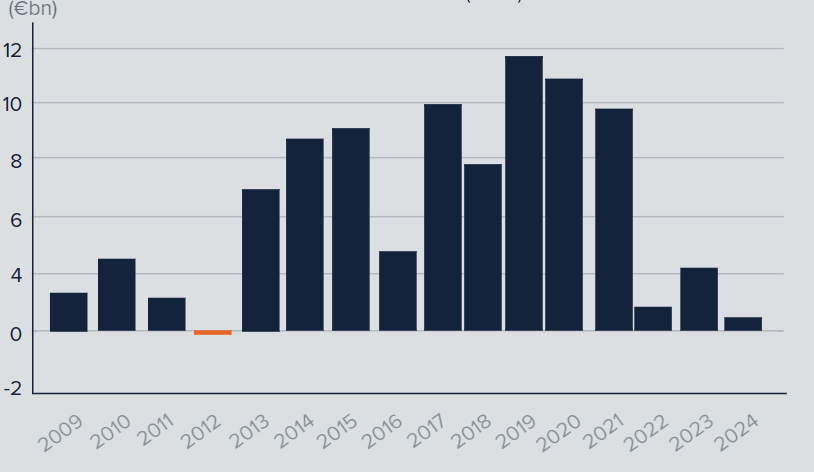

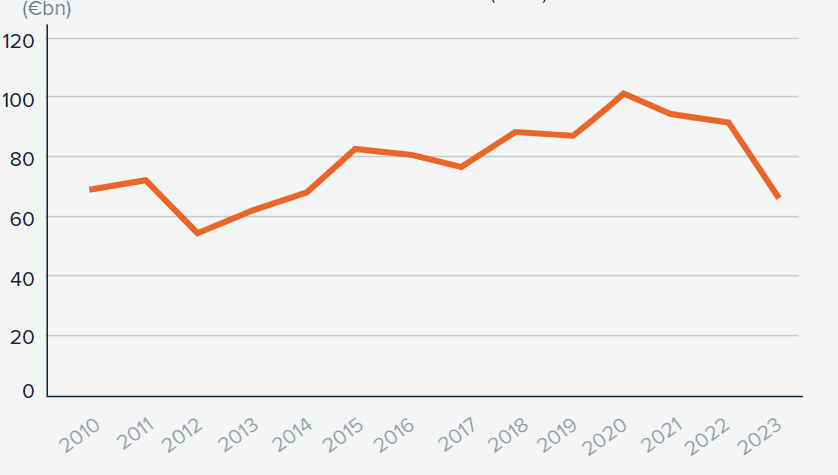

Much like the rest of Europe, ETFs have seen solid growth among Italian investors. Assets under management (AUM) of Italian-listed ETFs have almost quadrupled between 2014 and 2024, growing from €34.3bn to €121.5bn, respectively, accounting for just over 6% of the European market.

However, highlighting Italian investors' preference to use ETFs tactically, ETF turnover on the Euronext Milan hit €21.9bn in Q1 2024, roughly 13% of total turnover across European exchanges, according to data from ETFbook.

Italian listed-ETFS are seeing steady growth

Chart 1: ETF AUM (€bn)

Source: Euronext and ETFBook

Chart 2: Net inflow (€bn)

Source: Euronext and ETFBook

Thematics rising?

One area proving popular among fund selectors is thematic ETFs, helped by the strong narrative helping to attract the country’s burgeoning retail investment market.

Appetite is strong in the region despite significant headwinds across Europe over the past couple of years, with investors pulling €107m in Q1 2024, in addition to the €1bn outflows it achieved in 2023.

Enrico Girotti, portfolio manager at Banca Patrimoni, said he uses ETFs primarily to gain thematic exposure within his portfolio.

“We make significant usage of ETFs in every kind of portfolio mainly for equity investments and specifically for thematic investing,” he continued. “ETFs are the best way to address market trends and provide diversification in such portfolios which seek long-term trends in markets or thematic strategies.”

Highlighting this, the group recently looked to “diversify” its ESG thematic investment with the purchase of the BNP Paribas Easy ECPI Global ESG Blue Economy UCITS ETF (BLUE), gaining exposure to companies that seek opportunities in sustainably using sea and ocean resources.

Lorenzo Di Pietrantonio, CIO at Fineco Asset Management, said he uses thematic ETFs to get diverse exposures to broader megatrends.

“For thematic investments, we tend to use ETFs because during the first wave of structural changes it is difficult to identify the winners of the future so it is much more important just to be in the theme,” he said.

The Italian asset manager currently has 16 ETFs in Europe, seven of which are thematic products.

Giorgio Broggi, quantitative analyst at Moneyfarm, also said there is growing demand among its investors for thematic funds.

“We offer clients thematic overlays so they can customise their own portfolio,” he explained. “We offer four big themes and within each we select several ETFs that offer exposure to our macro views.”

Despite this, Broggi believes recent market overconcentration could mark some difficulties for thematic ETFs moving forward.

“It is becoming more complex for thematic ETFs because some of them are very idiosyncratic versus the market,” he said. “The thematic space has really shown what concentration means. There has been a big performance dispersion in thematics that has been very interesting.”

A tactical tool

Alongside the ability to access the next megatrend, Italian investors are also upping their use of ETFs as a tactical asset allocation tool.

Banca Patrimoni’s Girotti said the group will use ETFs as a tool to avoid much of the recent overconcentration in the markets: “ETFs represent the proper instrument to avoid concentration and to fulfill size requirements for each customer need.”

Highlighting their use of ETFs as a tactical play, Girotti said the group has recently purchased the UBS ETF CMCI Composite SF UCITS ETF (UC15) to capture the bounce in commodity markets, while also taking a position in the Amundi MSCI China ESG Leaders UCITS ETF (CNEU) “given attractive valuations and a potential rebound in the economic activity”.

Investors turning tactical

Chart 3: Turnover (€bn)

Source: Euronext and ETFBook

Chart 4: Number of trades (m)

Source: Euronext and ETFBook

Pietrantonio said this is also the case at Fineco AM. The group entered the ETF market in late 2022 with the launch of a financial ETF – alongside 10 other ETFs – as it anticipated rising interest rates were set to benefit the sector.

It also launched the Fineco AM MarketVector Japan Quality Tilt ESG UCITS ETF (JPMQ) last November following promising tailwinds for the country.

“If we believe in the short-term a particular sector might benefit from the current market conditions we will work on launching ETFs in this space,” Pietrantonio said.

While ETFs are experiencing growth in the region, the wrapper still faces hurdles such as distribution as it battles against inducements, a practice where asset managers pay commissions to financial advisers selling their products which tend to favour more expensive active funds.

ETF issuers are gradually looking to increase their presence in the market, making use of the growth of retail investing and striking partnerships with digital platforms.