Invesco has announced it is reducing the annual fixed fee on its $4.5bn Invesco Physical Gold ETC (SGLD). Originally having a fixed fee of 29bps per annum, SGLD now costs 24 bps p.a.

SGLD is the largest exchange-trade product Invesco has listed in Europe and has the lowest overall cost of any gold ETP in Europe as well, according to the firm.

Invesco says, gold ETPs are growing in demand. Since the beginning of Q4 alone, SGLD has captured $190m of net inflows as well as the European gold ETP markets seeing inflows in excess of $1bn.

The purpose of a gold ETP is to track the performance of the price of gold whilst minimising the fees compared to physically owning the commodity. Owning and holding gold involves more costs and maintenance to transport, store and insuring it.

Chris Mellor, Head of EMEA ETF Commodity Product Management at Invesco, said in a statement: "Gold could provide useful diversification for investors who are worried about volatile equity markets and the possible impact of slowing economic growth, trade wars and Brexit."

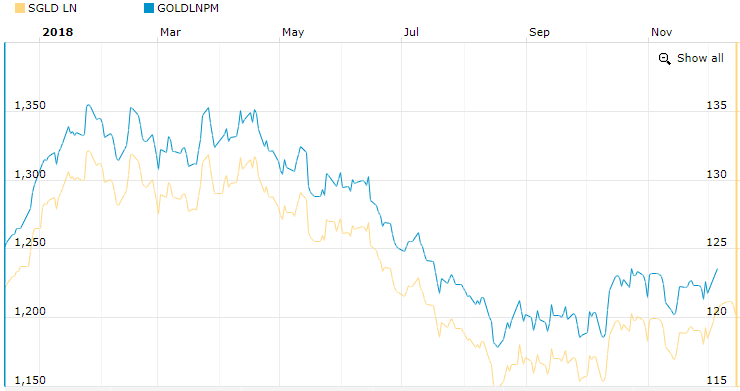

SGLD and Gold price Source: Investec

When buying SGLD, the investment is used to purchase physical gold bats which are then stored in the vaults of J.P. Morgan. Therefore the performance is always going to replicate the price of gold however the difference being the fees included with the ETC which was 0.29 per cent before today.