Thematic ETFs are viewed by critics as little more than baskets of repackaged growth stocks but in reality there are a number of investable value factor-related themes flying under the radar.

For the most part, the love affair between thematic ETFs and pricey growth stocks is hard to ignore. Research by Robeco’s quantitative research head David Blitz and quant selective research director Matthias Hanauer argued the thematic product range effectively trades against quantitative investors.

In fact, all but four of the 48 thematic indices offered by S&P Dow Jones Indices and MSCI had “strong” negative exposure to the value factor, with only one offering “marginally” positive exposure towards the profitability factor, Blitz and Hanauer’s research found.

Buyback bulls

However, this need not be the accepted norm for the still-developing thematic ETF class. In a recent paper, Scott Chronert, global head of ETF research at Citi, named buybacks as the most attractive investment theme based on quantitative scores spanning valuation, growth, price momentum, quality, low risk and earnings momentum inputs.

Buyback ETFs capture companies purchasing their own stock when view they think it is cheap and has the potential for future appreciation - such as Alibaba’s momentous $25bn buyback in mid-March.

Chronert said these ETFs carry an element of cyclicality but are mostly driven by economic sensitive factors such as value and size, along with fundamental elements via growth, quality and earnings momentum. Additionally, buyback ETFs display positive connectivity to higher rates and a steeper yield curve slope.

“This implies investors can use the buyback theme as a mean of transitioning from purer cyclical exposure, to a more fundamentally defensive stance against an uncertain backdrop,” Chronert said.

Echoing his views, Peter Sleep, senior investment manager at 7IM, also expressed his support for the theme:: “There is also good academic support for buying buyback stocks as a strategy – not unlike some of the smart beta funds or fallen angels.

“I like these strategies if it is supported by some evidence. Here are themes I can latch onto.”

Of course, CEO-level buybacks are not the only financially significant event a company can perform with its own stock. Sleep said research found shorting companies undergoing initial public offerings (IPOs) tends to generate returns as company management is more likely to list when their stock commands a premium. This is even more prominent with special purpose acquisition company (SPAC) deals, which often follow periods of retail hype.

Interestingly, company directors selling stock is not a reliable signal for shorting stock, Sleep said, given selling by individuals often occurs for tax planning or during other events such as divorce.

Tangible assets

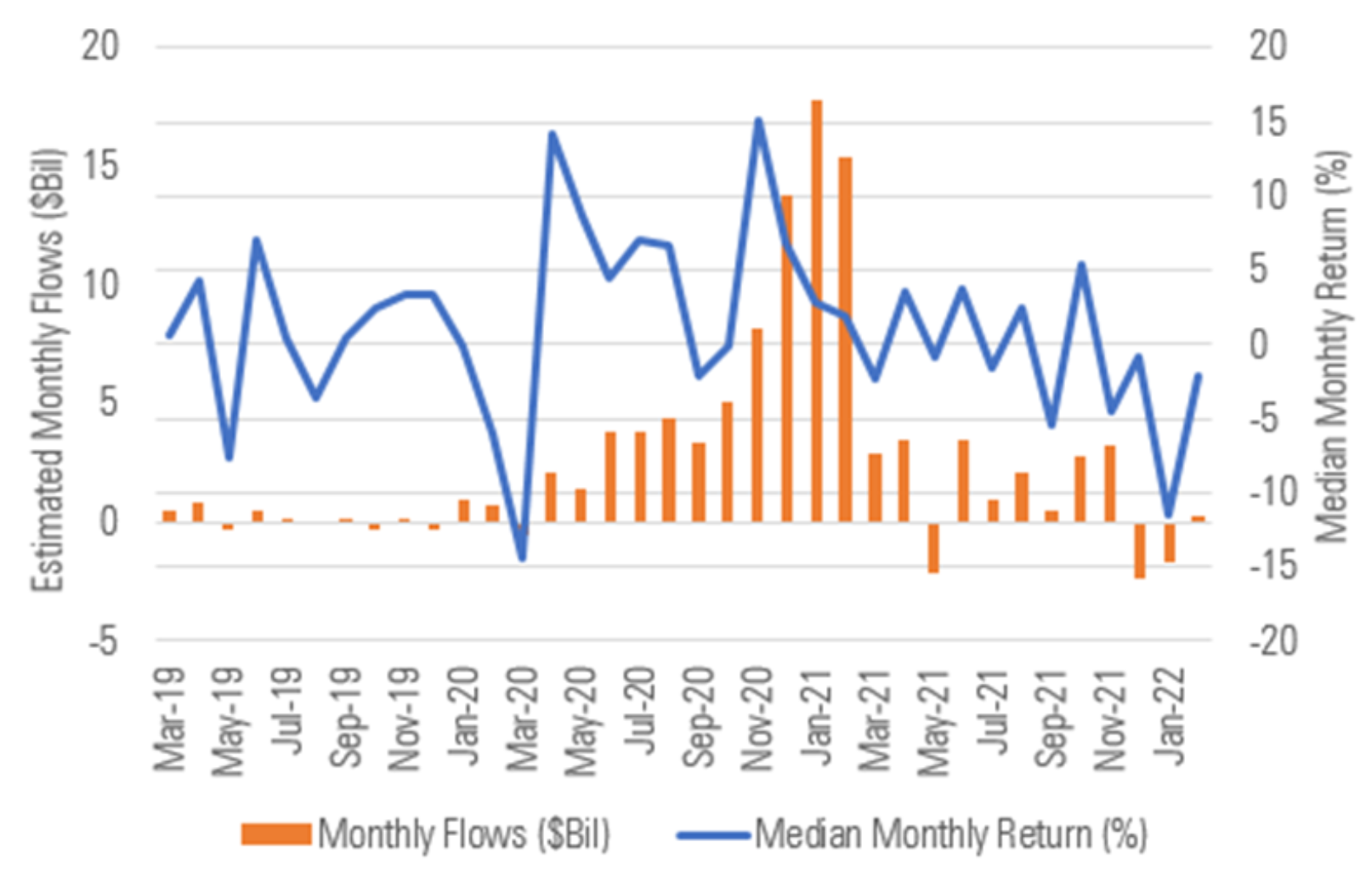

Benjamin Lavine, co-CIO at 3D/L Capital, bemoaned the fact ETFs have a similar tendency to other financial products “which are sold, not bought, based on trailing financial performance”.

This has certainly been true in the thematic space, where ETFs tend to be pieced together during periods where a theme is enjoying media attention and strong returns, only to gain regulatory approval and list towards the latter stages of periods of outperformance. In essence, these products – and assets going into them – tend to chase rather than front-run gains.

Thematic fund flows and gains

Source: Morningstar

Offering a counter to this dynamic, Lavine suggested a value thematic play that targets companies with ‘hard assets’. This might include those with large inventories and property, plant and equipment relative to their size, revenue and earnings before interest, tax, debt and amortisation (EBITDA).

The valuations of such companies are less likely to be based on intangibles like brand buzz or predictions of exceptional long-term expansion and more correlated with metrics such as a stable balance sheet.

Given the fact these tangible assets are difficult to convert into cash – and often costly – they imply a company has faith in its own profitability in the long-term. In this sense, the ‘hard assets’ theme still pays homage to the thematic ETF penchant for long-term growth, but with a strong twist of value and even quality factors.

Sensible moonshots

Another route for those who still want to use thematics to play future megatrends might be to overlay baskets of small-cap ‘moonshots’ with value screens, to try and avoid buying into frothier candidates.

Naturally, small companies in nascent themes may not have the most attractive or steady balance sheets and looking at companies’ tangible assets would not offer a fair comparison between a utilities player and a metaverse player, for instance.

One value-related metric which may make sense, however, is assessing what money a company might bring in versus its current price.

7IM’s Sleep said: “The value of any stock or financial instrument is the present value of future cashflows. End of story.”

Like other areas captured by rules-based ETFs, thematic ETFs offer exposure to a range of relevant companies at often varying price points.

The real disadvantage of themes, however, is the size of the investment universes of eligible companies is often small enough that offering suitable diversification is more of a priority for index providers and ETF issuers than offering exposure to companies with the best valuations.

In ETF format, being selective on the basis of something like ‘current value of future cash flows’ might mean a product has to cover more than one specific future theme in order to be well-diversified enough.

The main barrier to such an ETF, though, is simply the amount of work that would have to be done – by either an index provider or an issuer performing active management – and the corresponding costs attached to this.

Sleep noted: “Picking a stock is a difficult business that requires a lot or work to try to analyse a company’s future cashflows, present value them and decide whether to buy or not.”

Related articles