Global sovereign wealth funds are showing greater interest in ETFs following the resilience shown during the coronavirus turmoil, according to a recent report on asset management trends.

The Invesco Global Sovereign Asset Management study for 2020, conducted in the period just before the crisis struck, showed the take-up of ETFs by sovereign wealth funds was now central to their equities buying.

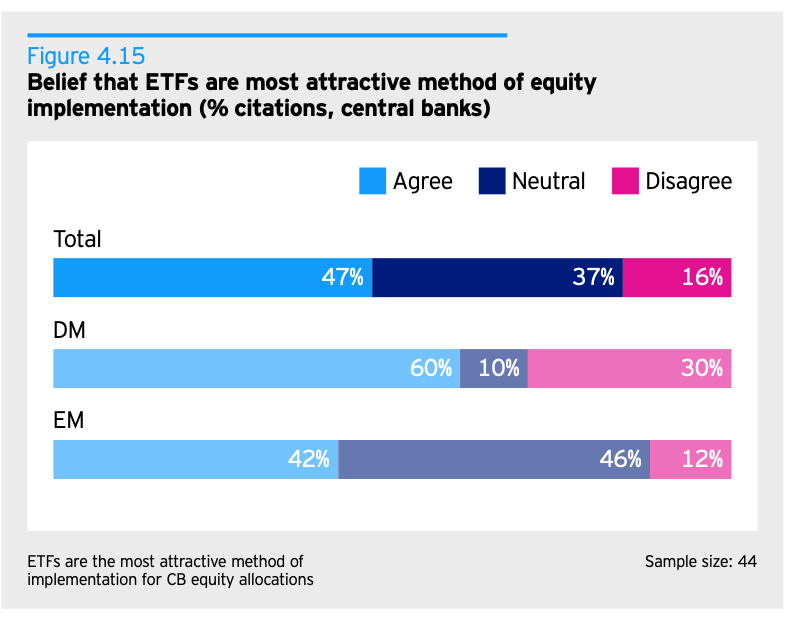

The survey of sovereign wealth and central bank asset managers across 139 institutions showed close on half now believe ETFs are the most attractive method of equity implementation. Among managers in developed markets, that figure reached 60%.

Chart 1: Belief that ETFs are the most attractive method of equity implementation (% citations, central banks)

Source: Invesco Global Sovereign Asset Management study

The use of ETFs is not restricted to equities. The survey also found that of the asset managers that use ETFs, nearly a third also used them for corporate debt (31%) and sovereign debt (31%).

The survey went on to state, though, that the market volatility triggered by the COVID-19 pandemic has “cast attention of some of the challenges of ETFs”, pointing out that these were already “front of mind” with the managers in the survey.

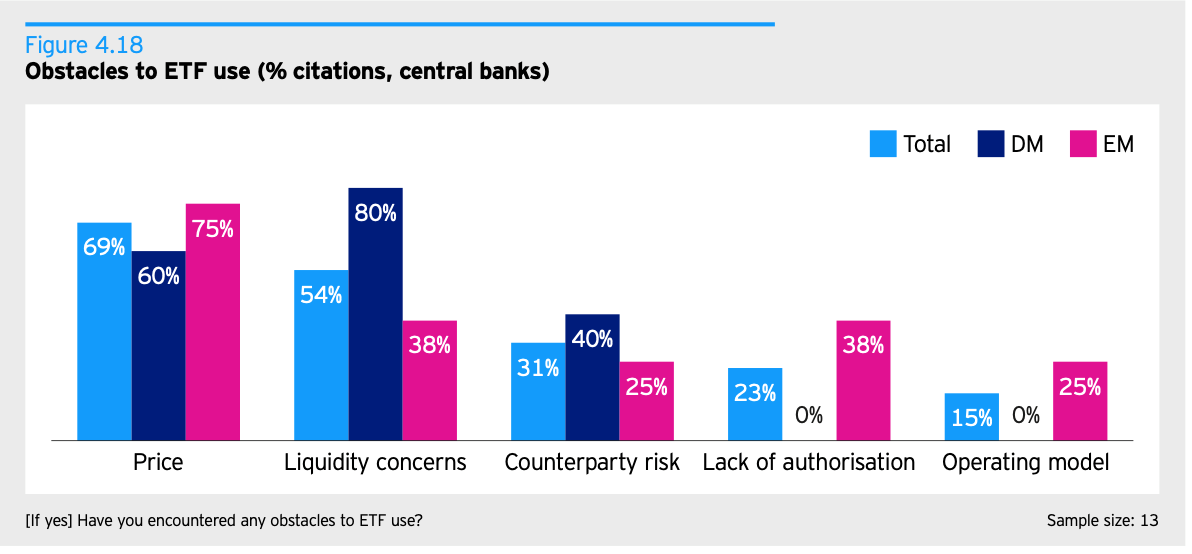

Key among these were liquidity concerns with 54% of all banks – and 80% of developed market banks – having worries over this issue.

Chart 2: Obstacles to ETF use (% citations, central banks)

Source: Invesco Global Sovereign Asset Managementstudy

Given the extent to which the reputation of ETFs through the crisis with regards to liquidity has been enhanced rather than diminished, it might be that these attitudes are now out of date.

Certainly, Rod Ringrow, head of official institutions at Invesco, suggested the strong inflows seen into ETFs since the March sell-off would have eased the worries on this score.

“Even before the coronavirus crisis, some commentators were questioning how ETFs would perform in a sharp market downturn, especially those investing in illiquid segments of fixed income markets,” he continued.

“As it turned out, ETFs performed as you should expect, continuing to trade even when some of the underlying markets were effectively seizing up.

“The Fed’s decision to include US-listed ETFs in its asset purchase programme further supports the validity of the ETF structure.”

From SWFs to NWFs

The next step with regard to ETF usage by central banks might come with the establishment of what authors Eric Lonergan, hedge fund manager and Marc Blyth, professor of international economics at Brown University, called in their recent book Angrynomics National Wealth Funds.

These would be similar to SWFs except in one crucial aspect; instead of investing a country’s already earned wealth for future generation, they would borrow at current historically low interest rates in order to buy equities, again for the use of future generations.

Considering the Fed’s ongoing recent bond-fund buying spree, it is no great leap to imagine that a similar effort in equities would also hit upon ETFs as the most efficient route to achieve their aims.

As Peter Sleep, senior investment manager at 7IM, said, the Fed bond-buying effort might be seen as a “seal of approval for fixed-income ETFs” and, moreover, it “will hopefully silence many of the ETF doubters”.

Furthermore, for Ringrow, it is the cost-efficiency of ETFs that make them look like an increasingly viable option when it comes to sovereign wealth fund, and indeed, any putative National Wealth Fund.

“With the liquidity concerns having been put to rest for many investors, ETFs should now be considered more widely and on an equal footing with other investment vehicles.”

Yet, the example of Japan might give some pause for thought as to whether it the ETF becoming an arm of state fiscal policy.

So hooked has the Bank of Japan become on buying ETFs in order to shore up sentiment since the Global Financial Crisis that it now is the dominant player in its domestic market, owning upwards of 80% of all ETF assets in Japan. In the face of such central bank largesse, the retail market is understandably underpowered in comparison.

Mark Northway, investment manager at Sparrows Capital, argued the example from Japan should set warning bells ringing if the idea of National Wealth Funds gets any further off the drawing board.

“The effect is to create an asset-guzzling monster that has eaten the whole supply of government debt and is now chewing up domestic equities, all via ETFs,” he added.

Whether this gives ETFs “a further leg up” might be considered moot given that in such circumstances they would be, as Northway concluded, “vehicles for asset price inflation and a dangerous experiment in economic intervention”.

At this point, ETFs would be simply too big to fail, an end result which would put the recent worries over ETF liquidity into the shade.