Technology and consumer staples were the top performing sectors for the US and European ETF markets, respectively, according to a recent report from SPDR, for both March and Q1 2019. The ETF arm of State Street Global Advisors found financials was the worst performing sector for the month of March in the same regions.

The world’s real estate sector had a significantly positive performance so far this year, increasing 4.6% in March and 16% for Q1. Japan was the notable contributor for this spike in performance. SPDR says the sector offers a lower volatility which nervous investors will be more attracted to since the Federal Reserve and European Central Bank have both announced there will not be rate rises in the coming months.

SPDR has selected real estate as one of its Sector Picks for Q2 as a result of its defensive traits, particularly in the European market. Defensive sectors in general performed better in Europe during Q1 compared to the US, such as consumer staples, materials and technology, which suggests the two markets are at two different points in their economic cycles.

The second sector SPDR shows confidence in is technology given its strong performance across all regions and investors showing interest having invested heavily during the month of February. However, investors quickly sold off their investments in March with technology ETFs seeing negative flows for Q1 in the US (-$2.7bn) and Europe (-£332m). Technology is one of SPDR's Sector Picks despite the sector's ETF facing negative net flows.

The equity market’s flows were underwhelming given the asset class’ prices rebounding from its difficult Q4 2018. This could suggest investors are remaining sceptical of the equity market and are seeking yield from fixed income ETFs.

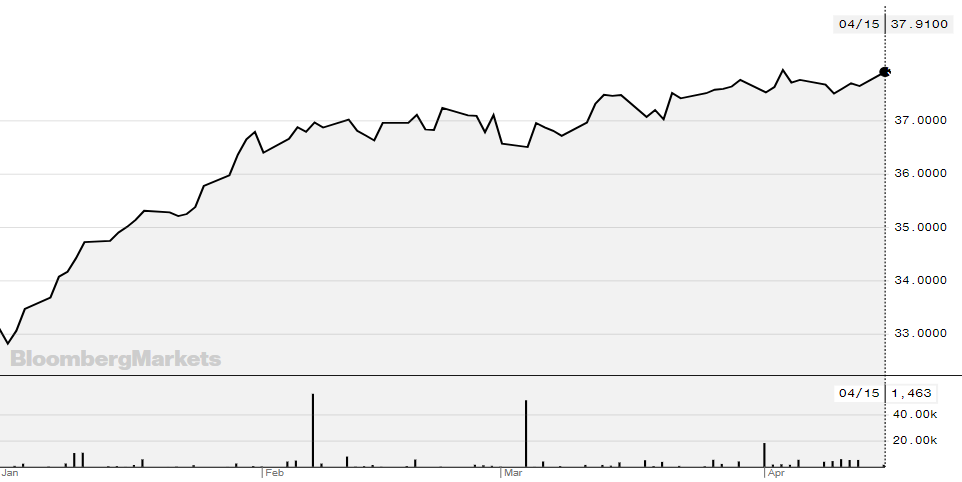

Real Estate

The SPDR Dow Jones Global Real Estate ETF (GLRE) has year-to-date returns of 14.3%. The $655m fund’s largest holdings include the Simon Property Group (4.7% of fund), Prologis (3.9%) and Public Storage (2.7%).

GLRE’s YTD performance - Source: Bloomberg

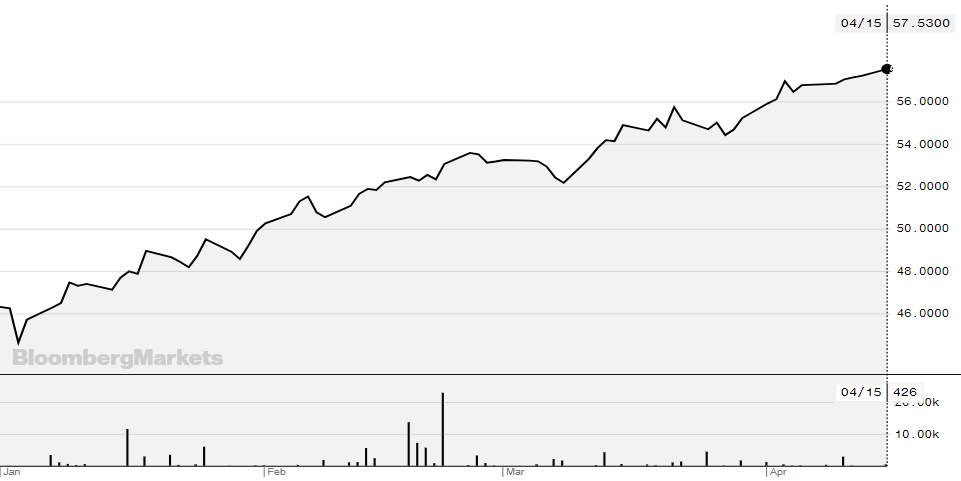

Technology

The SPDR MSCI World Technology ETF (WTEC) has year-to-date returns of 24.1%. The $164m fund’s largest holdings include Apple (14.3%), Microsoft (13.4%) and Visa (4.3%).

WTEC’s YTD performance – Source: Bloomberg