ETF investors spent last week hunting for safety after US Treasury Secretary Janet Yellen warned the country could default on obligations as soon as 1 June if its debt ceiling is not raised.

With the $31.4trn ceiling already hit, Yellen said the Treasury may be just weeks away from defaulting on US Treasury bond pay-outs and not being able to make civil staff salary and social security payments.

Such a scenario would represent a “constitutional crisis” and “an economic and financial catastrophe”, she added, with Finimize global markets analyst Eddie Donmez predicting default could lead to a 10% hit to US GDP and up to eight million jobs lost.

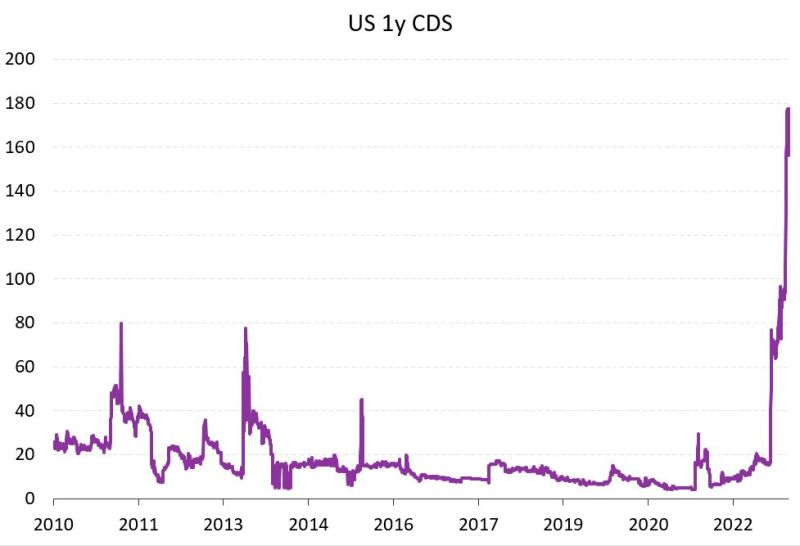

With the crucial juncture approaching and short-dated bonds set to mature, yields on one-month US Treasuries spiked 233 basis points (bps) – to 5.67% – between 21 April and 15 May. Meanwhile, US one-year credit default swap spreads – which price in the probability of US default – shot up to their highest level since 2011.

Source: 7IM

Unconvinced that elevated yields and cut prices represented a buying opportunity, European investors pulled $138m from the iShares $ Treasury Bond 0-1yr UCITS ETF (IB01) and $102m from the Invesco US Treasury Bond UCITS ETF (TRES) over the past week, according to data from ETFLogic, with the latter being 33.9% weighted to bonds with less than three years to maturity.

Even more drastic was US investors pulling a sizable $1.8bn from the iShares Short Treasury Bond ETF (SHV) during the same period.

On the reverse side of the trade, continued uncertainty saw gold maintain a near all-time-high price of $2,020 an ounce on Monday. While investors are mindful of US default risk, the more likely outcome of the debt ceiling being raised means more US dollar-denominated debt issuance, strengthening the precious metal’s case as a store of value.

Reflecting this, the iShares Physical Gold ETC (IGLN) booked $498m inflows while the Invesco Physical Gold ETC (SGLD) welcomed $168m net new assets.

Matthew Yeates, deputy CIO at 7IM, suggested it is “very unlikely” the US will default on its debt, however, the political impasse between Democrat President Joe Biden and Republican Speaker of the House Kevin McCarthy could spell systemic jitters in the short-term.

“[It is] almost certain that politicians will take things to the eleventh hour – and let us be honest probably past it – to try and force their hand.

“One of the key issues here is that US Treasuries are among the most commonly held securities for collateral against all sorts of financial transactions. Even if the payments end up being made, small delays can very quickly clog up the plumbing in the financial system. “Even if things resolve themselves ultimately, the interim damage to financial fragility could be significant in what is an already relatively thin market backdrop for liquidity. Let us hope politicians understand that!”

George Lagarias, chief economist at Mazars, agreed but added the events of COVID-19 should make onlookers “very careful” about dismissing unlikely outcomes.

“We believe this time, the risks are more pronounced and that we could, at least, see a replay of the 2011 Debt Ceiling Crisis,” he said.

While the US debt ceiling has been suspended seven times since 2013, the events of 2011 were described by Yellen as a “fiscal cliff” which saw S&P Global downgrade the US’s triple-A credit rating.

It remains to be seen whether demands made by the GOP’s Debt Ceiling Bill – such as pared back spending on student loan waivers, Medicaid, food stamps and renewable energy tax credits – will be met to increase the debt cap by an additional $1.5trn, or whether the prospect of being blamed for the US defaulting will force the Republicans to back down.