The Japanese Yen surged last Thursday as investors flocked to safety amid

warning that its quarterly revenue would be impacted by China's economic weakness and a broader economic slowdown.

The yen is traditionally seen as a 'safe haven' currency and some commentators suggest it could be one of the strongest currencies against the dollar this year, but is this really the case?

To get a better idea of how stable the currency is now, there are several factors to take into account. These include exports, imports, the health of the economy and how the yen has reacted to other significant events.

Last year was mixed for the currency. Japan was hit by continued low interest rates, Trump's steel tariffs and Typhoon Jebi, but it also ended the year as one of the few currencies to end the year stronger than the US dollar.

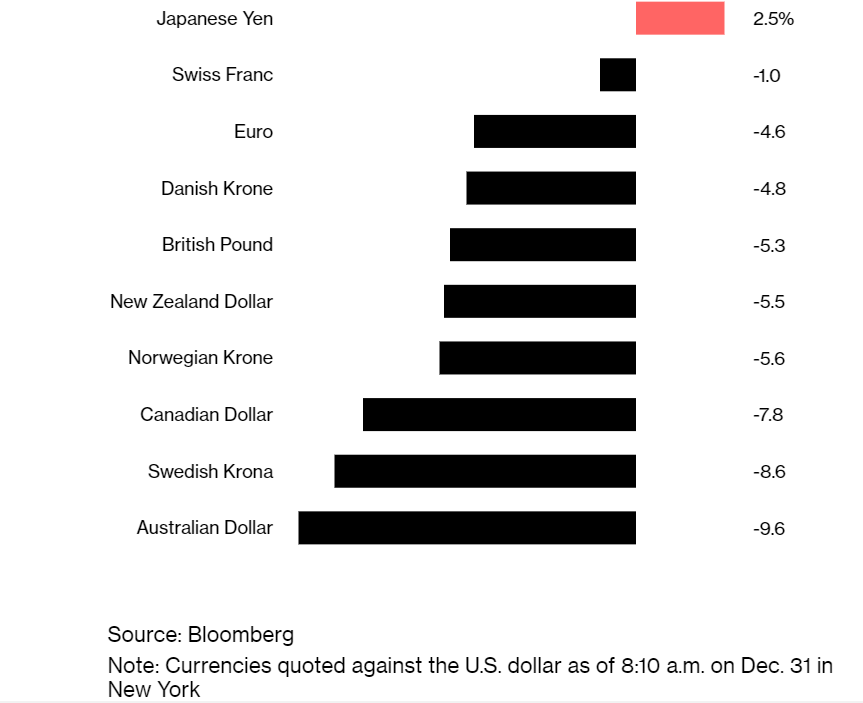

Looking at the ten currencies in the chart below, the yen is the only one to come out of 2018 stronger than the US dollar:

Following last year's strong performance, the yen was further boosted by the flash crash on January 3rd. The yen rose 8% against the Aussie dollar (a good proxy of the Chinese economy), and 4% against the US dollar in just seven minutes, according to the FT.

CNBC reported that "such big moves in foreign exchange markets reflect deep and growing angst about the global economy - the yen has traditionally been the go-to currency in times of stress because traders believe the legions of Japanese investors holding money overseas will rush back into Japan when markets are in flux."

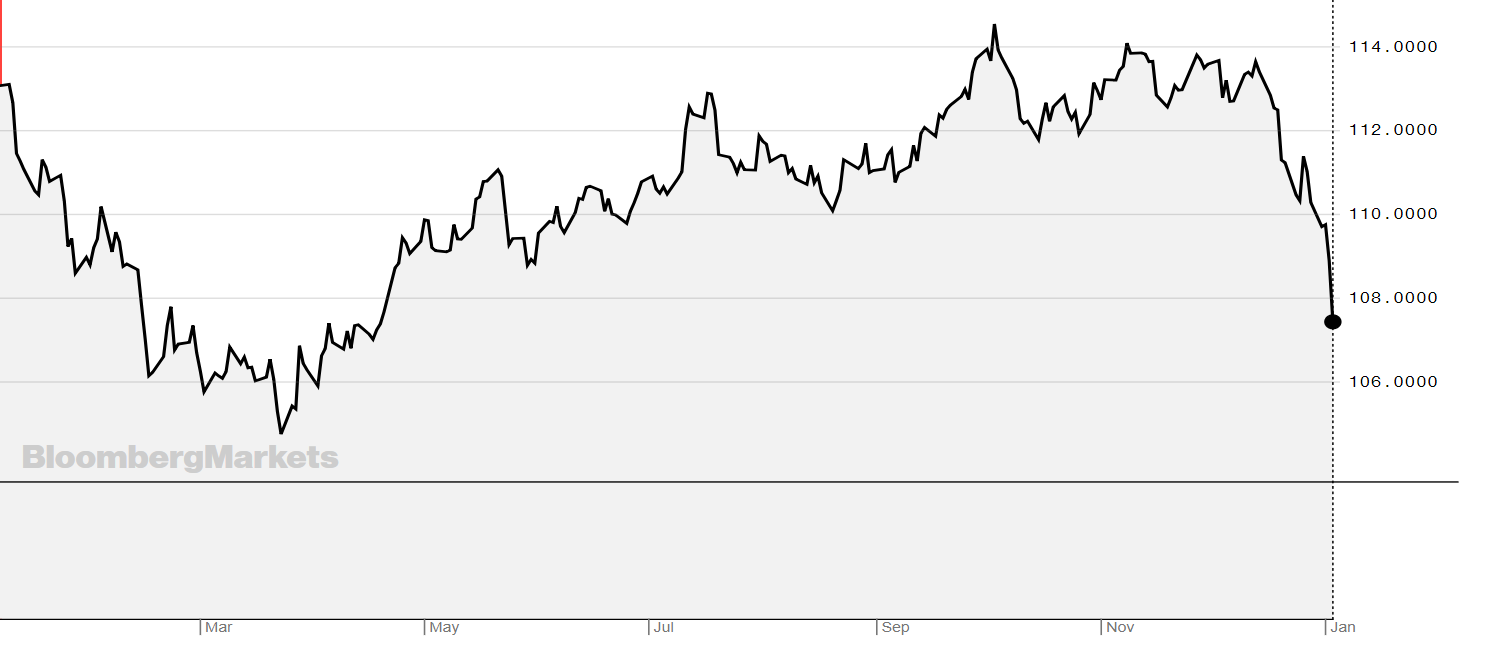

The graph below shows the JPY-USD exchange rate - trading at around 107.420 on 3rd January 2019.

Source: Bloomberg

Historically, the yen hit an all-time high of 306.84 in December of 1975 and a record low of 75.74 in October of 2011, according to Trading Economics. The research firm forecasts that the yen is expected to trade at 109.71 by the end of this quarter and at 111.37 in 12 months time.

Should the yen continue to appreciate against the dollar, it will mean that imports are likely to be cheaper and inflation will remain low. However, should it depreciate then there will be a boost for the economy and exporters.

The yen is the third most traded currency in the world and Japan has relatively strong fundamentals to back it.

There is also a good chance that the yen will continue to appreciate against the dollar as investors consider diversifying away from the US dollar.

So, does this mean that the success of the yen hinges on the health of the US dollar? Sort of.

Thursday's flash crash has been blamed on concerns over Chinese growth after Apple warned over its profits, others suggest that many retail investors moved out of the their long dollar vs yen positions, but perhaps a better explanation is thin trading in early January, as Colby Smith at the FT writes.

As I mentioned, the yen is the third most traded currency globally after the dollar and euro. Thin markets mean shallow markets, which means not enough liquidity and that meant it wasn't an ideal trading market.

Adam Cole, head of FX Strategy at RBC Capital Markets, is reported in the FT as commenting that "when you have modest selling and no buyers, you get these big gappy moves."

Saying that, the yen may well still be a profitable trade in 2019. After all, Japan is a major economic and industrial power and has low unemployment. And there's lots of uncertainty in the US particularly around any rises in interest rates. With that background, diversifying to the yen may not be all bad.

However, access through an exchange traded product (or exchange traded currencies as they are also known) is not as straight forward as an ETF. Many of the currency ETPs are leveraged, and they are not UCITS compliant because they are too concentrated. You should only consider leveraged currency ETPs as short-term trading products, held for days at most.

We list below a range of the ETPs on offer that give access to the JPY USD trade in varying forms. There are other JPY ETPs available that include GBP and leverage.

The best performing of the ones listed this year so far is the JPYP, which is long JPY and short USD and has returned 2.12% in the first few days of the year. It is also one of the best performing over the last year at 9.04%. It is denominated in sterling, which has helped its return. It tracks the MSFXSM Long Japanese Yen Index (TR) which provides exposure to movements in exchange rates equivalent to a long position in JPY forwards, plus exposure to O/N Japanese interest rate.

RTN

JPYP (£)

SJPP (£)

LJPY ($)

SJPY

ETF1YR TERINDEXETFS Long JPY Short USD9.04%0.39%MSFXSM Long Japanese Yen Index (TR)ETFS Short JPY Long USD7.91%0.39%MSFXSM Short Japanese Yen Index (TR)ETFS Long JPY Short USD1.16%0.39%MSFXSM Long Japanese Yen Index (TR)ETFS Short JPY Long USD0.06%0.39%MSFXSM Short Japanese Yen Index (TR)

If you're bullish on the yen, another option is to invest in the Japanese stock market. Of course, you're then taking the risk that Japanese shares could fall in value even as the yen rises. So you might not make money from your initial insight that the yen could rise in 2019. If you do want to invest in Japanese equities, read

.