Asset management behemoths such as abrdn and BlackRock are making waves as they plunge into crypto space amid rising institutional demand, braving the waters of an industry crippled by market turbulence.

In August, abrdn took to the crypto seas by purchasing a stake in cryptocurrency exchange Archax, becoming the firm's largest external shareholder. This followed BlackRock's, the world's largest asset manager, decision to launch a bitcoin trust and partner with Coinbase, offering its 82,000 institutional clients exposure to bitcoin through its Aladdin platform.

Meanwhile, asset manager Schroders bought a minority stake in digital asset manager Forteus while US giants Invesco and Fidelity International have both launched bitcoin exchange-traded products (ETPs) in Europe.

“Asset managers have gotten the memo. Their clients want crypto and they need to deliver,” Sui Chung CEO of CF Benchmarks told ETF Stream. Recently selected as BlackRock's crypto index provider, Chung added: “They have done their homework and now they cannot be late to the game.”

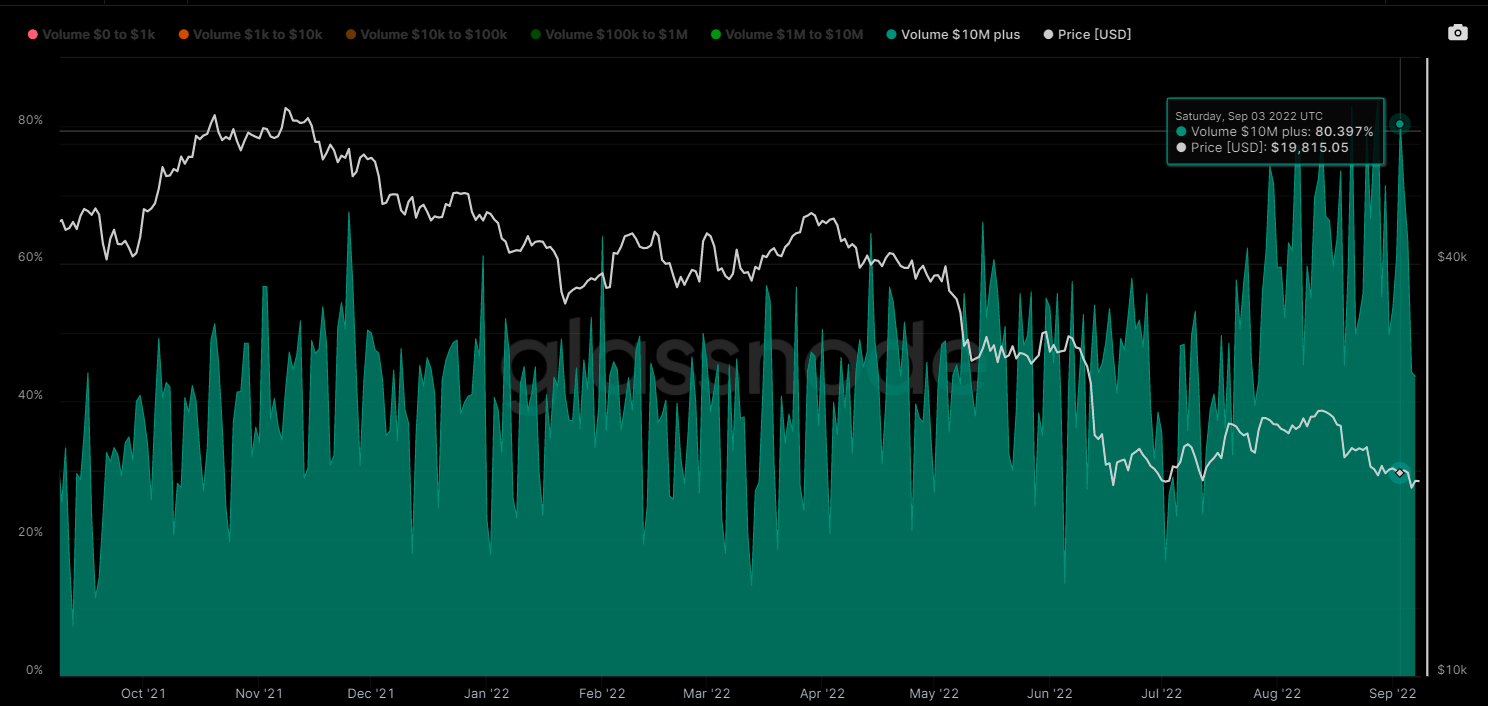

According to data from blockchain analytics firm Glassnode, the market share of investors transferring more than $10m per transaction grew from 33% in January to 80.4% in September, indicating a clear institutionalisation of the crypto market.

Chart 1: Institutional investors dominate bitcoin demand

Source: Glassnode

This new-found interest in crypto comes in the middle of a bear market. Bitcoin is trading 70% below its all-time high recorded in November 2021 and the industries market capitalisation hovers around $1tn, a third of what it was 10 months ago. However, this has not deterred institutional activity.

The “future” of funds, shares and other assets will be in the form of “tokenised digital securities”, Russel Barlow, global head of alternatives at abrdn told ETF Stream. "Ultimately, we could see the majority of traditional investments brought on-chain, opening up a wider range of opportunities to a much bigger audience of investors.”

In two papers published by the Bank of International Settlements, the authors attribute the growth of "robust infrastructure", "innovation" and "digitalisation" in the crypto market as key drivers in retail and institutional adoption. One of the papers focusing on institutional adoption also emphasises the importance of regulatory policies that need to develop in tandem with mainstream finance.

Despite the crypto contagion that ensued following the $40bn collapse of stablecoin Terra – which subsequently spelt the demise of crypto lender Celsius, brokerage firm Voyager Digital and crypto hedge fund Three Arrows Capital, to list a few of the casualties – regulators have been quick to act.

Not only have market dynamics posed a threat to investors but so have crypto fraud and theft. According to blockchain compliance and risk firm Chainalysis, more than $2bn have been stolen from cross-chain bridges – highways that connect different blockchains – this year.

Competitor Elliptic has also voiced its concerns about theft in crypto, reporting that more than $100m in NFTs have succumbed to heists between July 2021 and July 2022. Cybercriminals like the North Korean Lazarus Group and Russia's Wizard Spider gang have been involved in the thefts.

In the US, the Stablecoin TRUST Act has sought to bring stablecoins, a type of crypto pegged one-to-one to the dollar, into the remit of regulators. The Lummis-Gillibrand Bill, currently debated by Congress, looks to shine light upon the murky crypto regulatory landscape in the US.

In Europe, the EU has ardently been developing its markets in crypto-assets (MiCA) framework and the UK is attempting to bring crypto and stablecoins into the remit of regulators through its Financial Services and Markets Bill (FSMB) – which is taking anti-money laundering and terrorist financing (AML/CFT) very seriously.

“Institutional money is moving into crypto comes at the hand of increased regulatory oversight and safety for investors,” Lukas Enzersdorfer-Konrad, deputy CEO of Bitpanda, told ETF Stream. There will be “winners and losers” but that can only be a “good” thing for the industry as a whole, he added.

With better infrastructure and policymakers racing to unlock the industry’s regulatory mess, the traditional financial powerhouses’ decision to enter the market may have cemented the longevity of an asset class once deemed to be purely nefarious.

Related articles: