A troubling start to the year littered with valuation cuts, interest rate hikes and economic contraction has left many investors scrambling for safety in fears the worst is yet to come.

The first quarter of 2022 was defined by western central banks ending more than a year of accommodative monetary policy, geopolitical headwinds and economic activity slowing down as input and end product costs soared.

With the likes of Deutsche Bank, Bank of America and Citi all suggesting a recession scenario is possible by the end of 2023, previously soaring equities began pricing in this stark picture.

Currently undergoing its longest drawdown in six years, the S&P 500 has shed 16.6% since the turn of the year. Meanwhile, the Nasdaq has lost more than a quarter of its value since November in its worst correction in more than a decade – with only 16% of Nasdaq constituents trading above their 200-day average.

Speaking on Tuesday, Gina Martin Adams, chief equity strategist at Bloomberg Intelligence, said: “Sentiment is terrible, and stocks have nearly priced recession now, but even yesterday’s downdraft was not likely enough to make the low for this sell-off.”

Set against this backdrop, Citi suggested a model portfolio built for recession risk should lead with minimum volatility and broader quality ETFs for its core allocations and satellite positions in healthcare sector, single country Switzerland and precious metal miner and water thematic exposures.

Looking at core positioning, the bank said minimum volatility factor plays have inherently defensive attributes with portfolio beta of less than one, which suits the assumption that most equity indices will suffer weaker returns going forward.

Scott Chronert, global head of ETF research at Citi, argued: “A stronger US dollar and wider High Yield credit spreads would support the relative performance of a minimum volatility allocation.

“Interestingly, the rate impact is fairly muted based on the past two years of trading, and negative correlation to energy and broader commodity price action is muted.”

However, Chronert warned in aggregate minimum volatility components make up a “rather small portion” of broader market cap, so investors would have gaps to fill in their core allocations.

Thankfully there are a number of subsets with high minimum volatility correlation, Citi said, including dividend strategies, utilities, real estate, infrastructure, consumer staples and several single-country strategies.

It added some quality factor attributes correlate to minimum volatility – and when screening for both factors, core and satellite products point to health care, multi-factor, ESG, Switzerland and water.

Supporting its argument, Citi pointed to average factor returns versus core indices during the last six times US industrial production turned negative.

Against the MSCI USA and ACWI indices, Citi’s value style returned outperformance of 1.6% and underperformance of -1% after six months, respectively. Even weaker was the growth style basket, which underperformed the US benchmark by 1.4% and the ACWI index by 0.6% after six months.

Meanwhile, the minimum volatility basket outperformed both by 9.1% and 10.4%, respectively, while the quality factor benchmark outperformed by 4.7% and 4% after six months.

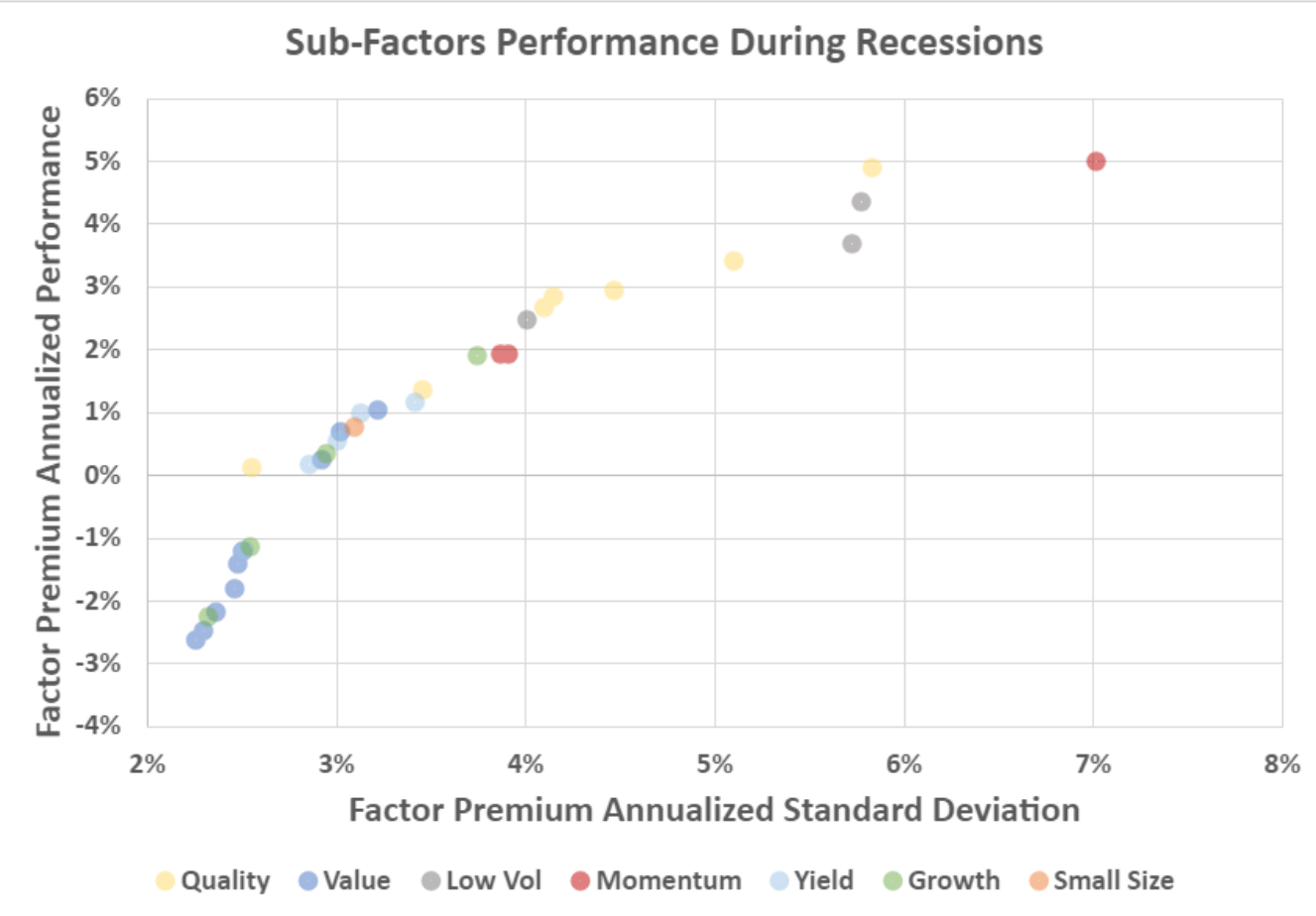

Agreeing, Investment Metrics said in a note: “We would expect more defensive companies to perform well as the economy slows, because these companies have a stronger balance sheet to weather the storm.

“Value, growth and small size companies, which are more dependent on a stronger economic environment and easier access to financing, should struggle during such an environment.”

Source: Investment Metrics

However, Citi pointed to MSCI’s US and ACWI indices returning an average of -14% and -11% after six months of industrial inflection, so even with minimum volatility and quality’s relative outperformance, an investor might still expect negative returns.

In such a scenario, many will ponder if they should weather the storm or look outside of equities – at the yield environment in fixed income or towards alternatives.

Related articles