ETF issuers continue to hoover up new bond issuance from carbon-intensive companies despite the increasing focus on environmental, social and governance (ESG) investing, according to new academic research.

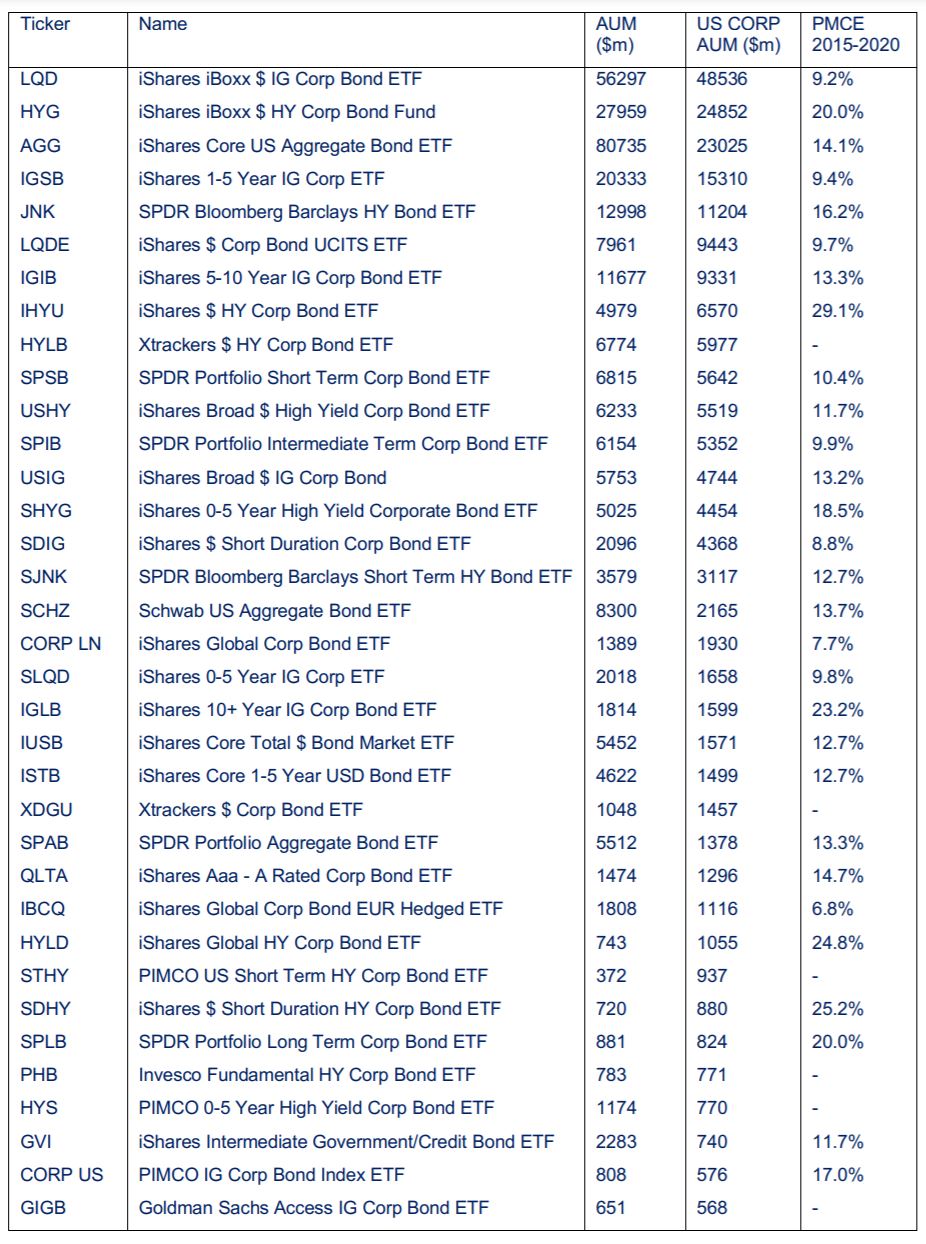

The research, titled Breaking the Bond: Primary Markets and Carbon-Intensive Financing, found 13.6% of new bonds purchased by the 35 largest US-listed corporate bond ETFs between 2015 and 2020 were issued by carbon-intensive companies.

This, according to analysis by Oxford Sustainable Finance Programme at the University of Oxford’s Smith School of Enterprise, was higher than the wider global corporate bond market which only purchased 10% of new issuance from the same sectors.

In particular, high yield ETFs had a Primary Market Carbon Exposure (PMCE) – the proportion of primary market transactions that occur in carbon-intensive sectors – score of 20.5% versus 15.8% for the wider market.

For example, 20% of the bonds purchased in the $19.9bn iShares iBoxx $ High Yield Corporate Bond ETF (HYG) were in carbon-intensive sectors while the $9.3bn SPDR Bloomberg Barclays High Yield Bond ETF (JNK) had a PMCE score of 16.3%.

New corporate bond issues are often priced at a discount in order to attract buyers which encourages ETF portfolio managers to purchase them before they are included in the underlying index. As passive strategies have a mandate to track an index as accurately as possible, this is one way to reduce the tracking error of the ETF.

“ETFs in our sample systematically partake in primary market transactions by investing in new issues before they are included in indices that rebalance monthly,” the report said.

Therefore, if the portfolio manager avoided primary market issuance in these sectors, ETF performance would be negatively affected. However, the report warned any performance lost in the short-term needs to be weighed against the long-term benefits of avoiding carbon lock-in and achieving the necessary goals of the Paris Agreement.

“A focus on portfolio flows is necessary to align the financial system with the Paris Agreement,” the report said. “As primary markets can be considered the point of maximum leverage, ETF providers serious about climate change must consider how they can align portfolio flows."

However, in a letter to clients earlier this year, BlackRock said its broadest bond ETFs will continue to remain carbon intensive due to the nature of the global economy.

The letter said: "That cannot and will not change overnight, and BlackRock’s aggregate portfolio will necessarily be subject to the investment decisions of our clients."

Overall, authors Ben Caldecott and Christian Wilson warned there is a danger ETFs could become the buyers of “last resort” for carbon-intensive sectors as active investors start to reduce their exposure to these companies.

“Given the rapid growth in passive investing, this dynamic could restrict the ability of financial markets to facilitate the low-carbon transition,” the report concluded. “To avoid becoming capital providers of last resort for carbon-intensive sectors, ETF providers need to reduce their PMCE in line with Paris Agreement carbon budgets.”

Chart 1: ETFs in scope

Source: The University of Oxford. Data from Bloomberg. Note. PMCE is only shown for ETFs with over 100 primary market trades identified.