Financial Conduct Authority (FCA) research has found more authorised participants (APs) enter the market to take on the extra redemptions during periods of evaporating liquidity.

The research note, entitled What happens to Exchange Traded Funds in times of stress?, warned there was concentration in primary market trading with the top five APs accounting for 91% of the fixed income ETF trading volume.

Despite these concentrations, the report found during periods of market stress, other APs entered the primary market to “provide alternative liquidity”.

Source: Financial Conduct Authority

In particular, analysts at the FCA studied three periods of volatility; the February 2018 spike in volatility, the sharp sell-off in December 2018 and the US Presidential election in November 2016.

Of these three periods, the Presidential election was the only event where primary market redemptions exceeded unit creation and therefore “the most useful for assessing stress on the ETF primary market”.

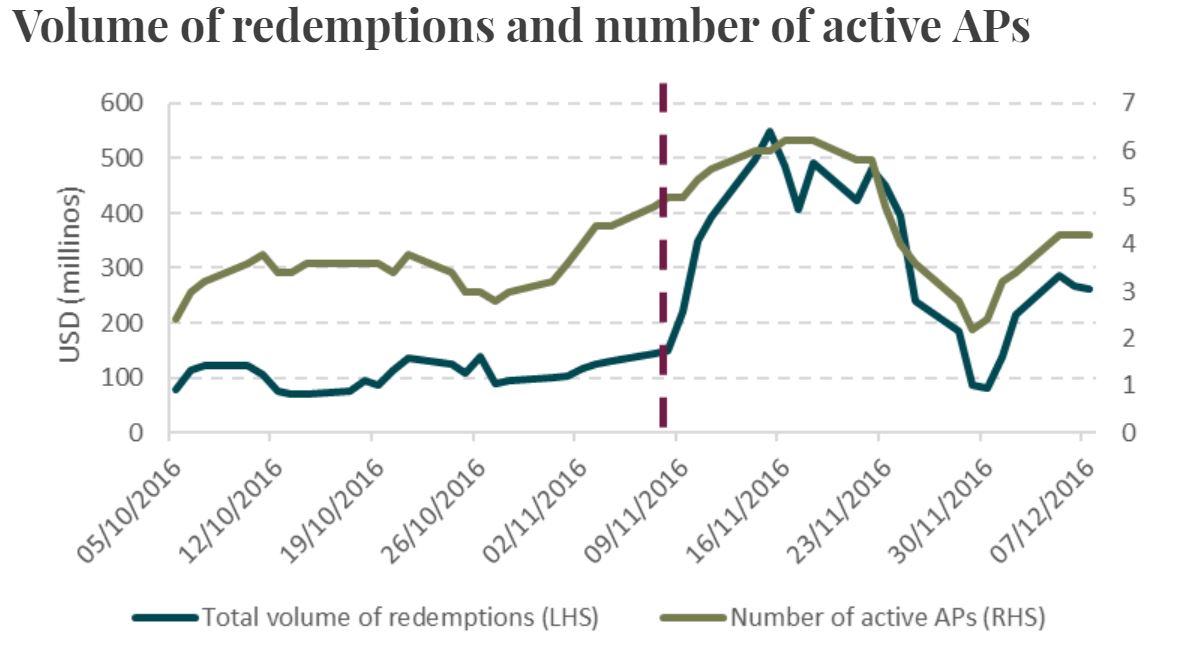

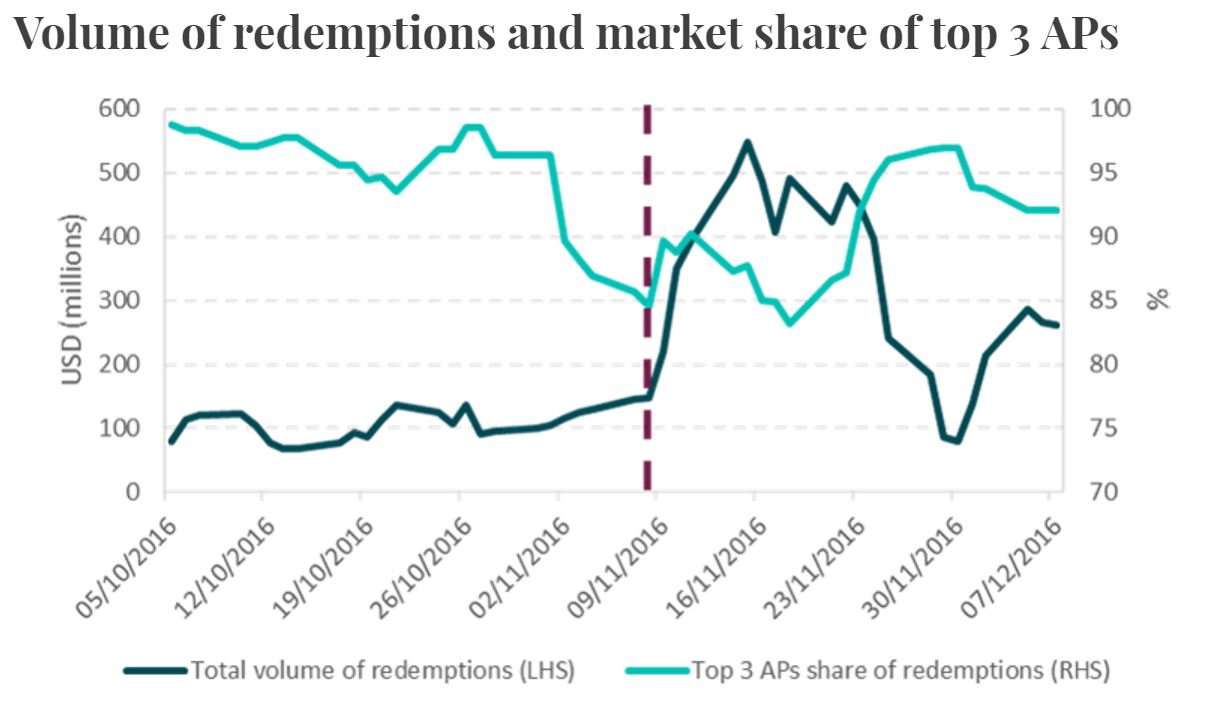

The research monitored two key indicators; the number of APs active in the market during this event and the market share of the three most active APs.

It found APs who were normally less active entered the market to provide liquidity and the concentration of the top three most active APs drops.

Source: Financial Conduct Authority

Matteo Aquilinia, manager in the FCA Economics Department and co-author of the report, commented: “[This initial research] shows preliminary evidence for alternative liquidity providers being willing to step in during times of market stress.

“Beyond these reassuring results, the analysis does not detect any initial signs of concern to financial stability.”

However, Aquilinia did highlight the “significant” concentration activity among a tiny number of participants in the ETF market.

“If APs were to stop or significantly reduce their activity, it could lead to ETF unit prices diverging significantly from the price of underlying assets in either direction and hence a disorderly market.”

Overall, this research will come as welcome news to APs, who have found themselves, and the ETF creation-redemption mechanism, under scrutiny in recent years.

Last year, the European Central Bank (ECB) warned ETFs have the potential to amplify risks in the financial system, in particular, highlighting the counterparty risk in synthetic ETFs and liquidity risks in the primary and secondary market.

Furthermore, in June, the European Systematic Risk Board (ESRB) argued the role of the authorised participant was of concern.

Last month, Jane Street, one of Europe’s leading APs, hit back at these claims, arguing these concerns around ETFs were unfounded as they would continue to trade even if liquidity does become strained.