With high demand and geopolitical tensions creating a perfect storm for commodities, ETFs such as the iShares Bloomberg Enhanced Roll Yield Commodity Swap UCITS ETF (ROLG) and the L&G Multi-Strategy Enhanced Commodities UCITS ETF (ENCG) offer a diversified way of playing the asset class while offsetting some of the typical performance drag of many commodity strategies.

Though commodity baskets are not a new fixture in the European ETF market, both products in our comparison blend the traditional approach of tracking the futures of more than 20 commodities at once with some interesting financial engineering.

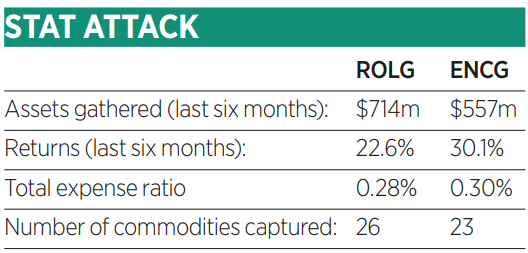

Despite going about this in different ways, both have been a hit with investors in recent months. Launching in September 2018, the $1.2bn ROLG amassed $714m assets over the past six months, as at 22 February. Meanwhile, ENCG has gathered an impressive $693m since its launch in July 2021, with $557m of this arriving over the last half-year.

Both have also booked impressive returns, with ENCG edging a lead in recent months. Over the trailing six months, LGIM’s ETF shot up 30.1%, ahead of ROLG’s 22.6% returns.

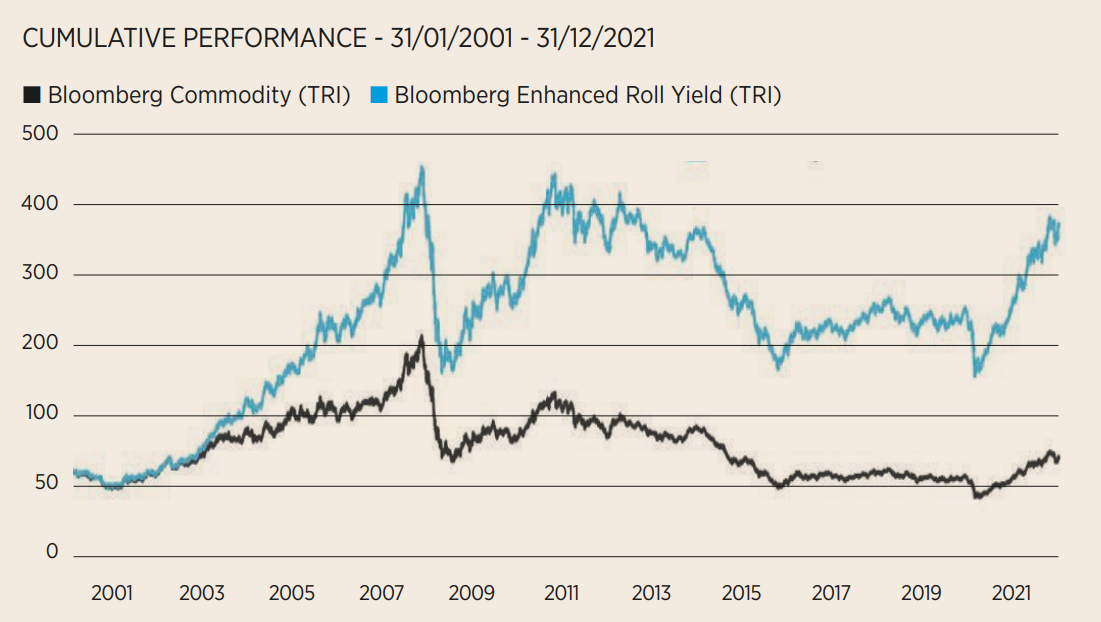

However, ROLG recently changed its underlying index, with its new index managing to significantly outperform its parent benchmark on a backdated basis, with annualised returns of 6.8% versus 0.8% between 2001 and 2021.

Exposure and methodology

Taking a look at what makes the two products tick, ROLG’s twist is the way it plays capital markets while ENCG optimises based on economic cycles.

Realising the costs that can be incurred when exchanging short-dated futures contracts for longer-dated ones, ROLG’s underlying Bloomberg Enhanced Roll Yield index seeks to reduce the trade-off between liquidity and performance.

The product’s previous benchmark – effective until the start of February – sought to track futures contracts of 21 commodities spanning energy, agriculture, industrial metals, precious metals and livestock. For each, the index rolls into futures showing the most backwardation or least contango, with nine months or fewer until expiry.

Adding to this, the current index attempts to reduce roll congestion and mitigate the effects of negative carry by using three or four equal-weighted contracts from across the term structure for each commodity, with the aim of benefiting from the long-term structural shape of commodities futures curves.

During the roll period, contracts are progressively replaced by the next set of contracts at a rate of 10% per business day over the course of 10 days. Single nearby contracts are excluded to avoid sudden moves in the futures curve, which BlackRock warned could lead to higher roll costs and reduce sensitivity to short-lived price shocks.

The result is an index that tends to overweight commodities trading in backwardation rather than contango. This creates a notable 5.8% underweight to natural gas and a 3.1% overweight to Brent Crude versus its parent benchmark.

The arrival of the enhanced roll index in ROLG also sees the addition of new commodity exposures such as tin, lead, feeder cattle and low-sulphur gas oil. These are overweighted 3.3%, 2.1%, 2% and 1.1%, respectively.

Looking at ENCG, it also seeks to optimise the way it rolls its futures contracts but blends futures curve with market cycle considerations to create a multi-factor approach.

First, the ETF’s underlying Barclays Backwardation Tilt Multi-Strategy Capped index allocates to seasonal futures contracts on commodities such as heating oil, gas oil and natural gas at heightened points in the production and demand cycle. Next, it applies a roll yield factor to invest in energy and industrial metals futures at their most favourable positions in the futures curve, with the best-implied roll yield.

The combination of these considerations saw ENCG massively overweight energy commodities with a 48.3% allocation in December last year. This likely explains some of its significant outperformance in such a short period of time. It quickly reduced this weighting to 34.5% by the end of January – in line with ROLG’s allocation of around 35% at the turn of the year.

Finally, the ETF factors in momentum on agriculture and livestock commodities – which have historically been affected by crop yields, weather and breeding cycles – by investing in futures contracts with the highest annual outperformance versus the nearby futures contract.

By the end of the first month of the year, ENCG weighted 40.6% to agriculture commodities – ahead of ROLG’s 29% allocation at the end of 2021.

Overall, ENCG’s multi-strategy approach has fared well since launch. Its 23-commodity basket is less diversified than ROLG’s because it does not capture the BlackRock product’s new weightings to tin, lead, feeder cattle and low-sulphur gas oil – but to rule one as more successful than the other would probably be premature.

Given both have been operating in their current formats for less than a year, it may be worth watching how both methodologies play out in product form over the longer term.

Cost breakdown

The situation is similar in costs. Though there is a notable gap in their total cost of ownership, the true picture will only be understood once both products have more established track records.

At present, ROLG carries a total expense ratio (TER) of 0.28%, just shy of ENCG’s 0.30% fee. Meanwhile, both products have virtually identical spreads on their primary listings, both at 0.26%, according to data from Bloomberg Intelligence.

The greatest disparity is in the futures trading costs incurred within the products. While ROLG has an average weighted swap spread of just under 0.11%, ENCG’s swap spread is just shy of 0.20%.

Though this nine basis point gap is significant in the low-cost world of ETFs, it is not representative of future trading costs. BlackRock told ETF Stream that due to the recent index switch, it is unable to provide a historical view of average spreads using ROLG’s new benchmark.

So once again, as the performance disparity might change now ROLG’s new index is in effect, ROLG’s cost of ownership advantage may narrow in ENCG’s favour, going forward.

As an end product, ROLG focuses heavily on offsetting the costs associated with trading futures contracts, though this can mean it underweights certain commodities while they are in boom phase. Meanwhile, ENCG attempts to perform a balancing act of capturing performance when momentum is strong while trying to find the best roll yield possible.

This article first appeared in ETF Insider, ETF Stream's monthly ETF magazine for professional investors in Europe. To access the full issue, click here.

Related articles