Vanguard has been steadily increasing exposure to ETFs across its LifeStrategy range, a suite that has gained near cult status among UK investors.

The US giant waited until 2012 to enter the European ETF market with the firm’s founder and ‘father of index funds’ Jack Bogle previously describing the structure as “a wolf in sheep’s clothing”.

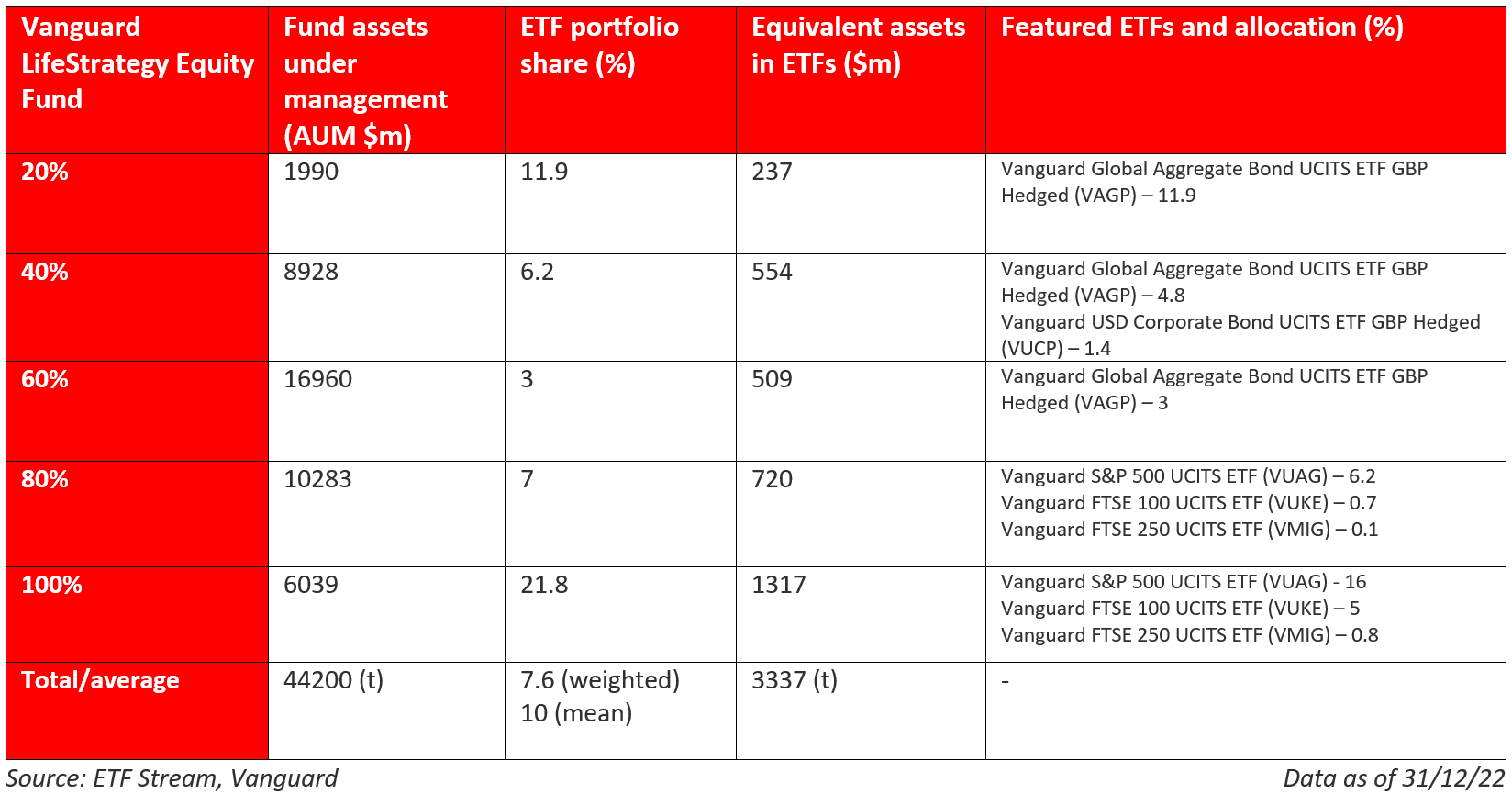

Despite this, the $44.2bn LifeStrategy suite now invests 7.6% of its assets under management (AUM) – or $3.3bn – in ETFs, as at the end of 2022, according to research conducted by ETF Stream, up from 0% when the funds launched in 2011.

ETFs make up as much as 21.8% of the $6bn Vanguard LifeStrategy 100% Equity and 11.9% of the $2bn Vanguard LifeStrategy 20% Equity funds, while only 3% of the $17bn Vanguard LifeStrategy 60% Equity fund, which is the largest in the suite.

Vanguard’s five-strong suite is a series of risk-rated portfolios that invest in the firm’s in-house index funds and ETFs.

Explaining the rationale behind using ETFs in the fund-of-funds range, a Vanguard spokesperson told ETF Stream the wrapper allows the firm to diversify between product structures as well as access to the “quality and liquidity” of ETFs as a structure.

Furthermore, the growth of Vanguard’s 34-strong ETF range in Europe, which now houses €80bn AUM, allows it to be used as building blocks within other products.

Mohneet Dhir, product manager, multi-asset, at Vanguard, commented: “LifeStrategy looks to apply diversification at multiple levels. That means across both different markets and asset classes but also at the product level.

“Product diversification within a fund of funds structure is an important element and we try to achieve this by investing in both funds and ETFs.”

While this case study is a vote of confidence for ETFs as a tool for efficient asset allocation, it may point to other more impactful implications.

First, it illustrates the power of ready-made portfolio products as tools for fund distribution. In fact, LifeStrategy assets make up 33.9% of the combined AUM of the five ETFs.

These funds-of-funds are a ready source of large-scale and – crucially – sticky assets for the products included within their portfolios.

If Vanguard and other asset managers increasingly use ETFs as core components of their multi-asset products built for long-term and retirement investing – such as Vanguard’s Target Retirement or BlackRock’s MyMap range which also feature ETFs – this will be a key route of funnelling more retail investors into ETFs.

As a secondary effect, ETFs playing a more prominent role in household favourite funds may provide retail investors across Europe with much-needed awareness and familiarity with the structure.

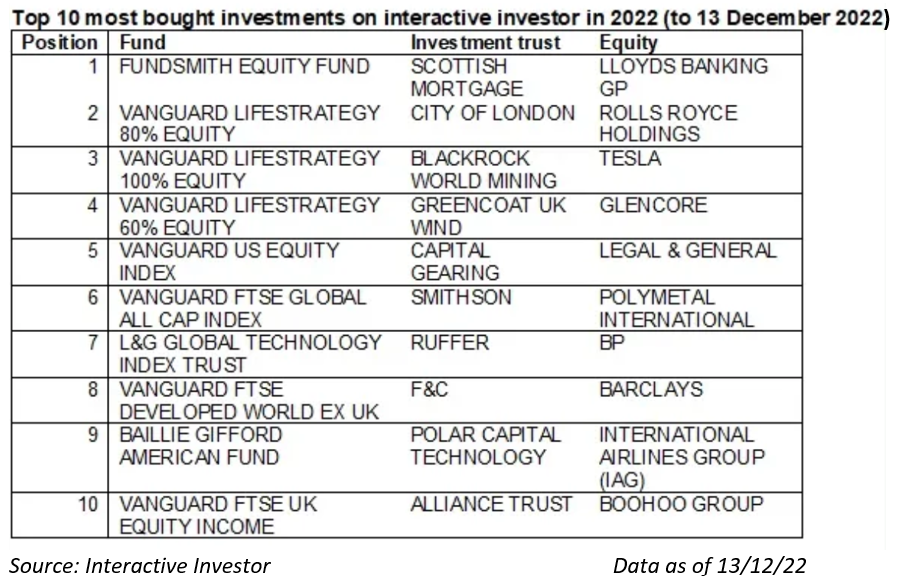

While ETFs are often overlooked by many retail investors this side of the pond, LifeStrategy products made up three of the top five best-selling funds in the UK last year, according to Interactive Investor data, showing individual investors are already moving into ETFs whether they are aware of it or not.

Related articles