Institutional investors with smaller mandates are more likely to use passive products than those with larger ones, according to Mercer’s

European Asset Allocation Survey 2019

.

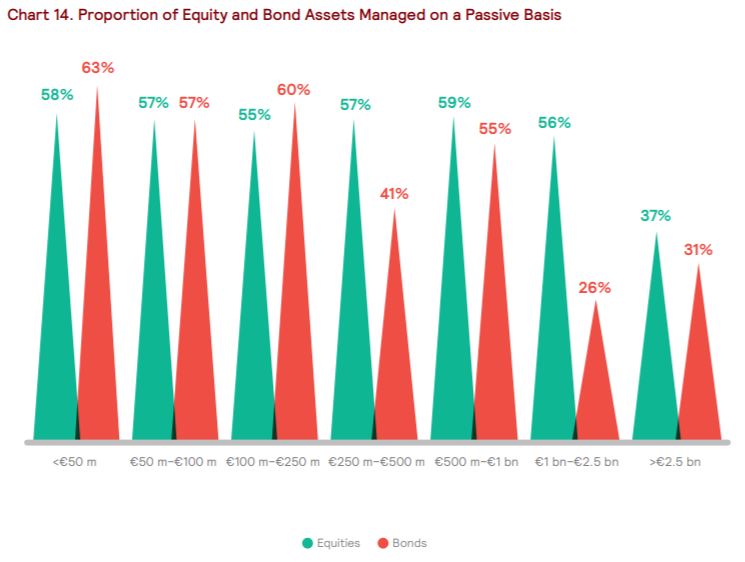

The survey, which interviewed 876 institutional investors across 12 countries with around €1trn assets under management (AUM), found over half of respondents were investing in passives in the equity space when the AUM managed was under €2.5bn.

However, when the assets managed were greater than €2.5bn, just 37% of investors used in passives for equities and 31% for bonds.

The category which used passives the most were investors with under €50m AUM, where 58% use them for equities and 63% for bonds.

This figure only dropped to 59% and 55%, respectively, when the AUM managed was between €500m and €1bn.

Source: Mercer

The reason for this, Kishen Ganatra, European director of strategic research at Mercer, and co-author of the report, who has recently moved to QMA, said was because smaller clients have higher fee sensitivity and are less able to negotiate attractive fees on active mandates than investors with larger tickets.

Pension fund usage of ETFs and smart beta on the increase, says survey

“Many smaller investors are also refocusing their governance budgets on liability risk considerations or towards growth in alternative asset class areas (where credible passive options rarely exist),” Ganatra continued. “These can lead to increased utilisation of passive management for equity portfolios.”

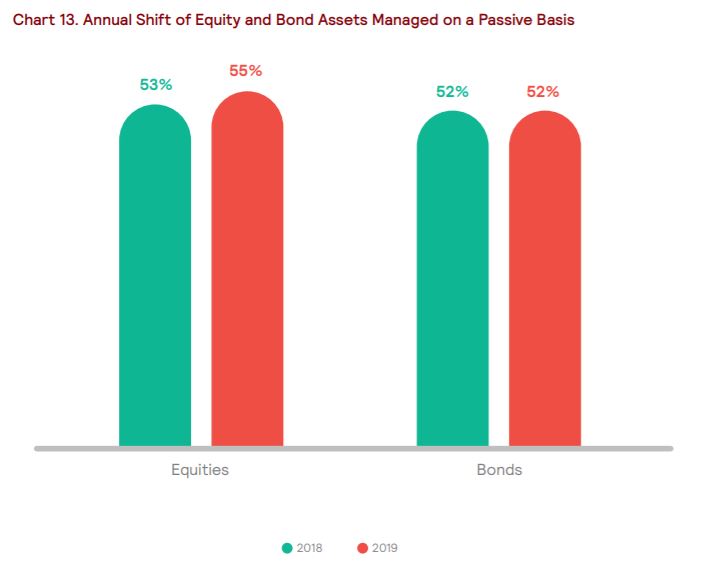

Overall, there was an increase in allocation to passively managed equity assets in 2019 with the average proportion increasing from 53% last year to 55%. Meanwhile, allocations to fixed income stayed the same at 52%.

Source: Mercer

“The continued reasoning for this is a shift of governance focus to issues related to strategy and to other areas of growth, particularly in the alternatives universe,” Ganatra explained.

“Underperforming equity mandates are often moved to passive management, following a loss of confidence in manager ability to deliver long-term outperformance.”

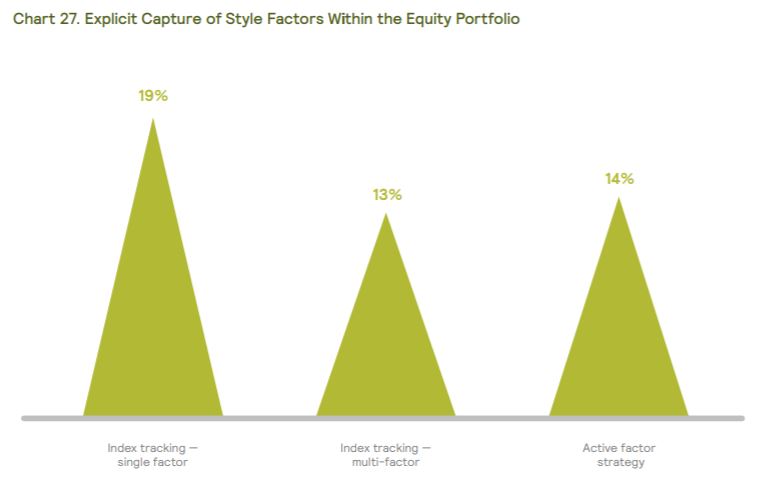

Furthermore, the survey found factor investing in the equity space is an increasing area of institutional investor focus. Investors using a single factor index strategy increased from 12% in 2018 to 19% this year.

Ganatra concluded: “It is worth noting, however, that many investors will have implicit biases to various style factors via traditional active managers.”

Source: Mercer