BetaShares has announced a sudden change in the investment strategy on its oil ETF, known by its ASX Ticker “OOO”.

Due to the unprecedented splat in global oil prices, BetaShares has stopped using one month oil futures and started using three month oil futures instead. The change means the fund will no longer directly track its index, until further notice.

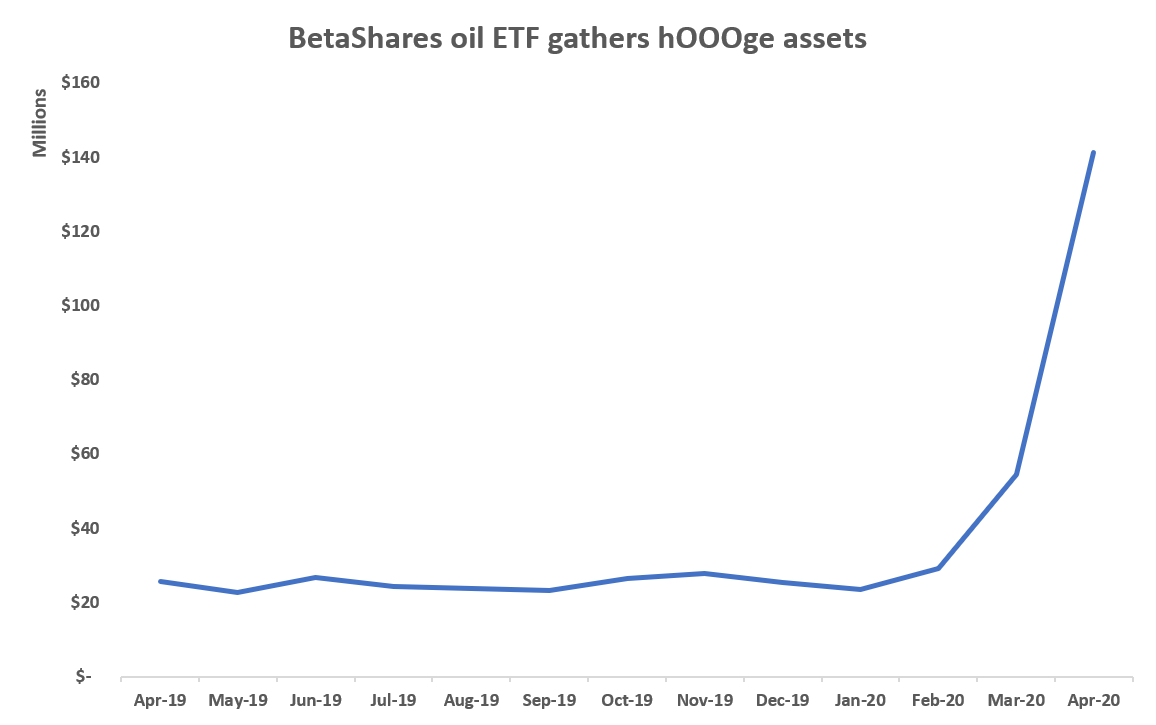

OOO has gathered huge assets the past month despite - or because of - the oil price collapse

BetaShares made the change in order to reduce the chance that OOO goes to zero, which would make the fund worthless and result in its delisting from the ASX.

Thanks to storage costs, political tensions between Saudi Arabia and Russia, and the coronavirus, May oil futures began trading below zero this week. This meant those stuck holding May oil futures were left with a worthless asset.

As OOO rolled out of the May futures contract in the beginning of the month, it dodged a bullet.

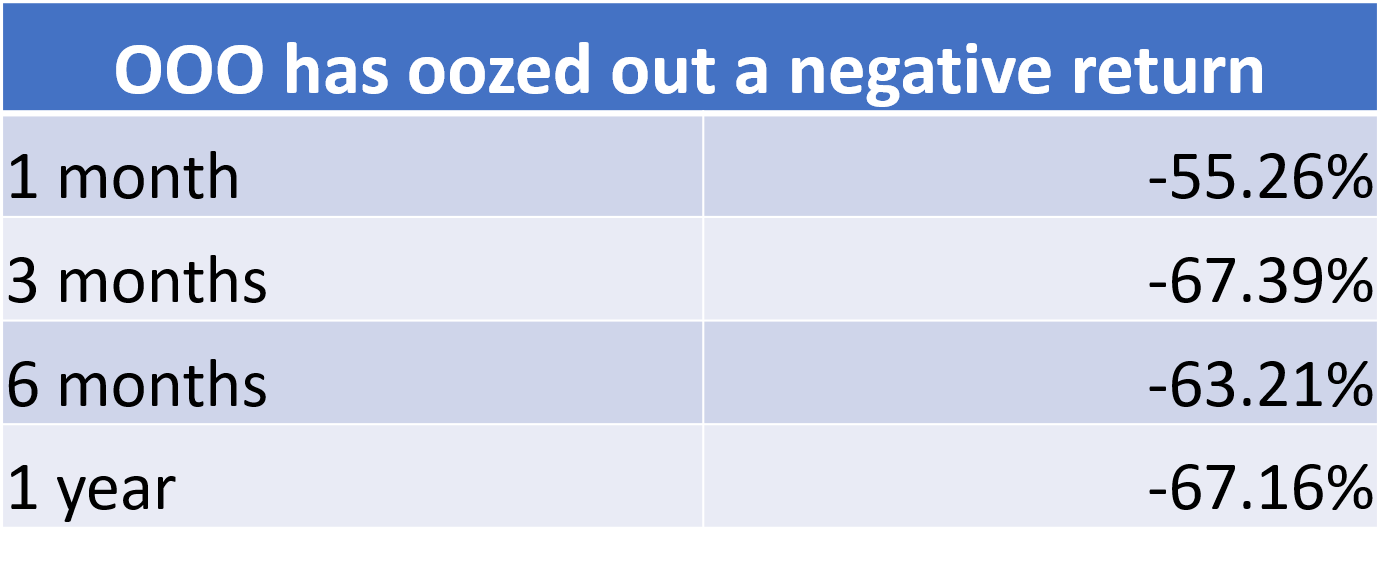

Investors holding OOO the past month have been hosed

In a statement on the ASX website, BetaShares said: “To reduce the risk to the Fund of the June 2020 futures contract trading at a negative price (which would reduce the Fund’s value to zero), BetaShares considers it prudent, an in the best interest of unitholders, to temporarily replace its investment exposure to the one month… contract with exposure to the three-month contract.”

“While this change can be expected to temporarily result in a higher level of tracking error…BetaShares considers that the longer-dated futures contract should have relatively lower volatility and that exposure to it should reduce the risk of the fund, and unitholders, experiencing a permanent loss of capital.”

ETF investors get caught on wrong side of oil market collapse

In making the change, the fund will remain strongly correlated to the oil spot price, BetaShares said.

Sign up to ETF Stream’s weekly email here