Investors are calling an end to the commodity trade after ETFs saw significant outflows last week amid improving supply-side issues and ongoing recession fears.

The supply of goods has been the uncontrollable force in price inflation since the start of the Russia-Ukraine conflict, with central bank policymakers only able to influence demand with rate hikes, while having no control over the availability of key products and materials.

Illustrating this, Brent Crude and the Bloomberg Agriculture Subindex both hit eight-year highs during their respective peaks in H1.

Following last year’s global economic reopening and the supply disruption caused by Russia’s invasion of Ukraine, Bloomberg’s agriculture benchmark more than doubled in under two years while in June,oil was more than six times its price in April 2020.

Benefitting from this have been broad commodity plays such as the $1.8bn iShares Diversified Commodity Swap UCITS ETF (ICOM), the $1.3bn UBS ETF CMCI Composite SF UCITS ETF (CCUSAS) and the $294m WisdomTree Agriculture ETC (AIGA).

However, this changed last week with two developments seeing the products book $334m, $93m and $84m outflows, respectively, according to data from Ultumus.

Last Thursday, the Nord Stream 1 pipeline between Russia and Germany reopened after a 10-day hiatus for repairs following fears from German and EU politicians that the key piece of gas infrastructure would not come back online.

A day later, Russia and Ukraine penned a UN-backed deal to resume exports of Ukrainian grain through the Black Sea in the coming weeks. This comes as welcome news to exporters in ports such as Odesa and Pivdennyi which have been unable to ship their goods since the conflict began.

While serious question marks were raised against the robustness of gas, oil, softs and even metals supply chains since the invasion of Ukraine began in May, investors would always be wise to question how long resource security anxiety can be reflected in inflated commodity prices.

Proving this, the price of Brent Crude shot up more than 38% between the end of January and the start of March. Then, between a recent high in June and this Monday, prices fell 13.9%.

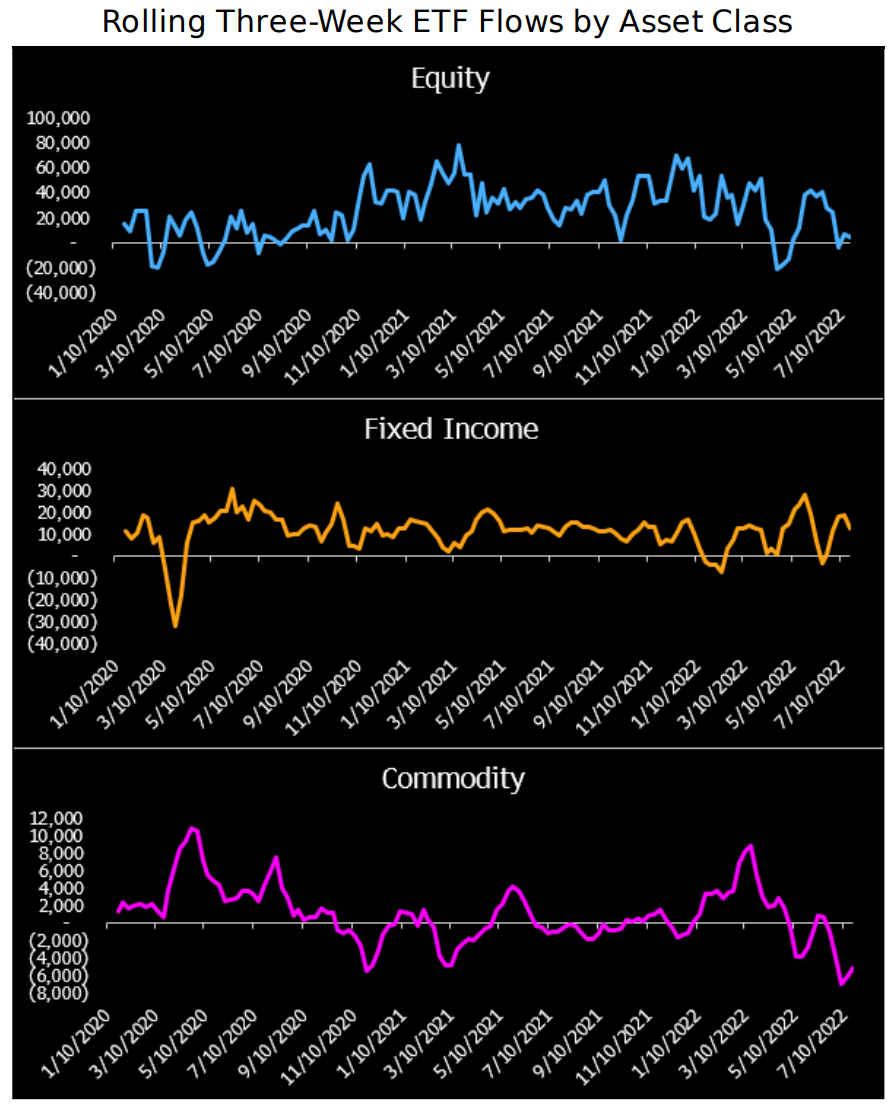

Interestingly, Europe’s commodity outflows are also playing out on a larger scale in the US, with investors pulling $5.1bn out of commodity ETFs, according to data fromBloomberg Intelligence, which added this represents “one of the worst three-week periods” for commodity ETFs since 2012.

Source: Bloomberg Intelligence

These trends could ease, however, as on Monday evening Russia performed a U-turn with Gazprom warning it would cut Nord Stream 1 throughput back to 20% capacity from Wednesday to carry out further maintenance.

How the unreliability of Russian resource supply and reduced economic activity will play out in investor demand for commodity exposure, remains to be seen.

Related articles