ETF investors have piled into ETFs offering exposure to the China tech sector despite fears of further crackdowns by the Chinese Communist Party (CCP).

According to data from ETFLogic, the $268m KraneShares CSI China Internet UCITS ETF (KWEB) has seen $61.7m inflows over the past six months while its US counterpart, the $6.1bn KraneShares CSI China Internet ETF (KWEB), has seen $3.4bn inflows in the three months to 25 August, including $55m in a single day last Friday, Bloomberg noted.

This trend has been seen across a range of China tech strategies over the last three months with $102m going into the $262m HSBC Hang Seng Tech UCITS ETF (HSTE) and $63m into the $339m EMQQ Emerging Markets Internet & Ecommerce UCITS ETF (EMQQ).

These new assets have arrived following a campaign of regulatory crackdowns against Chinese consumer software firms by the CCP which began in earnest with the cancellation of the Ant Group IPO last November.

Tensions have progressed in 2021 as regulators have individually disciplined and “rectified” big names including ByteDance, Baidu and Didi with the state displeased with companies raising capital overseas or becoming large enough to publicly challenge its authority.

The consequence of these crackdowns has been a dramatic reduction in the valuations of some of China’s largest companies with Alibaba, Tencent, Pinduoduo, Baidu and Meituan all down between 28% and 44% in the last six months. Almost $800bn has been wiped off the value of US-listed Chinese equities in the last five months.

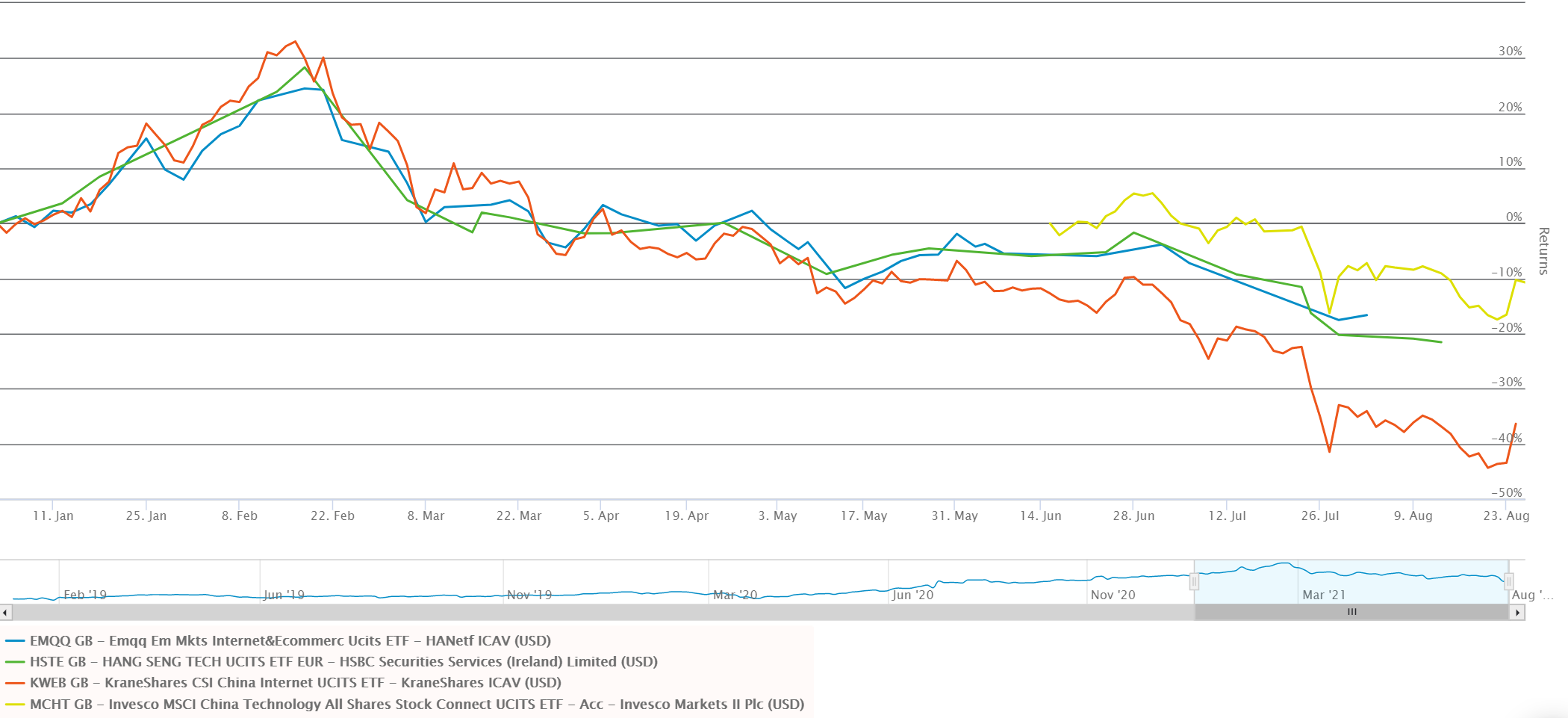

In ETF investment terms, this has brought about something of a fire sale with the European-listed rendition of KWEB returning -46.1% over the past six months while HSTE has returned -30.7% and EMQQ has dropped 26.8%.

Source: ETFLogic

To provide some context on the level of value currently on offer, the Nasdaq Golden Dragon China index and Hang Seng TECH index are now both below their summer 2017 levels.

Furthermore, in April, Bloomberg found the combined market caps of Alibaba, Tencent, Baidu and JD.com to be $1.6trn – higher than their current combined market cap but below Amazon’s $1.7trn market cap at the time.

However, the four companies had a combined free cash flow of $44bn, far ahead of Amazon’s $26bn, highlighting the premiums currently commanded by US tech giants versus their Chinese counterparts.

Instead of viewing this as a clear-cut opportunity, investors ought to remain cautious. According to Perth Tolle, founder of Life + Liberty Indexes, the interests of private stakeholders will always be secondary to those of the state.

While what Henry Kissinger said rings true to an extent – that the CCP retains its absolute control only so long as it delivers on its promise of Chinese prosperity – the road the state takes to achieve this end is not one of appeasement and small adjustments but swathing adjustments and central planning – and this could spell further disruption for China’s tech giants.

This is acknowledged by the tech behemoths themselves with Tencent’s founder, Pony Ma, having political involvement himself, supplying his company’s platform data to the state and recently allocating $15bn of company profit to social aid programmes. Such moves show the threat to such companies still remains very present and rocking the boat is something they should avoid at all costs.